As the macroeconomic debt spiral is set to spin out of control in 2023, Bitcoiners should prepare for the fight to intensify.

This is an opinion editorial by Mickey Koss, a West Point graduate with a degree in economics. He spent four years in the infantry before transitioning to the Finance Corps.

“First they ignore you, then they laugh at you, then they fight you, then you win”

At the time of this writing, the U.S. Senate had just introduced the Digital Asset Anti-Money Laundering Act of 2022. The bill contains many threatening aspects, such as KYC laws for self-custody wallets and money-transmitter licensing requirements.

This bill also comes on the heels of the European Central Bank’s (ECB) recent revelation that Bitcoin is on an “artificially induced last gasp before the road to irrelevance.” About a week later, an official from the bank announced it was considering a Bitcoin and crypto ban in order to mitigate environmental damage.

But as the energy crisis in Europe deepens, don’t you think European regulators have bigger fish to fry, like Germany’s rising use of coal power? Or maybe politicians and officials are starting to understand Bitcoin and how it tips the scales of power? On second thought… maybe not.

The below is a thread by Level39 depicting testimony from the recent Senate Banking Committee hearing.

I think this is just the beginning of the “then they fight you stage” and it will only get worse in 2023. Stay vigilant this year. While a ban and much of the regulations would be comically impossible to actually enforce, they would serve as a significant speed bump to widespread adoption. I would keep an ear to the ground (and probably to Bitcoin Twitter) to stay abreast of situations that could be influenced by a sea of calls to your governmentally-elected representatives, just like what happened with the infrastructure bill in 2021.

The Debt Spiral… Spirals

Luckily, I think more and more people will begin to wake up from the matrix and realize just how bad the situation really is. The fact is, it’s getting pretty hard to obscure at this point.

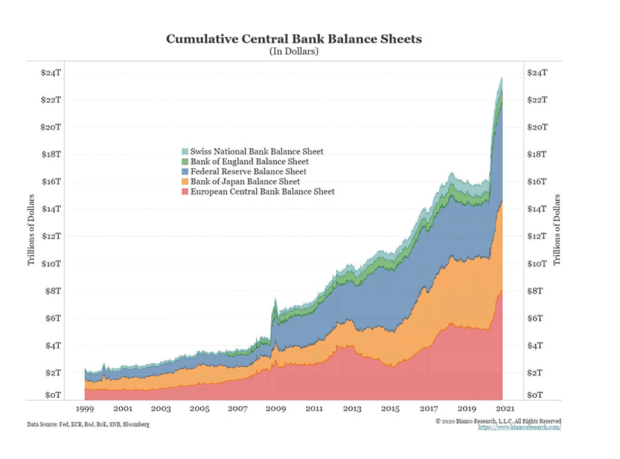

The above chart is essentially my new favorite picture. When people ask me about Bitcoin lately, all I do is show them this graph and they pretty quickly understand the magnitude of money creation during the 2020 COVID-19 era. What they don’t quite understand, just yet, is that it is going to continue, and probably at increasing rates and intervals.

The U.S. federal government is already projected to run a $1 trillion deficit in 2023 (that’s 12 zeroes, folks). Even if the U.S. government shut down the entire military and eliminated the Department of Defense’s projected $800 billion budget, the budget would still be projected to be operating in the red for 2023. The real kicker in this is that the deficit is likely to be much higher, meaning that more debt will have to be issued, and that would be in a period of increasing interest rates due to Federal Reserve tightening.

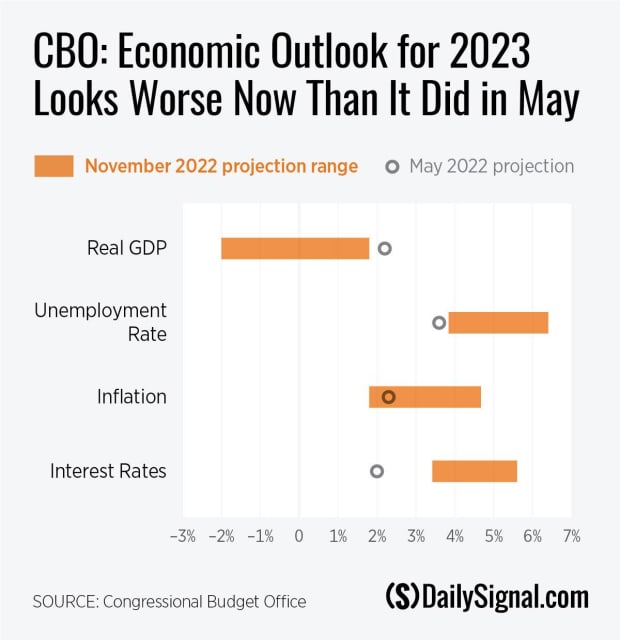

The Congressional Budget Office is projecting that negative growth in GDP is about as likely as lower-than-expected positive growth. Couple that with an expected increase in unemployment, and you get yourself a fiscal double whammy. First, unemployment and negative GDP growth imply less tax receipts to the federal government, meaning a potentially bigger deficit, i.e., more debt. You add in the fact that the debt is being issued at a significantly higher rate, and you’ve got yourself the ingredients for an accelerating debt spiral.

Even if everything goes completely to plan, a trillion-dollar deficit is certainly nothing to celebrate. I think the numbers speak for themselves. People I work with and am friends with are really starting to notice and get worried; people who have never previously given a lick of interest to economics before.

And when all of the proverbial stuff hits the spinning thing, you can bet that the Fed steps right in with more money printing. Adding a trillion or so dollars to the debt at 5% interest? I don’t think it’s gonna happen. I’m betting interest rates won’t be much higher for much longer. Quantitative easing three is dead. Long live quantitative easing infinity.

Coincidentally, as I write this article, I received the above article in an email from the Bitcoin Layer. Looks like they agree with me. Rate hikes can’t hike much more than they’ve already hiked. They’re basically off of the trail.

Bitcoin Reignites The Pioneer Spirit

Once upon a time, in a place called America, people used to take responsibility for their actions, traveling off to seek adventure and opportunity in the West. The Oklahoma Sooners’ namesake hails from the Oklahoma Land Rush of 1889, where nearly 50,000 Americans lined up on the edge of the “Unassigned Lands” to race to claim their stakes in the undeveloped wildlands that became Oklahoma.

Much like homesteading in the 19th century, Bitcoin is both a team sport and a race. It’s a race in the sense that if you do not take responsibility to claim your stake in cyberspace before someone else, you may have missed an opportunity of a lifetime. It’s a team sport in the sense that successfully adopting Bitcoin into your life will likely require a degree of help from others.

How many BTC Sessions videos did you watch before setting up your first hardware wallet? How long after that did you actually send any UTXOs to your self-custody address? How long did it take before you even knew what a UTXO is?

Bitcoin is the new frontier, the digitalization of the Unassigned Lands in the old American West. The journey is fraught with dangers and pitfalls, but the payoff is an opportunity that we will likely never see again during our lifetimes. Everyone gets bitcoin at the price that they deserve, yes, but that doesn’t mean you can’t help them accelerate the learning process.

Let’s make 2023 the year we drained the exchanges; auditing them for paper bitcoin through sheer blunt force trauma. I challenge you to try and embody the homesteading pioneer spirit to help make this happen; to help your friends and family understand this phenomenon and opportunity. To help them take self custody and preserve their wealth in a self-sovereign way. Help lead the horse to water, so to speak. You can’t save everybody, but you can at least try to help them see what’s coming, and stake their claim in the new Wild West in cyberspace.

This is a guest post by Mickey Koss. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.

Source: Bitcoin Magazine - Bitcoin News, Articles and Expert Insights

#Culture, #Opinion, #Debt, #Eoy2022