The Bitcoin price experienced a resurgence yesterday, reaching a high of $26,843, a 3.7% increase after its recent crash from $29,000. The reasons behind this uptick are manifold.

Why Is Bitcoin Up?

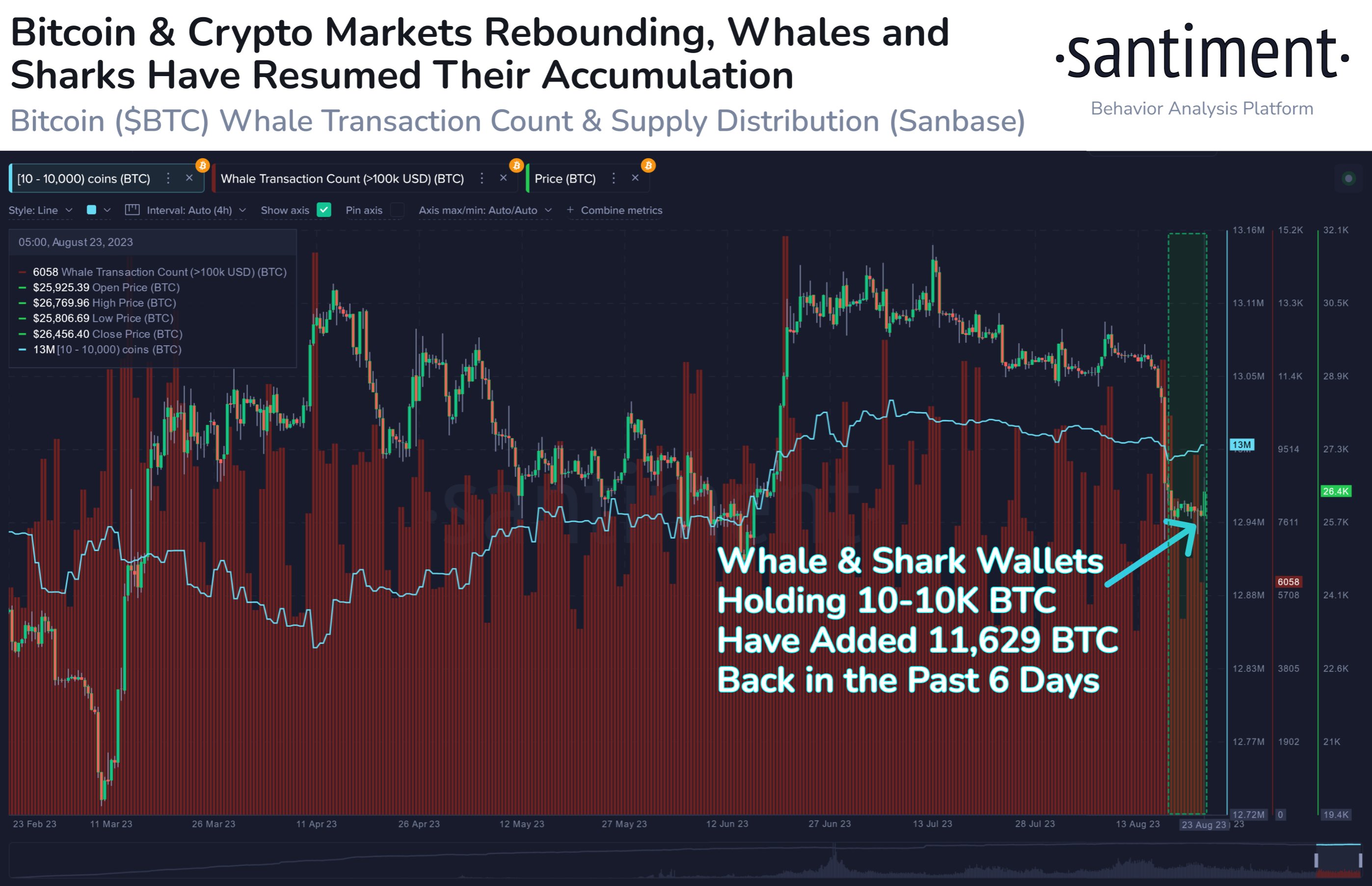

According to on-chain analytics firm Santiment, significant Bitcoin holders, often referred to as whales and sharks, have been actively adding to their holdings. As of now, there are 156,660 wallets holding between 10 to 10,000 BTC, with a collective accumulation of $308.6M since August 17th. Whale and shark wallets have added 11,629 BTC in the past six days.

Michaël van de Poppe, a well-regarded crypto analyst, drew attention to the strength shown by Silver & Gold, especially after the disappointing PMI rates yesterday. He believes that as yields appear to be topping out, Bitcoin might follow the trajectory of these commodities.

Recent economic indicators from the US private sector provide further context. The S&P Global Composite PMI for early August showed a decline, falling to 50.4 from 52 in July. Both the Manufacturing and Services PMI indices also registered drops from 49 to 47 and 52.4 to 51 respectively.

Moreover, the Bitcoin futures market certainly played a certain role in yesterday’s Bitcoin price movement. Yesterday, $28.06 million in short positions were liquidated on this market. After all, this is the third largest amount in August so far, surpassed only by August 17 ($120 million) and August 8 ($37 million).

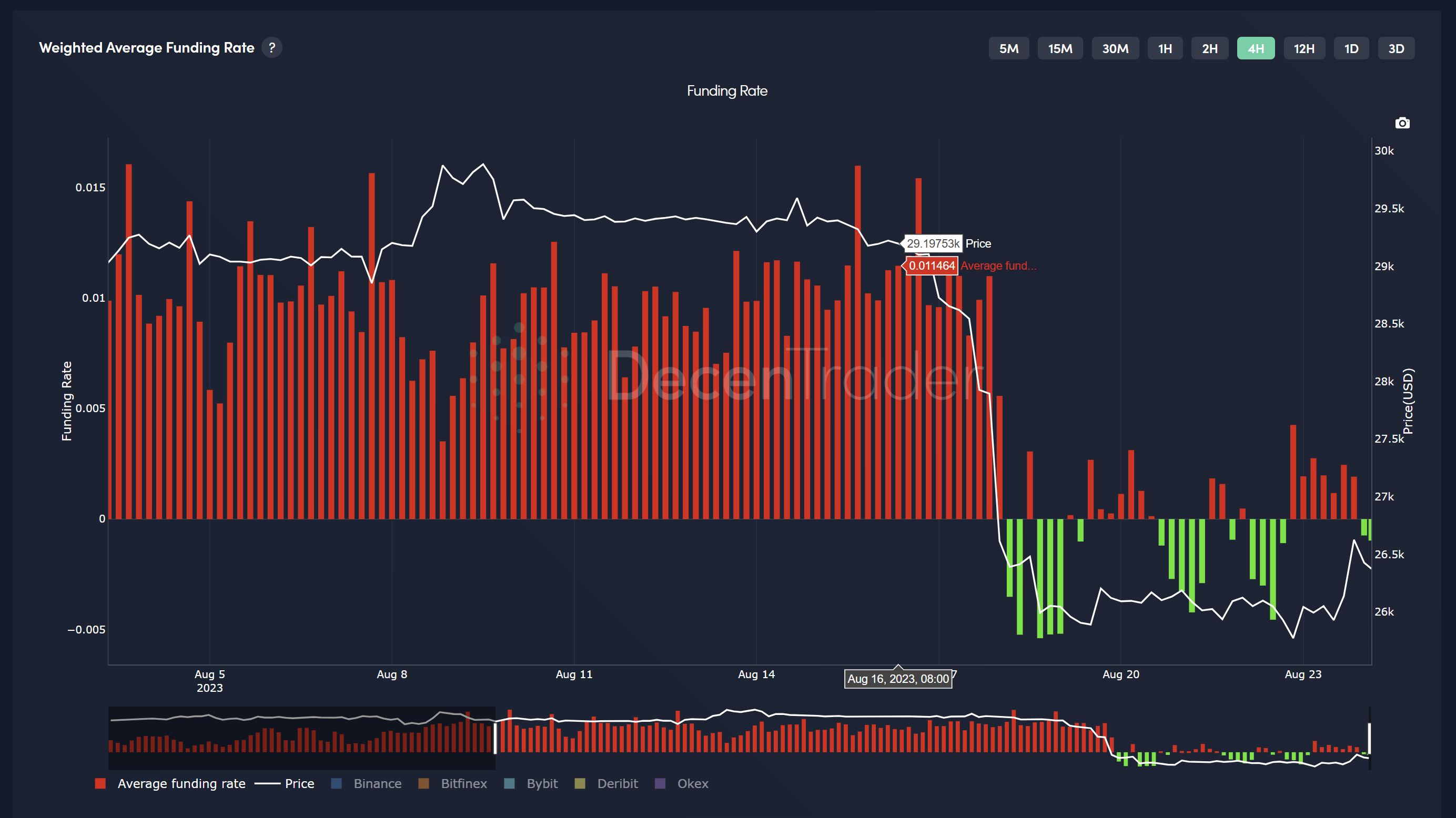

Market intelligence platform Decentrader highlighted the prevailing market sentiment, noting that despite Bitcoin’s price rise, there’s still a sense of uncertainty and fear. This sentiment is further underscored by the continuing negative dip in average funding rates. While this means that sentiment is still bad, it opens up the possibility for more short squeezes if traders are raging into shorts.

The Dollar-Index (DXY) and its inverse relationship with Bitcoin also played a part. DXY was rejected just below 104 yesterday and dropped back to 103.5. The SPX showed a nice relief bounce with USD coming off 103.96.

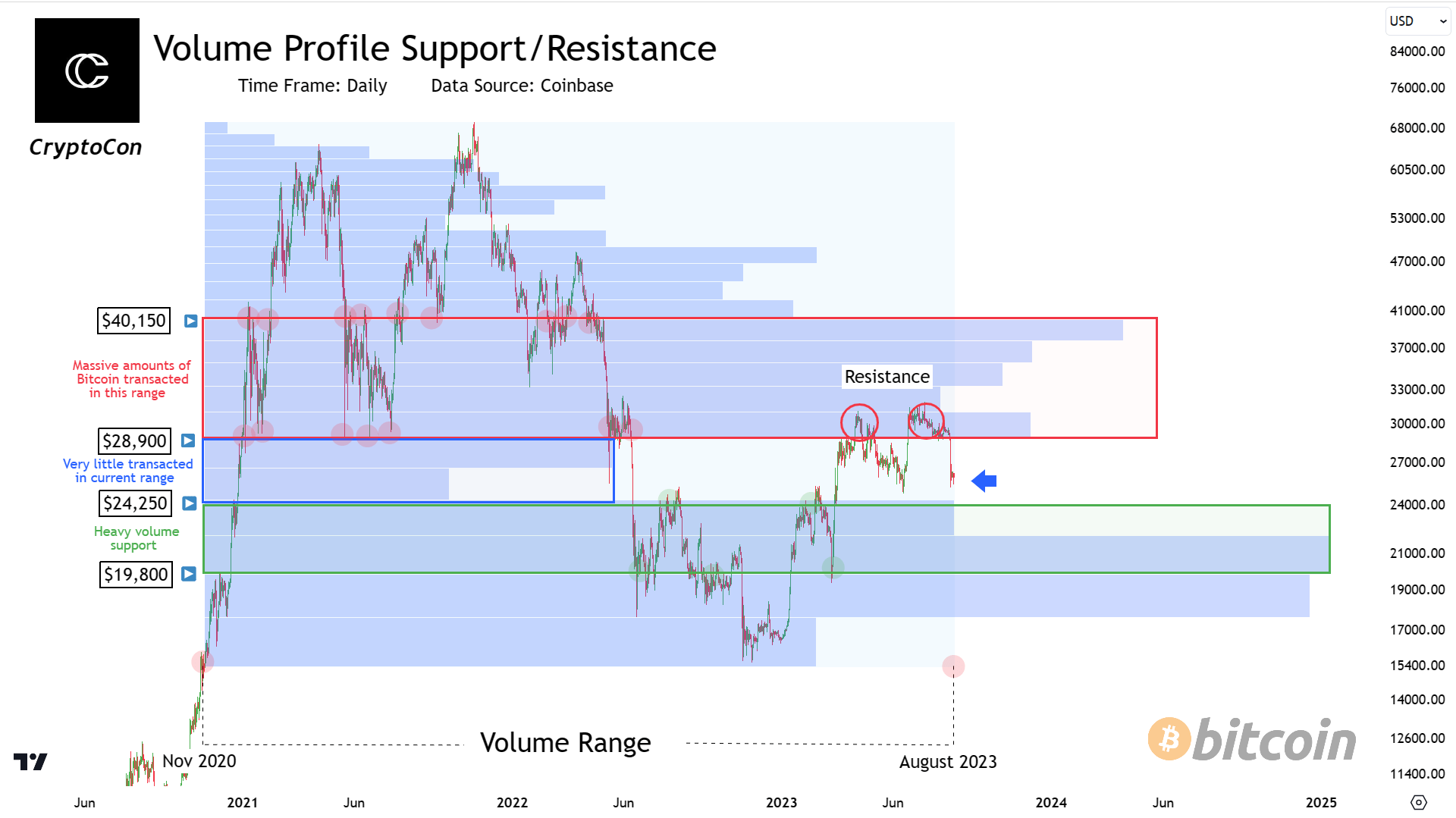

CryptoCon’s volume analysis offers a broader perspective on Bitcoin’s price movement. Since November 2020, the volume of Bitcoin transacted reveals why the price halted at its current position. The volume past $28,900 acts as a significant barrier. However, the current range of 24,000 to 29,000 for Bitcoin is relatively uncharted, suggesting that Bitcoin is searching for new support and preparing for a potential move to the next resistance zone.

What’s Next For BTC?

The upcoming Jackson Hole Economic Symposium tomorrow, Friday, where the Federal Reserve will discuss its future strategies, is a pivotal event on the horizon. Keith Alan of Material Indicators recalled the impact of last year’s symposium on Bitcoin, emphasizing, “Remember when FED Chair Powell spoke from Jackson Hole last year and his hawkish tone triggered a 29% BTC dump?”

While there are parallels in Bitcoin’s price action leading up to this year’s event, it’s crucial to note that market reactions can be unpredictable and hinge on various factors. With the Bitcoin market poised for the events of tomorrow, the prevailing mood is one of anticipation mixed with caution.

At press time, BTC traded $26,464.

#Bitcoin, #Bitcoin, #BitcoinFundingRates, #BitcoinOI, #BitcoinWhales, #Btc, #Btcusd