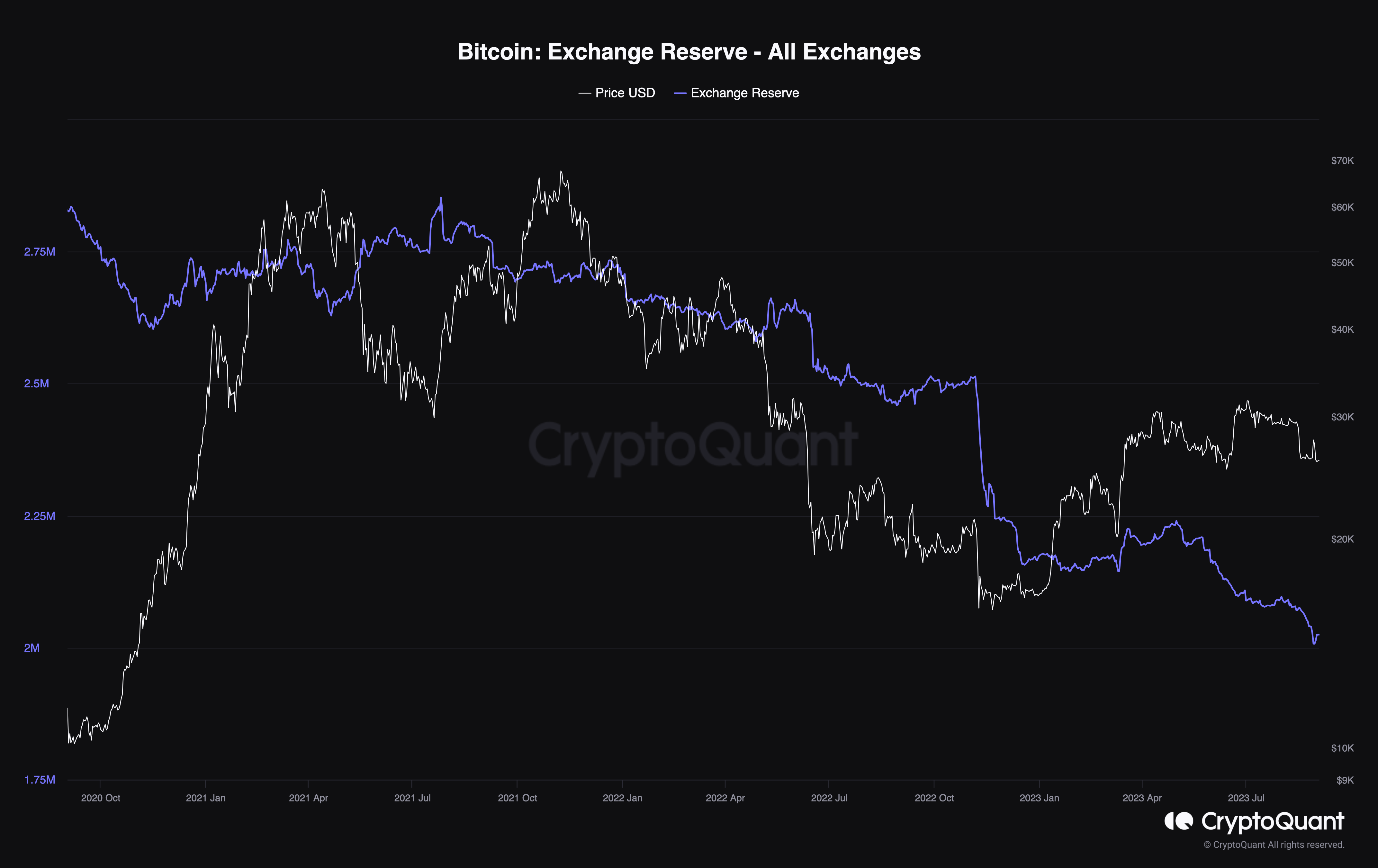

Over the past three years, there’s been a notable movement in bitcoin holdings. Since September 1, 2020, a whopping 804,000 bitcoin, equivalent to $20.79 billion, has been pulled from centralized exchanges. Notably, 184,000 BTC of that sum, valued at $4.75 billion, was withdrawn in just the last three months.

Billions in Bitcoin Withdrawn from Centralized Exchanges Amid Rising Self-Custody Trend

Centralized exchanges are holding significantly fewer bitcoins (BTC) than they did three years ago. Cryptoquant.com data reveals that on September 1, 2020, trading platforms had a reserve of 2.828 million BTC. Fast forward roughly three years, and that number has dwindled to 2.024 million, marking a decrease of 804,000 BTC. Although BTC holdings on exchanges have consistently decreased over these years, the FTX debacle triggered a substantial decline.

Just before the firm declared bankruptcy in November 2022, exchanges had 2.511 million BTC, indicating a withdrawal of 487,000 BTC since then. In just three months since May 23, 2023, around 184,000 BTC has been withdrawn from centralized crypto exchanges. By August 28, the BTC holdings on these platforms nearly dipped below the 2 million mark, with cryptoquant.com data indicating a balance of 2,007,427 BTC. Over the past few days, there’s been a modest increase, pushing bitcoin holdings to 2.024 million.

Data archived September 2, 2023, shows that from August 2, Binance, the top centralized trading platform in bitcoin holdings, experienced a withdrawal of 892.09 BTC over 30 days. During the same period, Coinbase saw 5,718.86 BTC leave, based on coinglass.com metrics. Bitfinex lost 429.02 BTC, while Okx had 1,778.97 BTC withdrawn. Among the top five, Gemini witnessed a significant outflow of 22,313.24 BTC from its reserves. Bybit also recorded a sizable withdrawal of 30,673.34 BTC over the past month.

The trend of BTC withdrawals from centralized exchanges underscores the growing preference for self-custodial bitcoin (BTC) holdings. Such an approach offers users full control over their assets, eliminating the risks associated with exchange vulnerabilities like hacks, potential insolvencies, or regulatory crackdowns. The FTX collapse served as a stark reminder of these risks, pushing the self-custodial ideology further into the limelight. While the exact reasons for these massive withdrawals remain uncertain, the advantages of self-custody are undeniable.

What do you think about the number of bitcoin removed from centralized exchanges over the past three years? Share your thoughts and opinions about this subject in the comments section below.

#Exchanges, #Bankruptcy, #Binance, #Bitcoin, #BitcoinBTC, #BitFinex, #BTC, #BTCOnExchanges, #BTCReserves, #Bybit, #CentralizedExchanges, #Coinbase, #Cryptoquantcom, #FTXCollapse, #Gemini, #Holdings, #Insolvencies, #Okx, #RegulatoryRisks, #Reserves, #Selfcustody, #Withdrawal