The US-based spot Bitcoin ETFs has produced another impressive performance in the past week recording nearly $1 billion in total inflows. Meanwhile, the spot Ethereum ETFs have struggled to maintain a positive form with outflows dominating the market in the same period.

Spot Bitcoin ETFs Attract $3 Billion In 11 Days

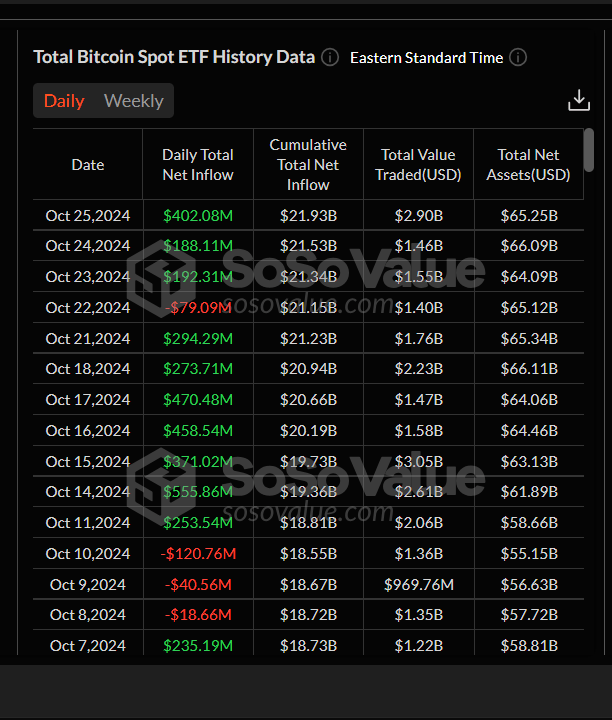

Following a splendid performance in October’s third week during which the Spot Bitcoin ETFs registered $2.18 billion in market inflows, these institutional funds retained investors’ interest the following week evidenced by a total weekly inflow of $997.70 million. According to data from ETF tracking site SoSoValue, the Spot Bitcoin ETFs recorded a positive netflow on all weekdays except Tuesday, October 22nd, where they experienced $79.09 million in outflows.

Meanwhile, the largest inflows came on Friday, October 25, valued at $402.08 million. Of this figure, The dominant BlackRock’s IBIT attracted $291.96 million as its cumulative net inflows moved to $23.99 billion.

In a similar fashion, Fidelity’s FBTC emerged in second place recording $56.95 million inflows, while $33.37 million was invested in Ark & 21 Shares’s ARKB. Other ETFs that contributed to Friday’s gain include Bitwise’s BITB, Grayscale’s BTC, and VanEck’s HODL with respective inflows of $2.55 million, $5.92 million, and $11.34 million.

Interestingly, these positive net flows recorded on Friday mean the spot Bitcoin ETFs have now recorded over $3 billion in inflows in the last eleven trading days. Commenting on this development, popular crypto analyst Michaël van de Poppe shared the general excitement of the crypto community as such massive inflows indicate significant institutional interest in Bitcoin.

Van de Poppe said:

The #Bitcoin ETF has seen an inflow of more than 3 Billion US Dollars since October 10th. 3 Billion US Dollars. That’s a strong sign that we’re about to see the big breakout for #Bitcoin to $100K.

As of now, cumulative total net inflows for the Spot Bitcoin ETFs now stand at $21.93 billion, with their total net assets now valued at $65.25 billion which represents 4.93% of Bitcoin market shares.

Ethereum ETFs See Negative Returns Again

In other news, the struggles of the spot Ethereum ETF market persist, which saw total outflows of $24.45 million over the past week, marking their 11th week of negative returns since debuting on July 26. Total net assets for these Ethereum ETFs currently stand at $6.82 billion but with a cumulative total net outflows of $504.44 million.

At press time, Bitcoin and Ethereum traded respectively at $67,077 and $2,484 following a minor decline in both assets in the past day.

#Bitcoin, #BlackRock, #BTCUSDT, #ETHUSDT, #Fidelity, #SpotBitcoinETFs, #SpotEthereumETFs