Solana Mobile, a subsidiary of Solana Labs, announced a significant 40% price reduction for its Saga smartphone, slashing the price from its initial $1,000 to a more affordable $599. This move comes just four months after the phone’s launch, sparking a flurry of reactions from the crypto community.

The official statement from the company suggests that the price cut is a strategic move to foster wider adoption of mobile web3 and to enhance the user experience for the Solana mobile community. However, on-chain data paints a slightly different picture.

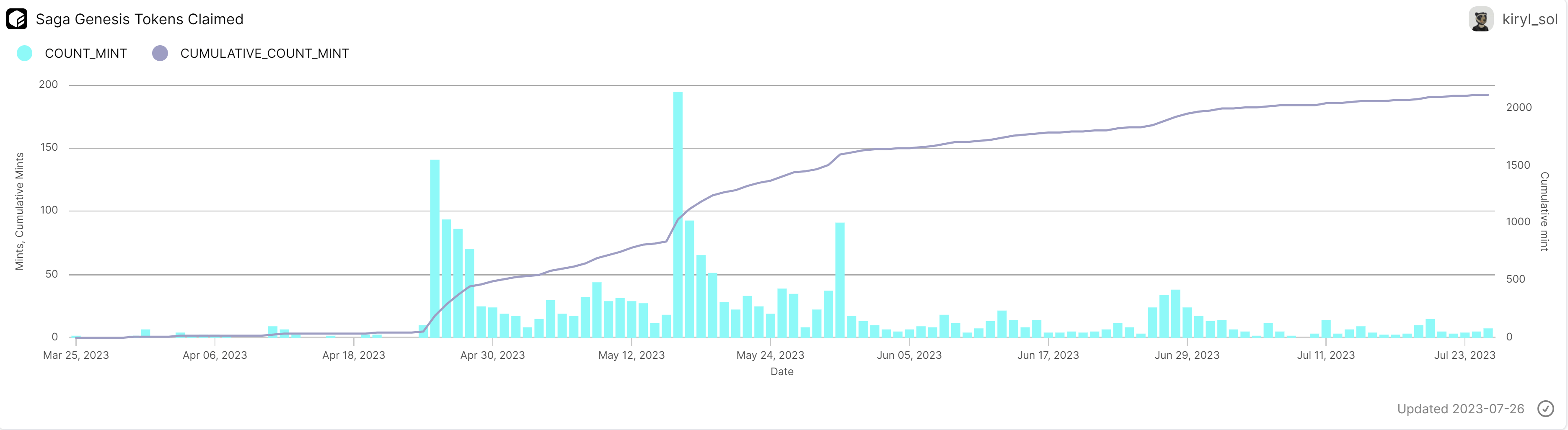

According to data compiled by Flipside Crypto, sales of the Solana Saga have seen a sharp decline since their peak in April and May. This is evidenced by the number of Saga Genesis NFT mints, which are generated when a user sets up their Solana Saga smartphone and accesses the Solana app store. The chart below shows a clear downward trend of sales. Since June sales volume has been extremely flat after a successful May 2023.

The price reduction has elicited mixed reactions on Twitter / X. While some early adopters expressed their frustration at purchasing the device at its original price, others defended the move, pointing out the benefits of being an early bird. Notably, early owners had the exclusive opportunity to mint Claynosaurz NFTs, which currently have a floor price of around 33 SOL on Magic Eden, translating to over $800.

Solana (SOL) Price Analysis

On the flip side, the Solana (SOL) token is in bullish territory. At the time of writing, SOL was trading at $24.38. A look at the daily chart shows that SOL was able to confirm the breakout from its downtrend channel on Monday after the price found support at both the channel’s trend line and the 200-day Exponential Moving Average (EMA).

As a result of this bullish confirmation, SOL broke above the 50% Fibonacci retracement level at $23.94. For now, it looks like SOL can defend the level and make a new run towards the 61.8% Fibonacci retracement level at $27.42.

Remarkably, on July 14, SOL reached its year-to-date peak of $32.36 and recoiled from the 78.6% Fibonacci retracement level. Subsequently, SOL dipped below the 61.8% Fibonacci level and couldn’t sustain a daily close above it.

Given this context, the $27.42 price point emerges as the most pivotal resistance currently. Should a breakout occur, a clear path to the year’s high would be established. In this case, a bullish breakout seems imminent. However, strong profit taking can be expected around $32.36. If the yearly high falls, though, the bulls could target the 1.618 Fibonacci extension level at $56.86.