The comeback of the Stellar Lumens (XLM) price keeps going on. In the last 24 hours, XLM has risen by another 15%, bringing the Ripple competitor’s price in line with XRP. Indeed, both tokens have risen by close to 65% (at this stage) since the summary judgment in Ripple’s legal battle with the U.S. Securities and Exchange Commission (SEC).

Remarkably, the relationship between Stellar Lumens (XLM) and Ripple’s XRP has been an intriguing tale of correlation and decoupling. As the market reacted to the recent developments in the Ripple-SEC battle, XLM followed suit, experiencing a remarkable price surge. However, as the broader market conditions cast their shadows, the question arises: Can Stellar Lumens maintain its newfound independence and continue its upward trajectory?

The Correlation Between XLM and XRP

It is no secret that Stellar Lumens and Ripple’s XRP share many similarities in their blockchain technologies and use cases. Moreover, the founder’s Jed McCaleb’s connection to Ripple adds another layer of intrigue, as investors hope that XLM will not be deemed a security by regulators.

This connection has often resulted in XLM mirroring the price movements of XRP. The market’s anticipation of developments for Ripple being equally impactful for Stellar has often led to such correlated movements, just like last week after the Ripple ruling. However, in recent days, Stellar Lumens has managed to stand on its own feet, showcasing its ability to decouple from the fortunes of XRP.

One factor for this may have been its partnership with MoneyGram, which yielded the innovative B2B service called MoneyGram Access. This service enables the conversion of the stablecoin USDC into cash worldwide through MoneyGram’s branch network, tapping into Stellar’s ledger for seamless execution. This strategic collaboration has not only bolstered Stellar’s use case but also may catalyzed its recent surge in price.

With the integration of Access into various applications and fiat ramps, XLM’s demand and utility is substantially boosted. For instance, the HoneyCoin app’s integration of Access for straightforward cash out in multiple African countries and the United Kingdom might have contributed to Stellar’s outperformance relative to XRP in recent days.

We’re excited to share @honeycoinapp users can now cash out of their USDC balance at supported @MoneyGram locations in Kenya, Uganda, Tanzania, Nigeria, Ghana, and the UK

Another real-world use case for @Circle’s USDC on Stellar.https://t.co/0JKNhdJMx3

— Stellar (@StellarOrg) July 17, 2023

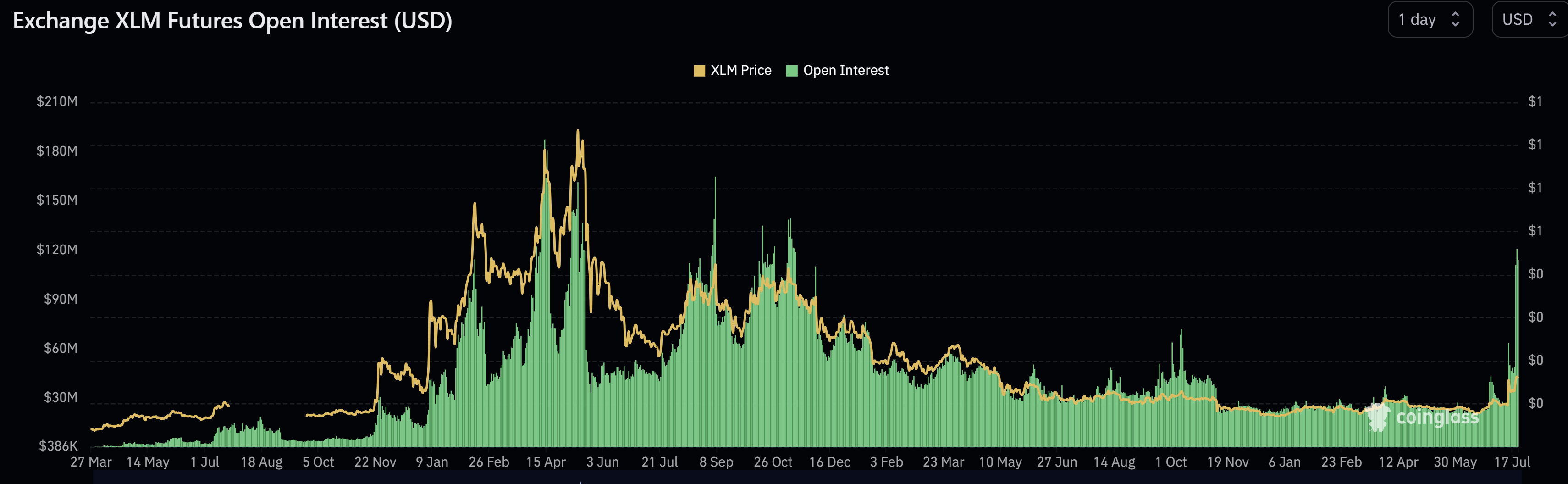

A second factor for XLM’s recently strong performance could be the extremely high interest on the futures market. The open interest for Stellar Lumens has skyrocketed to over $120 million yesterday, a level not seen since the peak of the bull market in November 2021. Notably, this phenomenon is similar to XRP which has also seen open interest soar to prior record levels.

Stellar Lumens Price Outlook

Despite experiencing a sharp rally, Stellar Lumens still remains in rather bearish territory when looking at the 1-week chart. For this week, it’s crucial that the XLM price regains the 23.6% Fibonacci retracement level at $0,1583 as well as the 200-week EMA at $0,1597 (blue line). With the weekly RSI at 73, another leg up could be possible.

On the 1-day time frame, XLM remains above all moving averages (EMAs). For a further bullish trajectory, it’s important that Stellar hold above the support at $0.1250. Should this happen, XLM could experience a further 35% rally towards the 38.2% Fibonacci retracement level. However, a drop below the support level at $0.1250 would challenge the bullish view.

#Stellar, #Ripple, #Sec, #StellarLumens, #XLM, #Xlmusd, #Xrp