In the dynamic world of crypto markets, recent trends have illuminated intriguing divergences in the altcoin market, particularly between ethereum and solana, relative to bitcoin. A comprehensive report published by Glassnode, an onchain analytics firm, delves into this phenomenon.

Altcoin Dynamics Altered: Ethereum and Solana Lead Post-ETF Era

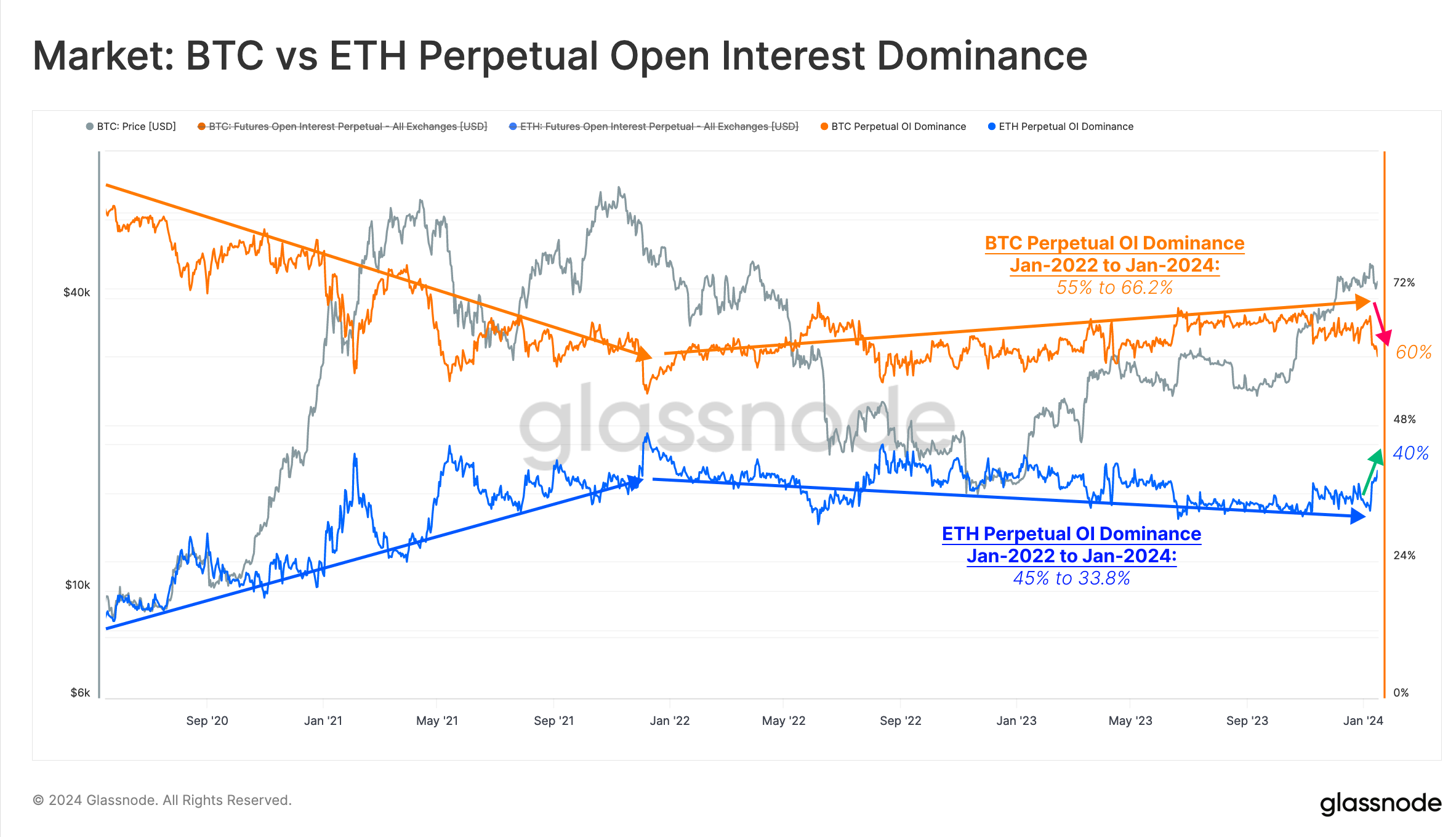

In the latest edition of Glassnode’s “The Week Onchain,” Alice Kohn’s research, published on Jan. 23, 2024, highlights ethereum’s (ETH) standout performance, marked by a notable surge in derivatives market activity, and the impressive journey of solana (SOL), especially post-bitcoin exchange-traded fund (ETF) approval. Ether has recently outshone bitcoin, recording its strongest performance since late 2022. Kohn’s report notes a surge of over 20% in ethereum’s value relative to bitcoin, coinciding with a revitalized interest in ethereum’s derivatives market.

This resurgence, signaling a potential shift in capital flows, has led to increased speculation about a forthcoming spot-based ethereum ETF. However, despite these gains, ethereum still trails behind the broader altcoin market in terms of momentum, underperforming by 17%. Solana, on the other hand, has charted a different course, Glassnode’s report details. SOL witnessed exceptional price performance last year, despite setbacks linked to its association with FTX.

SOL has significantly outperformed ETH in this period, with the SOL/BTC ratio increasing by 290% since October 2023. Interestingly, unlike ETH, solana’s price did not experience a significant revaluation following the BTC ETF approvals, as Glassnode’s Kohn suggests a divergent market response to broader sector movements. The broader altcoin market, as a whole, has seen nearly a 69% increase in market cap since the filing of the Blackrock Bitcoin ETF.

On Jan. 14, 2024, Bitcoin.com News highlighted that blockchaincenter.net’s Altcoin Season Index indicated the commencement of altseason. The index continues to declare it is “altcoin season,” with the leading 50 coins outperforming BTC in the previous season (90 days). Glassnode’s Kohn emphasized that the trend is primarily driven by tokens related to ethereum scaling solutions such as Optimism, Arbitrum, and Polygon. Staking and Gamefi tokens also outperformed BTC in the early stages of 2023, indicating a varied appetite for risk across different altcoin sectors.

Kohn’s research stresses the importance of these developments: “The approval of the new bitcoin ETFs has become a classic sell-the-news event, leading to a tumultuous few weeks in the market.” Glassnode says that ethereum has emerged as the short-term winner, with investors recording a multi-year high in net realized profits. This suggests a growing willingness to engage in speculative activities, particularly concerning an ETH ETF and capital rotation.

What do you think about Glassnode’s report concerning altered altcoin dynamics in the crypto market? Let us know what you think about this subject in the comments section below.

#Altcoins, #BitcoinBTC, #Crypto, #Cryptocurrency, #ETH, #Ethereum, #Glassnode, #SOL, #Solana