Polkadot (DOT), one of the prominent blockchain networks in the crypto space, experienced a 16% decline in market capitalization in the third quarter (Q3) of 2023, according to a recent report from Messari.

This decline came after a moderate downturn in the overall cryptocurrency market during Q3, despite favorable court rulings for XRP and Grayscale. The total crypto market capitalization declined by 5.8%, with Bitcoin (BTC) and Ethereum (ETH) falling by 7.5% and 10.0%, respectively.

Polkadot Closes Q3 With $5.2 Billion Market Cap

As reported by Messari, Polkadot’s market capitalization closed at $5.2 billion, positioning it as the 13th largest crypto asset by market cap in Q3 2023 (currently 15th).

Polkadot’s financial structure is based on a weight-based fee model, which differs from the gas-metering model in other networks, such as Ethereum.

Transaction fees in Polkadot are determined and charged before execution, with the calculation comprising a weight fee reflecting computational resources, a length fee based on transaction size, and an optional tip to incentivize block authors.

In Q3 2023, Polkadot generated revenue amounting to $94,000, representing a 3% decrease compared to the previous quarter. Messari suggests that Polkadot’s revenue tends to be relatively lower compared to its competitors due to the network’s structural design.

On the other hand, the native token of Polkadot, DOT, serves three primary purposes: governance, staking, and parachain bonding. During Q3 2023, the staking percentage of DOT rose by 12% compared to the previous quarter, reaching 49%.

This increase led to reduced staking rewards and a 12% decline in the annualized nominal yield to 15%. According to Messari, the close alignment of Polkadot’s staking rate with the ideal rate demonstrates the effectiveness of its mechanism.

Polkadot’s OpenGov Milestone

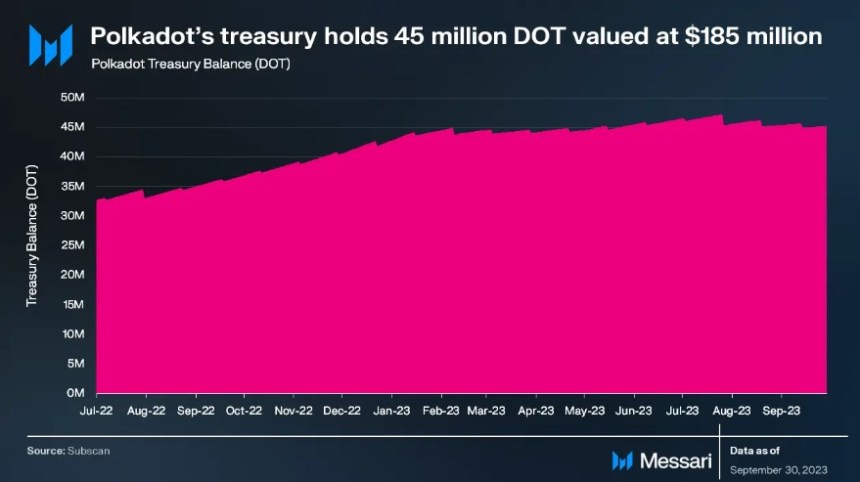

The Polkadot treasury supported various initiatives in Q3, including software development, bounties, client upgrades, and community events like meetups and hackerspaces.

According to Messari, the implementation of OpenGov on June 15 marked a significant milestone, revolutionizing treasury management and enabling concurrent proposals with distinct requirements. At the end of the quarter, the Polkadot treasury held approximately 45 million DOT ($185 million).

Furthermore, Polkadot has recently completed the official release of Polkadot 1.0, marking the achievement of a significant milestone outlined in the Polkadot whitepaper.

The network’s codebase has been fully transitioned to a repository managed by the community through Polkadot OpenGov and the Technical Fellowship. The roadmap for the next iteration, Polkadot 2.0, will be determined through community discussions and consensus.

Founder Gavin Wood has proposed ideas for additional mechanisms to allocate Polkadot’s block space and for creating treaty-like agreements between multiple blockchains called “accords.”

As of this writing, the DOT token has exhibited a noteworthy upward trend since October 19, closely following Bitcoin’s lead. Presently, the token is trading at $4,839, reflecting a notable increase of over 16% within the past fourteen days.

Featured image from Shutterstock, chart from TradingView.com

#DOT, #Blockchain, #BlockchainTechnology, #Crypto, #Cryptocurrency, #DOTAnalysis, #DOTPrice, #DOTPriceAnalysis, #DOTUSD, #DOTUSDT, #Polkadot, #PolkadotDOT, #PolkadotAnalysis, #PolkadotEcosystem, #PolkadotMarketCap, #PolkadotPrice, #PolkadotToken