The cryptocurrency sector is witnessing a new gold rush, and this time, it’s happening on a messaging app. Notcoin (NOT), a Telegram-based token, has exploded in value over the past week, surging 400% and reaching its all-time high of $0.027. This astronomical rise has left analysts scrambling to understand the driving force behind this social media-fueled frenzy.

From Humble Beginnings To Meteoric Rise

Notcoin’s journey began modestly as an in-game currency for a Telegram clicker game launched in late 2023. Players could earn NOT tokens by tapping a virtual gold coin, a simple yet addictive mechanic that attracted a large user base within the popular messaging platform.

This initial success paved the way for a wider integration with Telegram in May 2024, allowing users to earn tokens through various “earning missions” and tasks. This play-to-earn model, coupled with the massive user base of Telegram, seems to be the key to Notcoin’s recent surge.

The token’s skyrocketing price has also been fueled by a significant jump in daily transaction volume. Notcoin now boasts a daily trade volume exceeding $4.5 billion, placing it among the top four most actively traded cryptocurrencies. This surge in activity indicates a growing interest from investors and potential new users eager to capitalize on the play-to-earn opportunities offered by Notcoin.

Whales And FOMO: A Recipe For Volatility?

While the Notcoin rally is undeniably impressive, whispers of caution linger within the crypto community. The cryptocurrency market is notorious for its volatility, and such rapid price increases often raise concerns about a potential bubble.

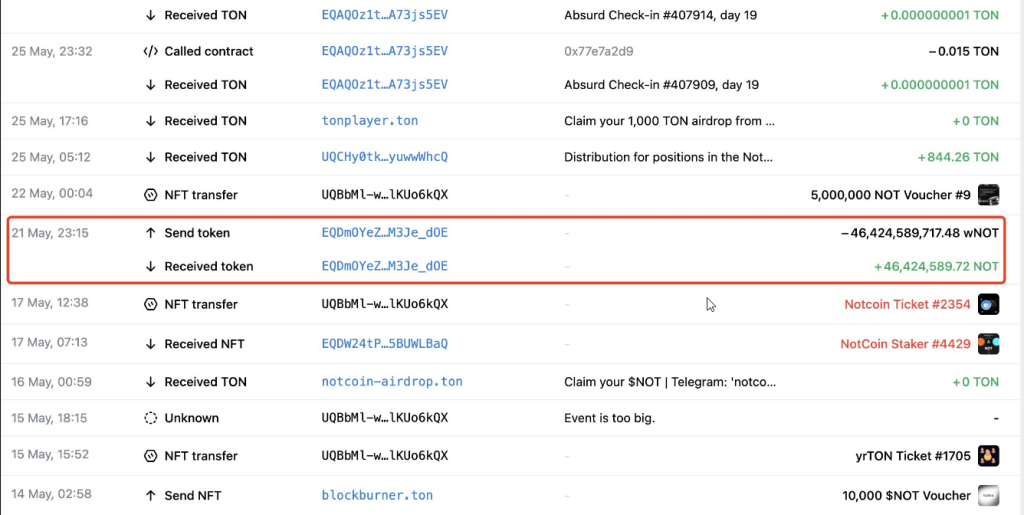

This is further amplified by reports from on-chain data provider Lookonchain. According to Lookonchain, a large investor (“whale”) profited significantly from the recent price surge. This whale reportedly purchased a substantial amount of wrapped Notcoin (wNOT) before the official listing of NOT.

The price of #Notcoin( $NOT) has risen by more than 400% in the past 7 days.

We noticed that a whale has an unrealized profit of $862K on $NOT.

He spent 50,550 $TON($278K) to buy 46.4B $wNOT before $NOT was listed.

1000 $wNOT can be exchanged for 1 $NOT.

On May 21, he… pic.twitter.com/Da29qniVzg

— Lookonchain (@lookonchain) June 3, 2024

Lookonchain highlights that upon listing, the whale converted their entire holding of wNOT into NOT, resulting in an unrealized profit of over $862,000. The whale’s sizable holdings and potential future actions could significantly impact the token’s price stability.

Another factor to consider is the fear of missing out (FOMO) currently driving the market. New investors, lured by the prospect of high returns, might be rushing into Notcoin without fully understanding the underlying technology or the risks involved. This could lead to a situation where the price becomes inflated beyond the token’s actual utility, setting the stage for a potential correction in the future.

The Road Ahead For NotcoinDespite the inherent risks, Notcoin’s success highlights the growing potential of integrating cryptocurrency with established social media platforms. The ease of access and user-friendly experience offered by Notcoin’s play-to-earn model could be a blueprint for future blockchain integration within social media.

However, the platform’s long-term viability hinges on its ability to maintain a healthy user base and demonstrate the real-world value of the NOT token beyond its current gaming and task-based applications.

Featured image from Coben Executive & Corporate Advisory, chart from TradingView

#CryptocurrencyMarketNews, #Altcoins, #Crypto, #Memecoins, #NOTToken, #Notcoin, #Telegram