Raphael Zagury, chief investment officer at Swan Bitcoin, has developed a new BTC pricing model that currently calculates a fair price of $387,823 in a base case. Zagury calls it Schrödinger’s Coin Model and bases the valuation of Bitcoin on the fact that it is a store of value that will demonetize all other assets.

Bitcoin Price Undervalued By At Least 13 Fold

Inspired by “Bitcoin as Property” by Michael Saylor, the model calculates Bitcoin’s potential to siphon off the monetary premium from traditional assets, resulting in a shift in capital allocation and a revaluation of their value.

It hypothesizes that the expansion of money supply by central banks around the world has led to a fundamental destruction of money and a flight of capital by investors into financial instruments such as stocks, real estate, and exchange-traded funds (ETFs) as their primary stores of value.

Central banks, flooded with excess currency, have fundamentally broken the value of money, leading investors to seek protection against the negative effects of money printing. This phenomenon has resulted in the financialization of the economy and huge monetary premiums.

These premiums have the effect of pricing many of these assets, including real estate, far above their utility value, Zagury argues. Bitcoin, according to the analyst, has the potential to benefit from this and become the premium asset by demonetizing the aforementioned traditional stores of value.

To calculate Bitcoin’s fair value, the model looks at the major asset classes and uses probabilities for when and how much share Bitcoin can take from each asset class. In addition, a time value is included.

Furthermore, the Schrödinger’s Coin model is based on the concept of quantum superposition, where Bitcoin has two possible outcomes. “It either fails and is worthless (Dan Peña scenario) or captures the monetary premium of traditional stores of value (Saylor scenario),” the analyst states.

How Is the Base Scenario Calculated?

In each scenario, the value of demonetization by Bitcoin is calculated for each asset class based on the parameters and summed up.

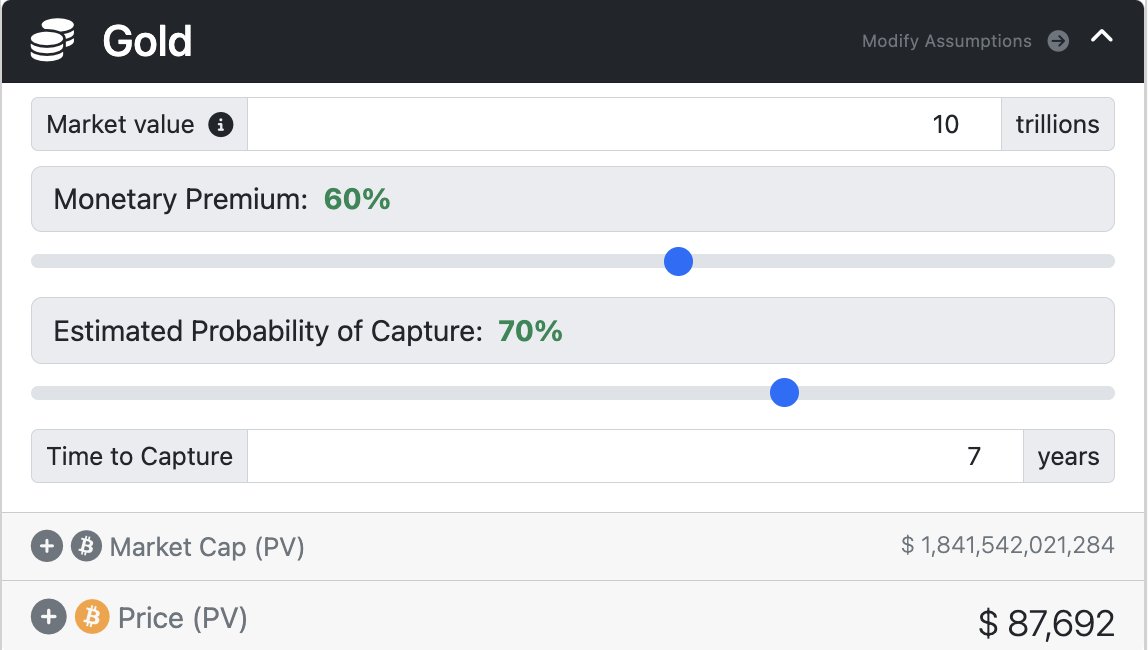

The base case assumes that 60% of gold’s market capitalization is due to monetization rather than utility. With a market capitalization of $10 trillion and a 70% probability of gold demonetization, this results in a Bitcoin price of $87,000.

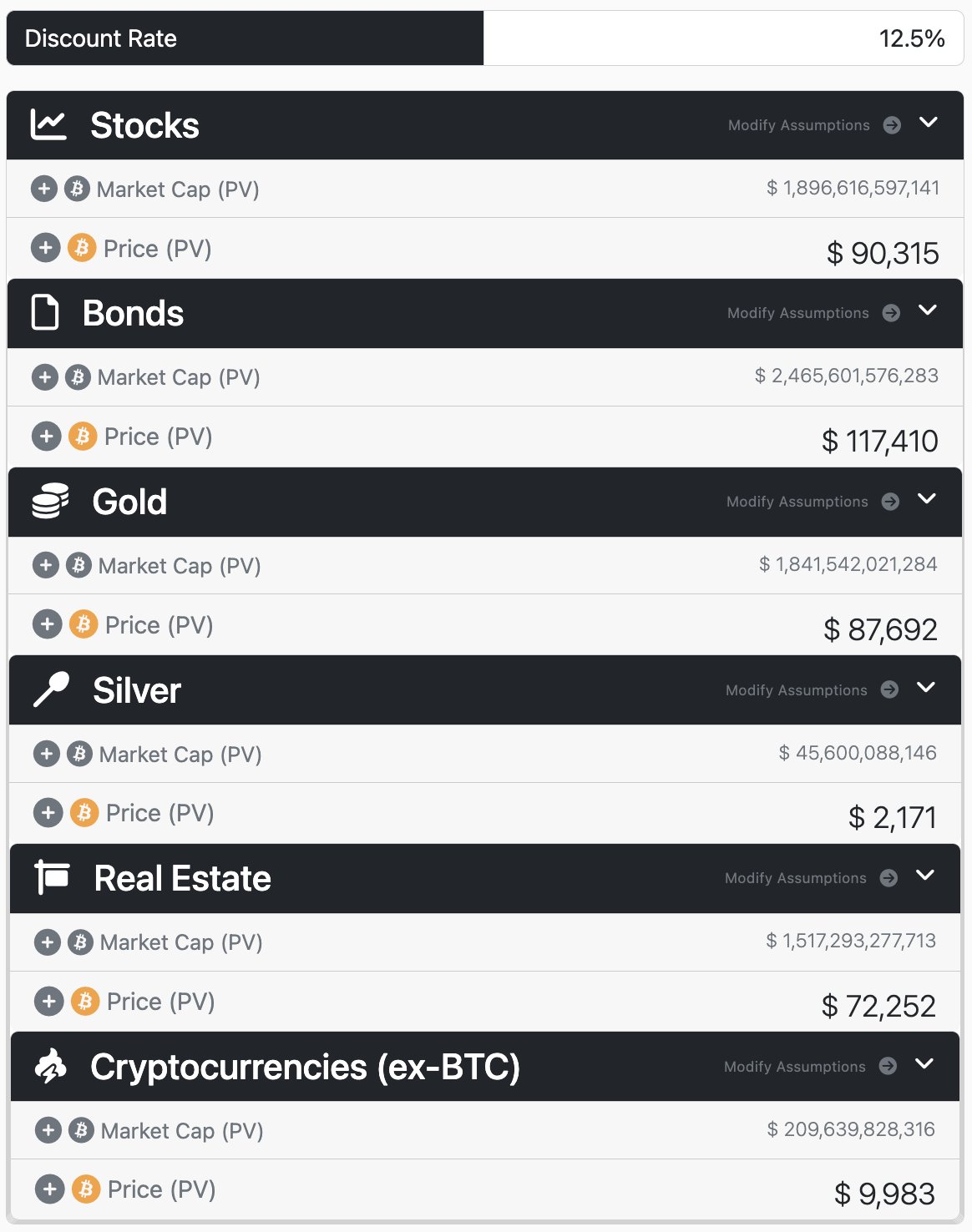

When the other asset classes are now added and an intertemporal discount rate of 12.5% is considered, this results in a Bitcoin present value of $379,823 in the base case. Underlying the base case are the following parameters of demonetization shown in the image below.

In the most bullish scenario, BTC could reach a price of over $3 million per coin. “In terms of expected value, here’s the path to HyperBitcoinization as this scenario plays out; leading to a Bitcoin price of +$3mm in 20 years,” Zagury writes.

The gif below shows the interface that Zagury is currently still developing to allow Bitcoiners to make their own assumptions and probabilities in order to calculate a fair Bitcoin price.

Full model description, sources and more info here:https://t.co/qwKsjTV8iz

I'm figuring out a way to share the dynamic application below as open source. This way anyone can make their own scenarios and assumptions. Soon…

Bitcoiners run the numbers.

pic.twitter.com/9VVidSH3PZ

— Alpha Zeta (@alphaazeta) April 5, 2023

Sam Callahan, lead analyst at Swan commented on the modell:

Bitcoin’s adoption won’t happen overnight. It’s a game of probabilities as more people learn about it and begin to value it over time. Eventually, it will demonetize other assets due to its superior monetary properties, but today, it remains underappreciated and thus undervalued.

At press time, the BTC price stood at $27,912. After another failed attempt to overcome the resistance area at $28,600, the BTC price is currently struggling to find support.