Terra has stirred considerable attention of late, experiencing an impressive surge in prices that has left market observers intrigued. The catalyst behind this upward trajectory can be largely attributed to notable advancements within the Terra Ecosystem. A recent substantial capital infusion likely instilled significant confidence among investors, acting as a driving force behind the recent upswing in LUNC prices.

Examining The Factors Behind LUNC’s Meteoric Surge

In the last month, LUNC has been on quite a ride, marking an impressive 90% surge in its value. This has triggered discussions, prompting questions about whether this surge is just a momentary spike or the initiation of a more enduring upward trajectory.

The remarkable boost in LUNC’s value finds its roots in a couple of noteworthy events unfolding within the Terra ecosystem. Specifically, Terra Classic Labs strategically invested around $500,000 into TerraClassicUSD (USTC), the algorithmic stablecoin linked to the Terra platform.

Our $LUNC and $USTC weekly burn numbers have come in.

We had a bumper week, with GIGANTIC burns in both.#LUNC finished the 7-day period with 702M

#USTC finished the week with 2.2M

We are on track to have the biggest month with regards to the #LuncBurn movement… pic.twitter.com/40SVd2IRTa

— titan2022 (@titan20221) November 27, 2023

The considerable token burn that has taken place recently is another key driver of the rally. The quantity of LUNC tokens in circulation has decreased to 5.8 trillion due to the destruction of around 78.24 billion of them, which could put more pressure on the token’s price.

The cryptocurrency industry frequently uses this process of token burning to control inflation and increase token value by lowering supply.

LUNC Showing Bullish Side

According to data from Coingecko, the price of LUNC has now surged by over 80% this month, with a 71% increase tallied this week in response to the announcement of Mint Cash and Binance’s launch of the USTC perpetual contract.

Furthermore, the increase happens a week after Terraform Labs allocated $10 million in assets among three different liquidity pools. As of writing, LUNC is trading at $0.00011. With a $513 million daily trading volume, LUNC’s market capitalization of $661 million places it as the 79th largest cryptocurrency asset.

LUNC’s indicators are all in very positive positions, which is not surprising given that the coin has increased by more than 30% in a single day. Before the present rally loses momentum, its relative strength index (purple) may peak at near to 90.

Whales are waking up and jumping into #LUNC

— Bull.Lunc (@Bullluncdao) November 27, 2023

The coin’s 24-hour trading volume, which has increased from less than $20 million to more than $600 million virtually overnight, is arguably the most encouraging of all. This surge implies that whales have finally made a comeback to the token, pilfering more of it and igniting a broader rally.

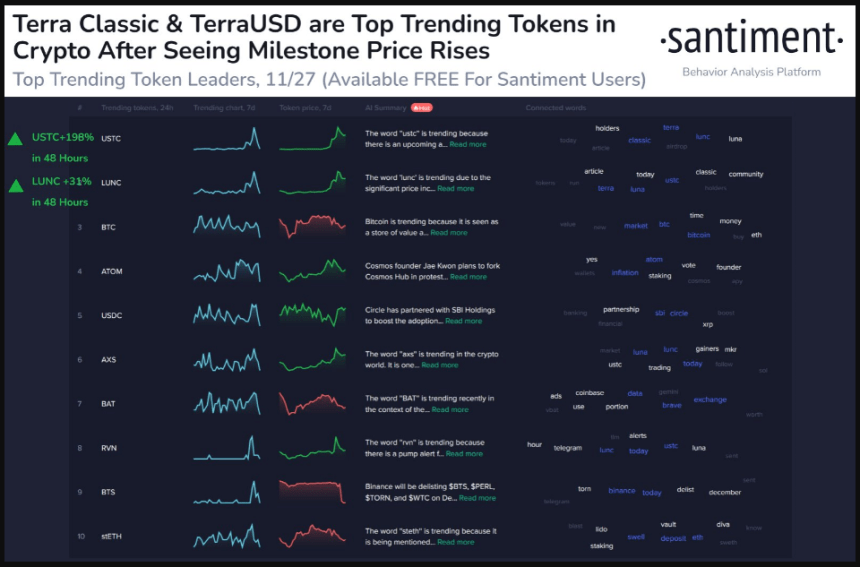

Meanwhile, LUNC and USTC reported milestone price increases over the previous week, according to data from the crypto intelligence tracker Santiment. As a result of the two coins’ historic weekly gains, LUNC and USTC are now the top moving cryptocurrencies on Santiment’s tracker.

Santiment’s analysts predict that the milestone price rallies in both cryptocurrencies are probably signs that investors are suffering from FOMO, or the fear of missing out on these tokens’ gains, which has propelled the assets to the top of the list, surpassing both Bitcoin and Cosmos.

(This site’s content should not be construed as investment advice. Investing involves risk. When you invest, your capital is subject to risk).

Featured image from iStock

#CryptocurrencyMarketNews, #TerraLUNA, #Btcusd, #Crypto, #Ethusd, #LUNC, #TerraClassic, #TerraUSD, #USTC