On Saturday, Bitcoin experienced a robust rally, climbing above $58,250. Despite this upward movement, it was unable to sustain the momentum and close above the 200-day Exponential Moving Average (EMA). This led to the formation of a bearish engulfing candlestick pattern on Sunday, signaling potential downside momentum. Currently, Bitcoin is trading below $56,000, positioning it at a critical juncture in terms of technical analysis and market sentiment.

Sina G, the COO and co-founder of 21st Capital, provided a breakdown of the factors influencing Bitcoin’s price trajectory today, particularly highlighting recent declines and evaluating its undervalued state through sophisticated metrics. Starting with a historical overview, Sina pointed out that Bitcoin had seen a drastic 26% decline from a March peak of $73,000, settling around $56,000 in recent weeks.

This sharp decrease has been attributed to several macroeconomic and sector-specific factors. According to him, Bitcoin’s fall from the $73,000 peak in March to $56,000 aligns with historical bull market corrections, which often see significant yet temporary retracements.

The influence of Bitcoin ETFs has been pivotal. Initially, these ETFs contributed significantly to the price surge from $16,000 to $73,000, as investors engaged heavily in a buy-the-rumor, buy-the-news strategy. “Up to mid-march ETF flows were very strong and the market moved up. Since then ETFs slowed down and bankruptcy outflows took over, causing a weak price action all the way down to $56K.

A notable recent impact on Bitcoin’s price has been the selling activity of the German government, which disposed of Bitcoin seized in 2013 from the pirated content platform Movie2k.to. “The government’s decision to liquidate approximately 10,000 coins across three transactions coincided directly with significant price drops on specific dates in June and July,” he noted. This selloff contributed to a steep 24% crash in June and July, exacerbated by the large volume of Bitcoin introduced into the market.

Is Bitcoin Undervalued?

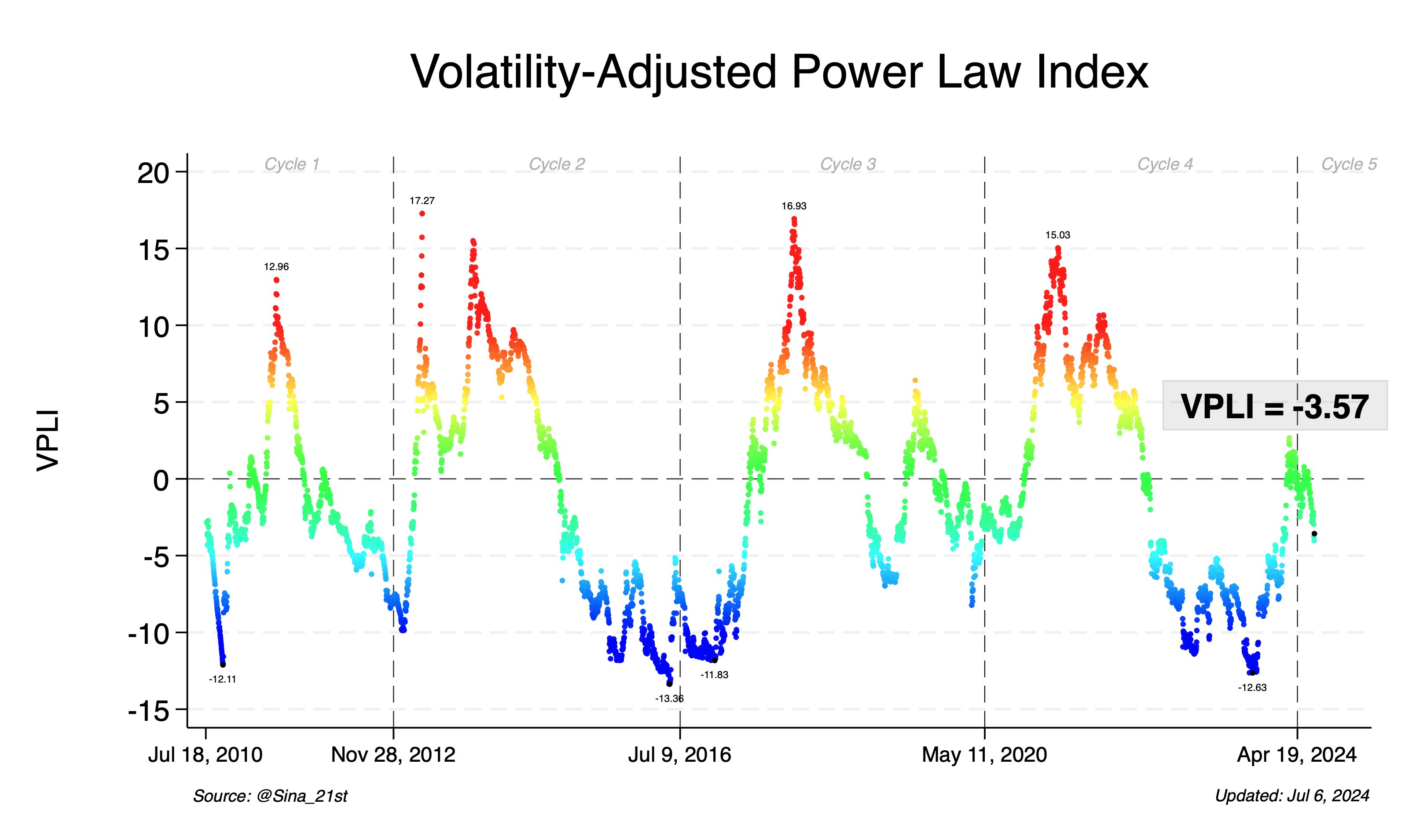

To address whether Bitcoin is currently undervalued, Sina turned to the Volatility-Adjusted Price Level Index (VPLI), a proprietary metric developed by 21st Capital. “Currently, our VPLI is at -3.57, which indicates that Bitcoin is significantly below its fair price,” Sina stated. He further clarified that historically, a VPLI score of -10 corresponds with bear market bottoms, placing the current reading in a context that suggests Bitcoin is potentially undervalued.

“This puts us in the 41th percentile of values – i.e., Bitcoin has only spent 41% of below this VPLI reading (most of which during the bear markets). So the risk-reward balance is favorable,” he added.

Looking forward, Sina highlighted two critical short-term indicators that could dictate Bitcoin’s immediate price movements: the continuation of Bitcoin sales by the German government and the behavior of the perpetual swaps funding rate. “Recently, the funding rate has been negative, which is typically a bearish signal. This suggests that many traders are taking short positions, anticipating further declines, which paradoxically might indicate that the market is close to reaching a bottom,” he concluded.

At press time, BTC traded at $55,835.

#Bitcoin, #Bitcoin, #BitcoinAnalysis, #BitcoinNews, #BitcoinPrice, #BitcoinPriceAnalysis, #Btc, #BtcPrice, #Btcusd