Bitcoiners Need The Guillotine

As Scottish economist and philosopher David Hume observed in A Treatise of Human Nature, nothing we know about what is true can tell us what ought to be true and nothing we know about what ought to be true can tell us what is true. The world of objective fact and moral truth are entirely separate. Hume called this the is/ought problem and his argument that descriptive and normative reasoning should be separated is known as Hume’s guillotine.

Hume’s guillotine is a philosophical razor – a rule of thumb for reasoning about the world. It is a way of cutting apart two lines of reasoning that become entangled when they intertwine. An argument where one side argues about what is true and the other side argues about what ought to be true is a useless argument. Those people are talking past each other.

Even more importantly, the guillotine is a tool for reducing bias in our thinking. Left unsupervised, our hopes can corrupt our beliefs – leading us to assume that which is true is good (naturalistic fallacy) and that which is good is true (wishful thinking). In the Bitcoin industry there are many who let their conviction about what Bitcoin should be distort their understanding of what Bitcoin is. They need to study the guillotine.

Decentralization Will Never Be Cheap

One harsh but simple truth is that real decentralization is too expensive to be universal. If you believe in the value of decentralization it is easy to see why you would want it to be universally available. But if you understand how decentralization works it is also easy to see why that will never be possible. The math simply does not allow it.

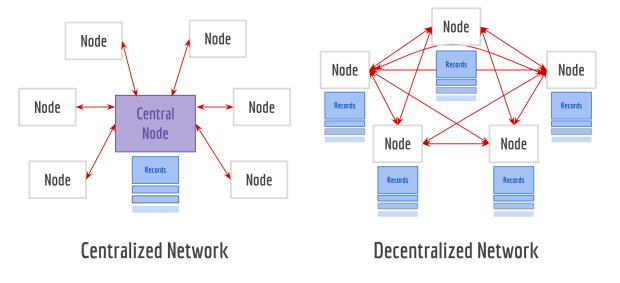

Decentralization is – by definition – more expensive than a centralized alternative. To be decentralized, networks need more copies of the network history (blue squares) and more connections between nodes (red arrows). Coordinating a centralized network is fundamentally cheaper and easier to do. Depending on the purpose of the network, decentralization might be worth paying for – but it will never be the cheapest option.

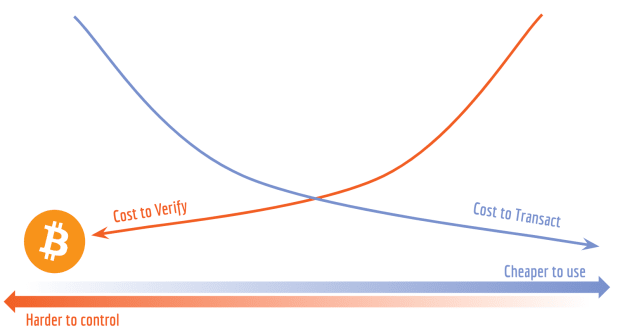

The expense of running a network is split between users and validators. Networks can either limit activity on the network (which makes transactions expensive because they are scarce) or they can demand more work from validators (which centralizes the network). Bitcoin keeps the cost of network validation low by limiting the block size – but that also by definition means transaction space is limited. Transaction fees on Bitcoin are expensive by design.

Adding more capacity to the network wouldn’t make it cheaper for individual users, anyway. That’s because Bitcoin’s transaction fees aren’t set by the network, they are set by users’ willingness to outbid each other in the blockspace auction. You can’t lower transaction fees by increasing capacity because increasing capacity doesn’t change anyone’s willingness to pay. Users don’t decide whether to pay for a transaction based on how full the blocks are, they decide based on how high the fees are.

Larger blocks would be good news for miners (because there would be room for more paying customers) but it wouldn’t change much for users – transaction fees would be about the same. The fancy economics term for this counterintuitive result is Jevons paradox.

Inventing new Layer2 technology won’t make transacting on Bitcoin any cheaper, either. Technology like Lightning, Liquid, Fedimint and Ark expand the power and flexibility of what Bitcoin transactions can do – but making transactions more useful does not make them cheaper, it makes them more valuable. More ways to use Bitcoin transactions means more demand for the limited available blockspace. We should expect Layer 2s to make L1 Bitcoin transactions more expensive, not cheaper.

That’s ok, because Bitcoin is not supposed to be cheap. It’s supposed to be Free.

Free As In Freedom

The lure of cheap decentralized transactions is strong. It was the heart of the blocksize wars and it is the central value proposition of most altcoin networks today. It’s also the driving force behind the widespread but misplaced belief that the Lightning network will allow Bitcoin scale to universal adoption. The reality is more nuanced: Lightning lowers the cost of using Bitcoin. That’s not the same thing as making Bitcoin cheap to use.

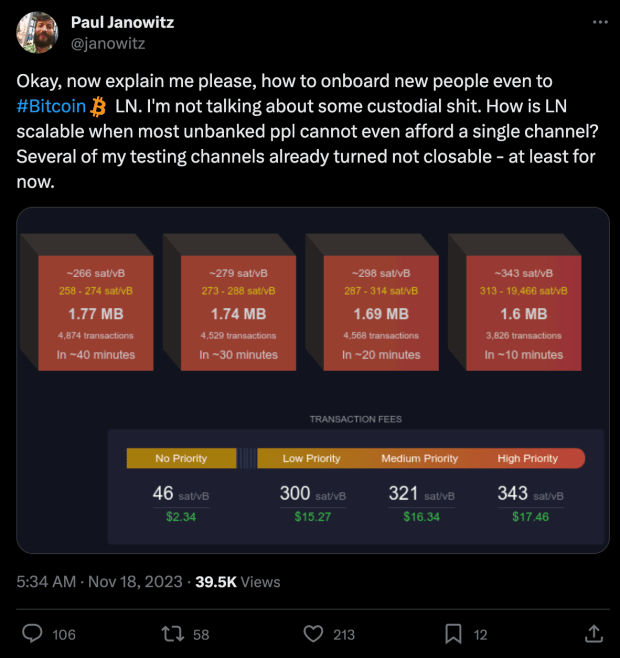

The truth is that Lightning channels require Bitcoin transactions and Bitcoin transactions will inevitably be expensive. Bitcoin confirms ~0.4M transactions/day. That’s one transaction/person every ~55 years, assuming no one is born or dies while waiting. The long term price of a bitcoin transaction is difficult to predict, but it isn’t difficult to predict they will be rare: either because most people can’t afford them or because most people don’t want them in the first place.

There are proposals to make channel management cheaper (e.g. channel factories) but since every proposal ultimately depends on some on-chain anchor transaction, every channel will need to be purchased/leased somehow from someone who can afford the original transaction. Anthony Towns did some interesting analysis and estimated that there was room for approximately ~50,000 entities to transact directly on-chain. Everyone else would need to rent custodial services from one of those on-chain entities. You can use a copy of this spreadsheet to tweak the assumptions and run your own estimates.

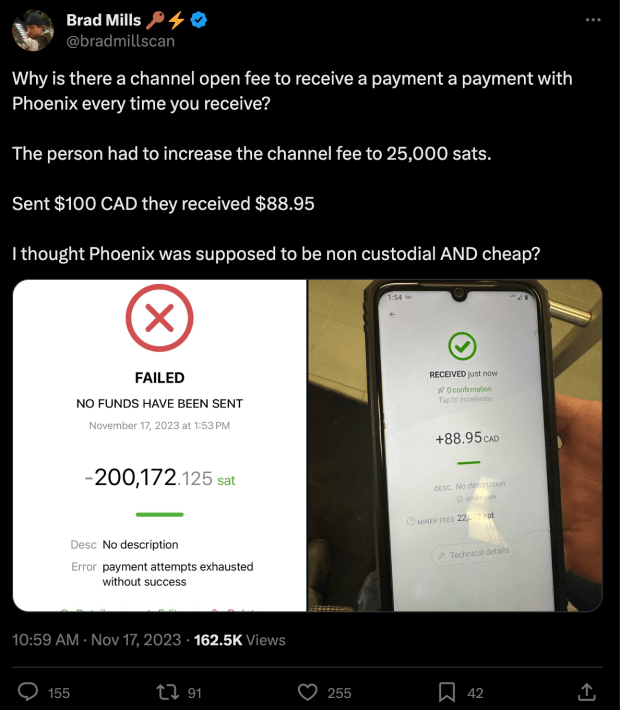

Even if we ignore opening/closing costs entirely, channels themselves are not cost-free to maintain. Users need an online presence to receive payments / supervise their counterparties for misbehavior. They need to either perfectly balance their sent/received payments or periodically pay a liquidity provider to rebalance their channels. Most importantly, any bitcoin being used to create Lightning channel capacity is necessarily online and not in cold storage.

The marginal cost of individual Lightning transactions is very small, but the total cost of creating, using and maintaining a Lightning channel is actually quite high — because it is denominated in bitcoin and bitcoin is the scarcest resource in history. Telling retail users to open Lightning channels to make cheap transactions is like telling them to launch their own satellites for cheaper mobile internet.

To be clear, I am a believer in the value of the Lightning Network – I just don’t think it will bank the unbanked. The Lightning Network makes Bitcoin transactions more powerful, not cheaper. Payment channels will only make sense for people who make enough payments to justify paying to streamline them. For most people even owning a single on-chain UTXO will be a privilege of significant luxury. I’m not trying to defend that outcome as good. It simply is. It exists on the other side of Hume’s guillotine.

Bitcoin Is For Saving, Not For Spending

The enormous size and continued growth of the stablecoin market is proof there is plenty of demand for low-cost, disintermediated retail payments. But Bitcoin is not a panacea – just because low-cost payments are useful does not mean that Bitcoin is a useful way to make low-cost payments. Bitcoin is not designed to be cheap – it is designed to be durable. Those aren’t the same goals and they probably won’t be achieved by the same system.

Even in a world where Bitcoin transactions were somehow cost free we should still expect stablecoins to dominate payments. Why would anyone who thinks bitcoin is precious want to spend it? Why would anyone who doesn’t think bitcoin is precious have any to spend? Bitcoin is emergency money, not convenience money. No one should be spending it on coffee.

Decentralized networks do not make good retail payment tools – they’re expensive, slow and unforgiving. Using Bitcoin to make a retail purchase is like driving to the mall in a M4 Sherman tank. It might be cool, but it isn’t practical – and it will never be normal.

This is a guest post by knifefight. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.

Source: Bitcoin Magazine - Bitcoin News, Articles and Expert Insights