Bitcoin.com News reported this week that leading crypto exchange Binance will settle with the United States Department of Justice (DOJ) for $4.3 billion, related to breaching anti-money laundering and sanctions regulations. The well-known face of the exchange, and former CEO, Changpeng “CZ” Zhao, has stepped down as part of the plea deal. In other news, the U.S. Securities and Exchange Commission (SEC) has once again named crypto assets which it views as securities. This and more just below, in the latest Bitcoin.com News Week in Review.

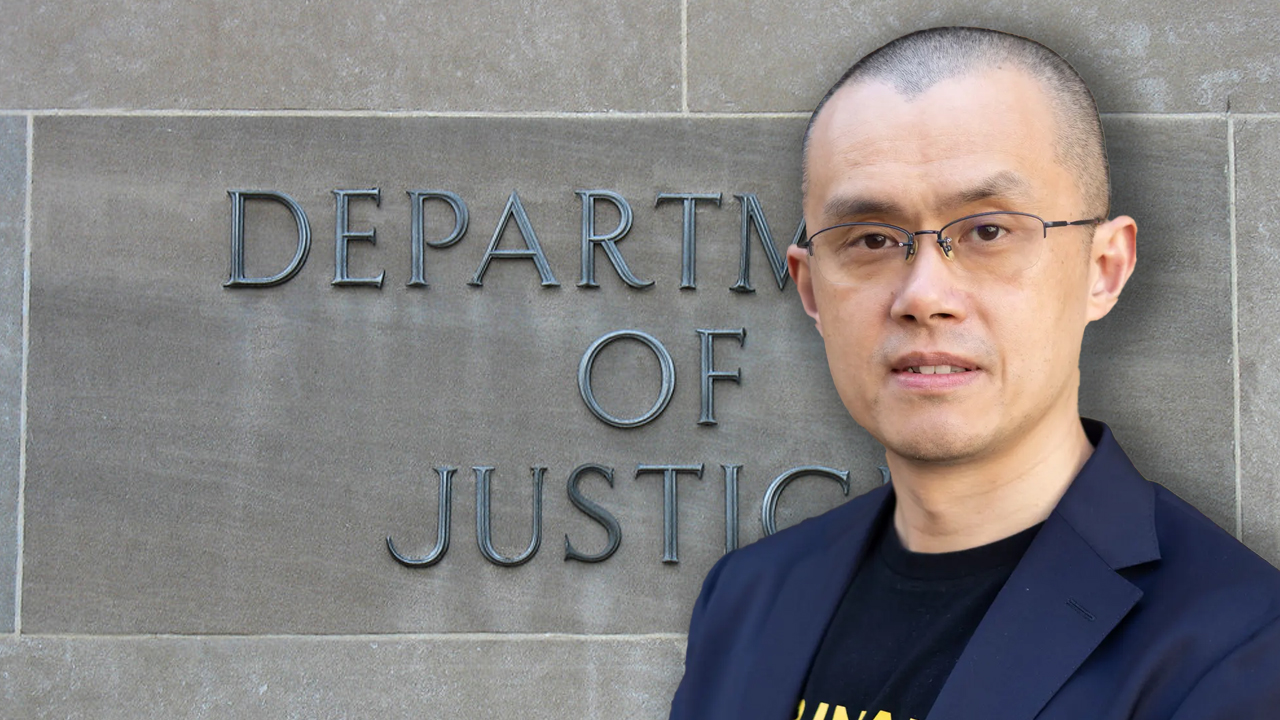

DOJ Announces $4.3 Billion Settlement With Binance; CZ to Step Down as Part of Plea Deal

The United States Department of Justice (DOJ) has revealed a landmark settlement involving Binance, the world’s largest crypto exchange by trading volume. Under the agreement, Binance will pay $4.3 billion to settle with the law enforcement authority. This significant development was disclosed during a DOJ press briefing on cryptocurrency enforcement, which took place at 3:36 p.m. Eastern Time (ET) on Tuesday.

SEC Identifies 16 Crypto Tokens as Securities in Kraken Lawsuit

The U.S. Securities and Exchange Commission (SEC) has identified 16 crypto tokens as securities in its lawsuit against cryptocurrency exchange Kraken. Some of the alleged crypto securities were the same as those highlighted in the SEC’s lawsuits against Coinbase and Binance. Kraken’s CEO stressed: “We strongly disagree with the SEC claims, stand firm in our view that we do not list securities, and plan to vigorously defend our position.”

Bitcoin Mining Pool F2pool Acknowledges OFAC Transaction Censorship; Backpedals After Community Backlash

F2Pool, a Bitcoin mining pool, has admitted to filtering transactions coming from Bitcoin addresses flagged by the Office of Foreign Assets Control (OFAC). After the situation was discovered by 0xB10C, a Bitcoin developer, F2pool co-founder Chun Wang acknowledged that his pool was indeed applying this filter, announcing it would drop the censorship until there was consensus in the community on the issue.

Tether Freezes $225 Million in USDT After DOJ Investigation, Calling It ‘Largest-Ever Freeze of USDT’

Tether has announced the “largest-ever freeze of USDT in history.” In collaboration with crypto exchange Okx, Tether froze $225 million in USDT following an investigation by the U.S. Department of Justice (DOJ). The tokens were allegedly linked to an international human trafficking syndicate in Southeast Asia responsible for a global “pig butchering” crypto scam.

What are your thoughts on this week’s stories? Be sure to let us know in the comments section below.

#TheWeekly, #Binance, #Crypto, #Cryptocurrency, #CZ, #F2Pool, #Freeze, #OFAC, #SEC, #Securities, #Tether