Dogecoin (DOGE) price has experienced a slight upward movement, bringing hope to its supporters amidst a tumultuous period for the cryptocurrency market. Earlier today, the meme-inspired digital currency has risen by 6%.

This latest surge in Dogecoin price albeit small may be partially attributed to the continued support of billionaire tech entrepreneur Elon Musk, who has been a vocal advocate of the cryptocurrency in recent months.

Musk’s tweets have been known to have a significant impact on the market value of Dogecoin, and he has referred to it as “the people’s crypto.”

Some analysts believe that Musk’s endorsement of Dogecoin has helped to increase its mainstream popularity and appeal, leading to greater investment and adoption among both individual investors and institutional players alike.

Billionaire Sends Dogecoin Price Up

The meme-inspired cryptocurrency Dogecoin appears to have received a boost from a recent tweet by Musk.

In response to a user’s tweet about visiting the U.S. to watch SpaceX’s upcoming Starship launch, Musk replied: “Okay, but it will cost 3 Doge.”

Ok, but it will cost 3 Doge

— Elon Musk (@elonmusk) March 23, 2023

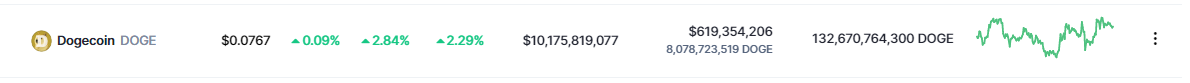

Shortly after Musk’s tweet, the value of Dogecoin experienced a significant increase, with the price rising 6% to reach $0.0785 on an hourly chart. However, at the time of writing, the price has slightly dropped and is now trading at $0.076, via CoinMarketCap.

Fed Hike Sends Prices Sliding

The Federal Open Market Committee (FOMC) followed through on their expected decision to raise interest rates by a quarter point on Wednesday evening, causing major cryptocurrencies to trade in negative territory.

DOGE saw a 2.63% decline in the last 24 hours, trading at $0.073, while Bitcoin (BTC) dipped below $28,000 and Ethereum (ETH) dropped 3.31% to sell below $1,800.

A major driver of depositor flight is people moving money from low interest savings accounts to high interest money market (Treasury Bill) accounts.

This foolish rate hike will worsen depositor flight.

— Elon Musk (@elonmusk) March 22, 2023

In response to the rate hike, Musk wasted no time in criticizing the Federal Reserve’s decision, expressing concerns that it could prompt a mass exodus of depositors from banks and complicate efforts to manage the ongoing economic crisis, causing headaches for both policymakers and the banking industry.

“A major driver of depositor flight is people moving money from low-interest savings accounts to high-interest money market (Treasury Bill) accounts,” Musk tweeted. “This foolish rate hike will worsen depositor flight.”

The Federal Reserve’s move to raise its main interest rate underscores its unease with the ongoing inflationary pressures. In a statement, Fed Chair Jerome Powell emphasized the central bank’s determination to bring inflation back to its targeted 2% rate.

However, the Fed also recognized the potential fallout from the recent banking crisis, acknowledging that it could lead to stricter credit access for both consumers and businesses. As a result, the Fed anticipates that these factors could dampen economic growth, job creation, and inflation.

-Featured image from Instructables

#CryptocurrencyNews, #DogePrice, #Dogecoin, #ElonMusk, #FedRateHike, #JeromePowell