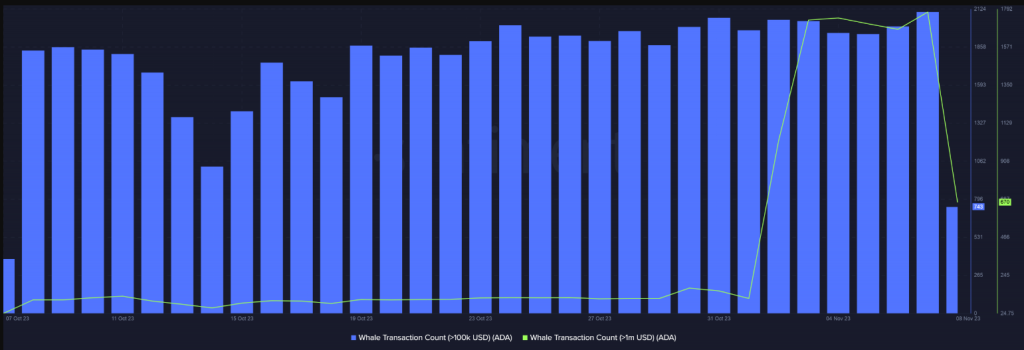

Cardano (ADA) experienced a significant shift in its ownership landscape during the month of October. Large holders, defined as addresses holding over 0.1% of a cryptocurrency’s circulating supply, accumulated nearly 1.89 billion ADA coins. But is this development good news or bad news for the Cardano ecosystem?

Large Holders Netflow is a metric that measures the number of inflows minus outflows pertaining to addresses held by large ADA investors. This metric provides valuable insights into the behavior of major stakeholders and their impact on the ADA market.

When large holders accumulate more ADA than they are selling, it suggests a bullish sentiment among the biggest investors. In this case, it indicates that they believe in the long-term potential of Cardano and are willing to hold onto their assets, possibly anticipating future price appreciation.

$ADA got a strong vote of confidence last month. Big holders accumulated 1.89 billion ADA last month, translating to over $600 million at current prices.

The majority of the accumulation took place between $0.249 and $0.271.

https://t.co/FCp16WINDG pic.twitter.com/cIRpSDC1fR

— IntoTheBlock (@intotheblock) November 7, 2023

Conversely, if large holders were offloading their ADA holdings in large quantities, it could be perceived as a bearish sign, signaling a lack of confidence in the project or an impending market downturn. However, the data suggests that they are accumulating, which could be seen as a positive indicator.

ADA’s Current Price And Recent Performance

As of the latest data from CoinGecko, Cardano (ADA) is trading at $0.369344. Over the past 24 hours, the ADA price has experienced a 3.3% increase, and it has surged by 20.4% in the last seven days. These price movements suggest a growing interest and confidence in ADA among investors.

In addition to the large holders’ accumulation, Cardano has been making waves in the blockchain development sphere. According to Santiment, a prominent analytics firm, Cardano ranks as the top blockchain in terms of development activity over a 30-day period. The project has recorded an impressive 502.57 GitHub commits during this timeframe.

Cardano’s Strong Development Activity

Santiment has previously emphasized that heavy development activity is a strong positive indicator for a cryptocurrency project. It signifies that developers believe in the protocol’s potential for success and are actively working on improving the technology. Such activity also reduces the likelihood that the project is an “exit scam” or a token without substance.

The recent accumulation of ADA by large holders, coupled with its positive price performance, suggests growing confidence in the Cardano ecosystem. Additionally, the blockchain’s active development and commitment to enhancing its technology indicate a bright future for ADA.

While the crypto market is known for its volatility, these factors point towards a favorable outlook for Cardano in the eyes of investors and developers alike.

(This site’s content should not be construed as investment advice. Investing involves risk. When you invest, your capital is subject to risk).

Featured image from Shutterstock

#CryptocurrencyMarketNews, #ADAPrice, #Altcoins, #Btcusd, #Cardano, #Ethusd, #PriceAction