In a detailed analysis released by crypto intelligence firm ChainArgos, allegations have surfaced about the Polygon team’s involvement in secret sales of MATIC tokens, potentially leading to a suppression of the token’s price. The revelations stem from an in-depth examination of the token allocations and subsequent flows to various exchanges.

ChainArgos, in a series of statements on X (formerly Twitter), elaborated on discrepancies between Polygon’s publicly stated token allocation plan and the actual flows observed. Notably, the firm identified irregular outflows from a “vesting contract” and a foundation contract, which ostensibly manages the allocations.

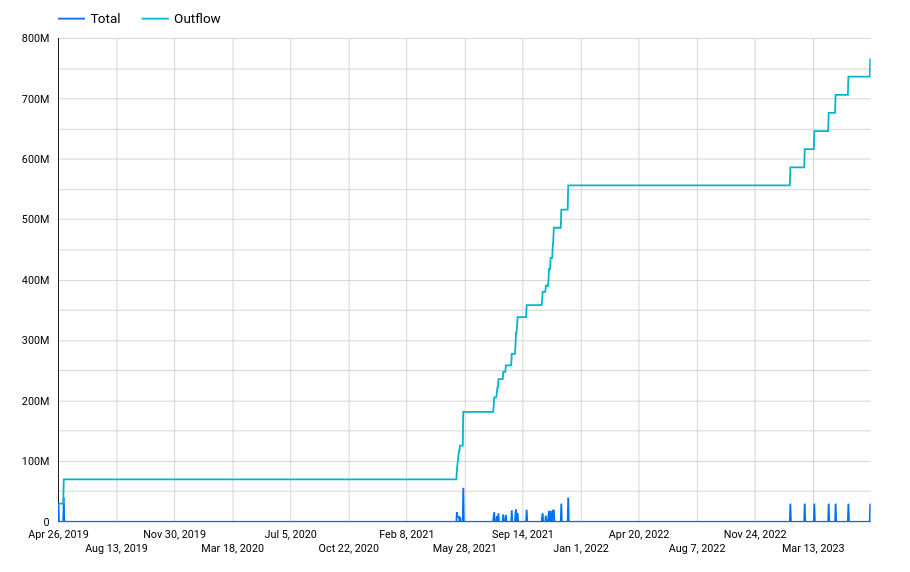

ChainArgos highlighted, “When you look at the flows you find a ‘vesting contract’ which mechanically unlocks all flows… That shape is odd and the gaps are all different sizes,” ChainArgos reported, indicating potential irregularities.

$1 Billion In MATIC Sold In Stealth Modus?

A critical point of concern is the supposed allocation for staking. ChainArgos’s analysis suggests that while the allocation table indicated a range from 400 million to 1.2 billion MATIC for staking, the actual flow into the staking contract started from zero and only reached 800 million.

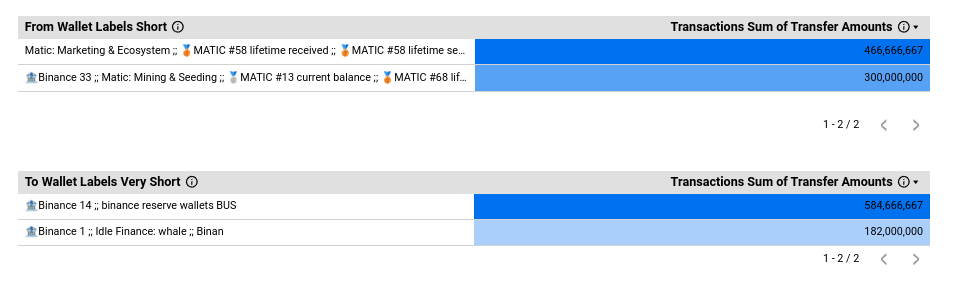

This discrepancy of 400 million MATIC was traced to an address labelled ‘Binance 33’ on Etherscan, which ChainArgos asserts is not associated with staking activities. This address, interestingly, was also involved in a significant flow of 300 million MATIC to another address, which in turn sent 767 million MATIC to Binance exchange wallets.

“467 million [came] from the Etherscan-labeled “Matic: Marketing & Ecosystem wallet,” ChainArgos notes. The firm further argues that this pattern of outflows is a clear indicator of price manipulation, suggesting a coordinated effort by the Polygon team and Binance to discreetly move large amounts of MATIC.

“So this isn’t just some Binance-adjacent thing. The team and Binance are clearly working together to feed these tokens out the back, such as it is. As we are talking about 767 million tokens with a price somewhere roughly $1-$2, this is something like a billion dollars”, the crypto intelligence firm claims.

The firm also correlated the outflows from the address 0x2f4Ee with the MATIC price chart, suggesting that these movements were indicative of impending price tops and subsequent declines. ChainArgos claims, “Now let’s look at the outflows from 0x2f4ee over time. Bring up a price chart. We leave it as an exercise for the reader to work out this is *very obviously* a good indicator for an upcoming top and subsequent move lower.”

Lack Of Transparency, More Inconsistencies?

ChainArgos criticized the lack of transparency and oversight in these transactions, urging investors to be more diligent and questioning where their funds are being allocated. “This is not even well hidden. Again this has been in our demo for a while. This example is published as part of our docs. Because none of this is difficult to find. Do better “investors.” Also, maybe, ask where your money went,” ChainArgos states.

For context, the Polygon token supply distribution includes various categories such as Private Sale tokens (3.80% of the total supply), Launchpad sale tokens (19%), Team tokens (16%), Advisors tokens (4%), Network Operations tokens (12%), Foundation tokens (21.86%), and Ecosystem tokens (23.33%). The Launchpad sale, in particular, was conducted in April 2019, raising approximately $5,000,000 USD.

This report raises serious questions about the integrity of token allocations and the potential for market manipulation within the crypto space.

At press time, the Polygon team had not yet responded to ChainArgos’ report. MATIC traded at $0.86, up 11.6% in the last seven days.

#CryptocurrencyMarketNews, #ChainArgos, #MATIC, #MATICPrice, #Polygon, #PolygonPrice, #PolygonPriceManipulation