The cryptocurrency market thrives on pivotal make-or-break moments at certain price levels where assets either collapse or catapult higher. For BNB, the $531 support level has proven to be a turning point. After a period of uncertainty, BNB has held this crucial zone and ignited a powerful rebound, confirming a shift in market structure from cautious consolidation to bullish momentum.

This resurgence is more than just a technical bounce. It reflects growing confidence among traders, resilient demand at key levels, and a broader market appetite for altcoins as Bitcoin stabilizes. With strong volume, reclaiming key moving averages, and breaking near-term resistance, BNB is signaling that the correction phase may be over.

BNB Chart Pattern Signaling Sustained Momentum

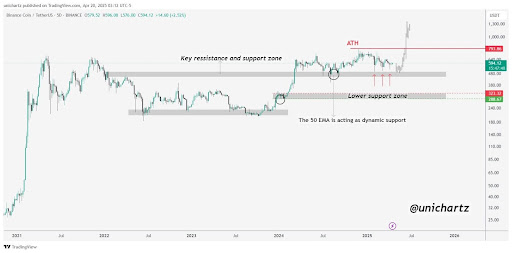

In a recent post shared on X, UniChartz highlighted that BNB is currently displaying strong bullish momentum after rebounding from a key zone. This level, which once served as a major resistance barrier, has now flipped into solid support, a classic bullish signal that often reinforces the strength of an ongoing uptrend.

According to the analysis, the successful retest of this zone validates the breakout and suggests that buyers are stepping in. With momentum building and price structure aligning in favor of the bulls, BNB could be primed for further climb if this support continues to hold firm.

He further noted that as long as BNB maintains its position above this key support zone, the overall bullish structure remains intact, keeping the momentum firmly in favor of the bulls. This sustained strength reinforces the possibility of a continued climb, with the path toward a new all-time high (ATH) near the $794 level looking increasingly viable.

This outlook is supported by the 50-day Exponential Moving Average (EMA), which continues to serve as dynamic support, closely tracking price action and cushioning minor pullbacks. The alignment of price above this moving average further solidifies the current uptrend, suggesting that BNB may be gearing up for a sustained rally if broader market sentiment remains favorable.

Breaking Barriers: Key Resistance Levels To Watch

Currently, BNB is on the verge of breaking above the crucial $605 resistance level. This level serves as a psychological barrier and aligns with a key technical area where selling pressure has historically emerged. A decisive break above this resistance, especially if supported by a strong surge in trading volume, might signal a clear confirmation of buyer dominance in the market.

Such a breakout would likely trigger a wave of new buying interest from retail traders and institutional participants. More importantly, clearing this level could open the door for BNB to target higher resistance zones, including the $680, $724, and all-time highs. Until then, traders should watch this level closely because BNB’s response here could shape the trajectory of its next major move.

#BNB, #BNBPrice, #BNBUSD, #Bnbusdt, #EMA, #EponentialMovingAverage