On-chain data shows that Bitcoin long-term holders have continued to hold strong recently despite the price of the asset taking a blow.

Bitcoin Long-Term Holders Continue To Not Show Any Significant Movements

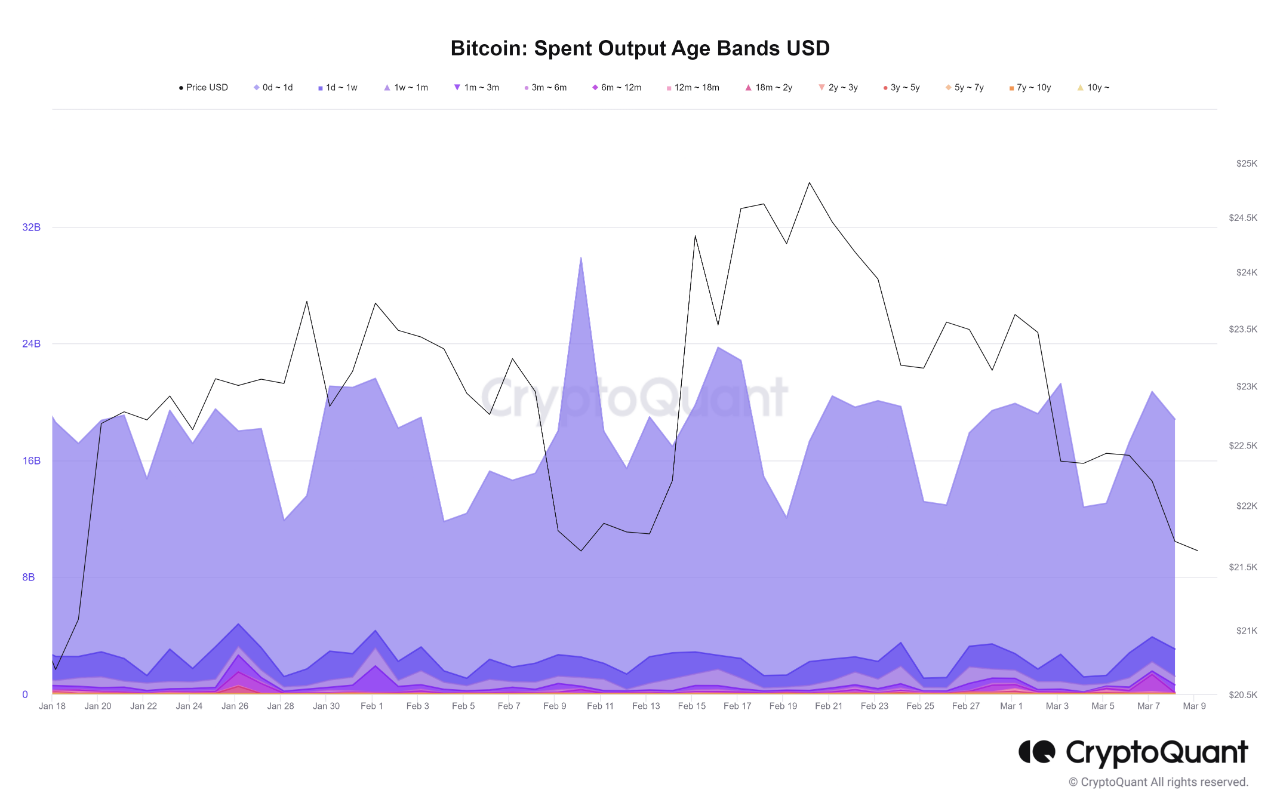

As pointed out by an analyst in a CryptoQuant post, short-term holders have continued to apply selling pressure recently. The relevant indicator here is the “Spent Output Age Bands” (SOAB), which tells us which investor groups have been selling or moving how many coins.

The “age bands” here refer to groups divided based on how dormant any batch of coins has been. For example, the 1m-3m cohort includes all investors that have been holding their coins for at least one month and at most three months ago in a single wallet address.

If the BTC SOAB metric is applied to this specific group, then it would track the transactions on the blockchain being made by the holders belonging to this age band.

Now, here is a chart that shows the trend in the Bitcoin SOAB for all the different age bands in the market over the last couple of months:

As shown in the above graph, the Bitcoin SOAB has had some consistently large values for the 0-day to 1-day age bands recently. The other younger groups have also shown some noticeable values, but the more aged bands haven’t really observed any significant spikes.

The BTC market is usually divided into two main cohorts: short-term holders (STHs) and long-term holders (LTHs). The STHs include all investors that have been holding onto their coins since less than 155 days ago, while LTHs include holders that have kept their coins dormant for longer than that amount.

This means that the younger age bands just correspond to different segments of the STHs. As these groups have displayed elevated values recently, it would appear that the STHs have been actively selling the cryptocurrency during the rally.

Statistically, the longer an investor keeps their coins, the less likely they become to sell at any point. Because of this reason, movements from the more aged coins can be of more importance as they provide a window into how some of the most resolute investors in the market have been doing.

So far, these LTHs haven’t shown any significant movements since the rally started, despite the fact that the price has seen quite a decline in recent days.

One noticeable instance of an LTH band showing a spike recently has been the 6 months to 12 months group, which observed an increase because of the US government moving around seized Bitcoin.

Naturally, this case was more of an exception and not an indication of a more general trend. The LTHs not showing any large transfers can be a positive sign for the price in the long term as it shows that these diamond hands still haven’t lost their conviction in the cryptocurrency.

BTC Price

At the time of writing, Bitcoin is trading around $20,000, down 10% in the last week.

#Bitcoin, #Bitcoin, #BitcoinDecline, #BitcoinLongtermHolders, #BitcoinSpentOutputAgeBands, #Btc, #Btcusd