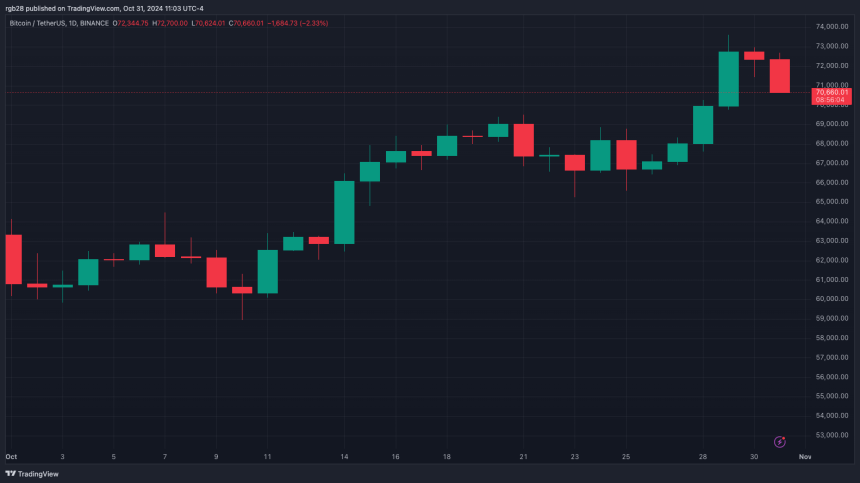

Ahead of its monthly close, Bitcoin (BTC) has seen another unsuccessful attempt to reclaim the $72,000 resistance as a support level. Despite the drop, some analysts consider the cryptocurrency is still in a strong position for an upcoming breakout, setting the next levels to watch.

BTC’s Sweet 16 Party Turns Spooky

Bitcoin, the largest cryptocurrency by market capitalization, recorded an impressive rally in ‘Uptober,’ surging around 13% in the last 30 days. BTC’s price has jumped from the $58,900 monthly low to near its all-time high (ATH) price of $73,737, reaching the $73,300 mark on Wednesday.

Following the green September close, the flagship crypto is set to have its best monthly close since March, potentially registering around 13$ to 14% in monthly returns despite its most recent price action.

On its whitepaper’s 16th birthday, Bitcoin recorded a spooky 2% drop, driving the rest of the market to a red Halloween party. BTC’s price fell below the $71,000 mark, reaching an intraday low of $70,600. Meanwhile, the second largest cryptocurrency by market capitalization, Ethereum (ETH), pulled back around 5.1%, losing the $2,600 support zone.

Crypto analyst Ali Martinez pointed out that today’s drop is the fifth consecutive rejection BTC faces at $72,000. Since its ATH, Bitcoin has been rejected from this resistance level five times, dropping between 8.2% and 18% the four previous times.

Analyst Altcoin Sherpa suggested that BTC could see a 4% to 5% dip if the largest cryptocurrency doesn’t hold the $70,000 support zone. Nonetheless, Sherpa considers that the cryptocurrency should “see some sort of bounce” from the $70,800-$71,400 area in the short term.

BTC is expected to have an extremely volatile week ahead of the US presidential elections. Bitfinex analysts predicted that Bitcoin volatility will peak between November 6 and November 8, as speculation and anticipation about the election outcome affect the cryptocurrency’s performance.

Is Bitcoin Gearing Up For End-Of-Year Breakout?

Cryptoinsightuk weighed in on Bitcoin’s performance, noting that BTC is still at ATH by Open Interest (OI). The crypto investor considers that the Daily Relative Strength Index (RSI) could potentially “cross bearish” today.

He also highlighted that $69,600 should work as a key support level for Bitcoin bulls but warned that losing the $66,500 range could be “messy” as BTC’s open interest would “flush.”

Meanwhile, Crypto Kaleo posted a more bullish outlook for BTC’s price action. The analyst highlighted that the flagship crypto didn’t break above its ATH when it retested the $20,000 mark in 2020.

Instead, Bitcoin initially pulled back nearly 20% during Thanksgiving, moving from $19,400 to $16,100. Moreover, BTC’s price accumulated within that range for 30 days before breakout, seeing the next leg up in late December 2020.

The analyst pointed out the breakout happened 219 days after May 2020’s Halving. As Bitcoin is currently 194 days post-halving, the analyst considers that “a little bit of a pullback here isn’t any reason for concern.”

As of this writing, Bitcoin has held the $70,000 support level, currently trading at $70,522.

#Bitcoin, #Bitcoin, #BitcoinATH, #BitcoinRejection, #BitcoinWhitepaper, #Btc, #BTCUSDT, #CryptoAnalyst, #CryptoInvestor, #CryptoMarket, #CryptoMarketSentiment, #CryptoTrader, #ETH, #Ethereum, #USElections