Bitcoin has declined below $22,000 in the past day as on-chain data shows deposits have risen on the crypto exchange Coinbase.

Bitcoin Coinbase Exchange Reserve Has Risen Recently

As pointed out by an analyst in a CryptoQuant post, the exchange reserves have been going up recently. The “exchange reserve” is an indicator that measures the total amount of Bitcoin currently being stored in the wallets of a centralized exchange (or a group of them).

When the value of this metric goes up, it means investors are depositing their coins to the exchange right now. If the platform in question is a spot exchange, then the reserve showing this trend could be bearish for the price of the crypto, as investors usually use spot exchanges for selling purposes.

On the other hand, a decreasing reserve can imply holders are withdrawing their coins from the exchange currently. Generally, holders take out their coins to cold wallets for holding onto them for extended periods. Thus, such a trend can be bullish for the price in the long term, as it means a reduction in selling pressure for the asset.

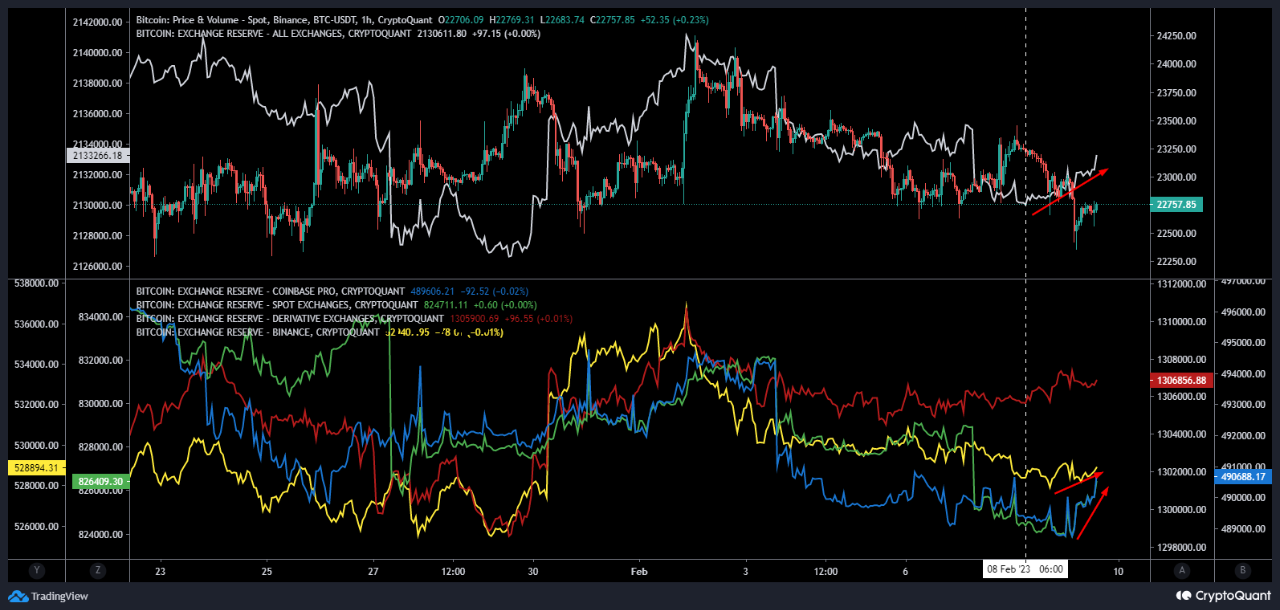

Now, here is a chart that shows the trend in the Bitcoin exchange reserve specifically for Coinbase and Binance, as well as that for all spot and derivative exchanges, over the last couple of weeks:

The quant posted the above chart yesterday and it seems like at that time, Coinbase’s Bitcoin exchange reserve had seen a sharp rise. Binance’s reserve had also seen a small increase, but it was much less in scale compared to the inflows Coinbase observed.

The version of the indicator for all spot exchanges together (shown in green in the graph) also naturally shot up in close tandem with the rise in Coinbase’s reserve. This increase in the spot reserve suggests that investors may have been planning to do a selloff yesterday.

And indeed, as it turns out, in the past day, Bitcoin has taken a 4% hit, with its price losing the $22,000 level. This might confirm that the deposits were done for dumping purposes after all.

The exchange reserve for all derivative exchanges has also seen a slight rise in recent days, but the increase is likely not significant enough to cause any noticeable effects on the market.

In the top chart (the one with the data for the BTC price), there are also all exchange reserves shown, which is the version of the indicator that combines the reserves of all kinds of exchanges.

While this indicator has obviously trended up in the last two days (due to the spot deposits), the metric has overall still gone down in the last two weeks, which suggests that some net Bitcoin accumulation has taken place in the market. If these withdrawals were really a sign of buying, then the coin could still see a bullish effect in the long term.

BTC Price

At the time of writing, Bitcoin is trading around $21,800, down 7% in the last week.

#Bitcoin, #Binance, #Bitcoin, #BitcoinDerivatives, #BitcoinExchangeInflows, #BitcoinExchangeReserve, #Btc, #Btcusd, #Coinbase, #CoinbaseBitcoinReserve