As the crypto community’s anticipation heightens for the upcoming Bitcoin halving, Changpeng Zhao (CZ), CEO of Binance, recently elucidated his observations around the historical patterns tied to this quadrennial event. Highlighting the evolving sentiments and speculations, CZ spotlighted the dominant themes before and after the halving events.

CZ observed that the preceding months to the halving are generally characterized by heightened discourse, diverse sentiments, and amplified expectations within the cryptocurrency sphere. “The few months leading up to the Bitcoin halving, there will be more and more chatter, news, anxiety, expectations, hype, hope, etc.,” he stated.

Addressing the commonly held belief that Bitcoin’s price will witness an immediate uptick post-halving, CZ dispelled such notions based on historical patterns. “The day after the halving, the Bitcoin price won’t double overnight. And people will be asking why it didn’t,” he remarked, addressing the immediate aftermath expectations.

While the short-term reactions post-halving may be tempered, CZ shed light on a longer-term trend where Bitcoin often reaches new all-time highs (ATHs) within the year that follows. In reference to the market’s ability to quickly transition from skepticism to marvel, he quipped, “People have short memories.”

However, CZ urged caution, emphasizing that historical patterns should not be construed as definitive indicators for future behaviors, noting, “Not saying there is proven causation. And history does NOT predict the future.”

A More In-Depth Analysis Of Bitcoin Halving

As Bitcoinist reported, renowned crypto analyst Rekt Capital recently published an in-depth analysis of the Bitcoin halving, offering a more granular view of the potential phases surrounding the event which is only 197 days and a few hours away according to Binance’s estimates.

Reflecting on historical patterns, the analyst suggested a possible deeper retrace for Bitcoin in the 140 days leading up to the halving. Drawing historical parallels, Rekt Capital emphasized, “You can debate whether 2023 is more like 2015 or more like 2019… Doesn’t change the fact that BTC retraced -24% in 2015 and -38% in 2019 at this same point in the cycle (i.e. ~200 days before the halving).”

Anticipating market dynamics as the halving nears, Rekt Capital postulated that roughly 60 days before the event, historically a pre-halving rally will likely emerge. This phase, marked by investor enthusiasm and elevated expectations as CZ puts it, is often characterized by buying into the halving anticipation.

But this enthusiastic phase doesn’t last. Around the halving event, the market often shows pullback behavior under the motto “buy the rumor, sell the news”. Highlighting this trend, the analyst cited the -38% dip witnessed in 2016 and the -20% decline in 2020, moments when the market re-evaluated the halving’s short-term implications.

Subsequent to this, Rekt Capital predicts a multi-month re-accumulation phase, often marked by investor fatigue due to stagnation. However, breaking out of this phase typically heralds Bitcoin’s entry into a parabolic uptrend, potentially culminating in new all-time highs.

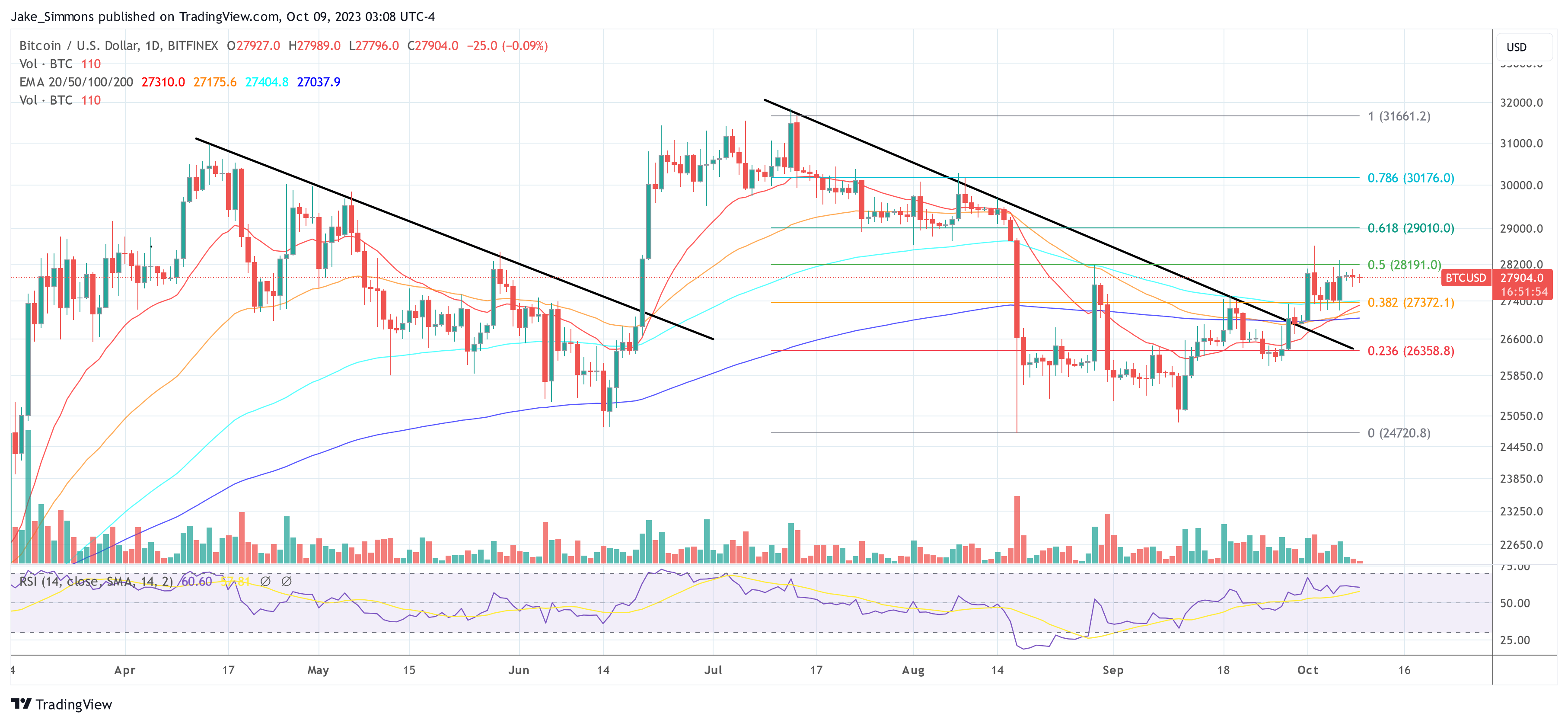

At press time, BTC traded at $27,904.

#CryptocurrencyMarketNews, #Binance, #Bitcoin, #BitcoinHalving, #BitcoinPrice, #Btc, #ChangpengZhao, #CZ