The best crypto copy trading platforms to use in 2025 are Binance, MEXC, Bybit, PrimeXBT, eToro, OKX, and Coinbase. These exchanges and brokers allow traders, especially beginners, to learn and earn profits by copying the trades of experienced traders.

Different crypto copy trading platforms offer different features and trading products, so to decide on the best copy trading platforms, we reviewed various crypto exchanges and brokers and compared them based on their fees, user interface, trade execution speed, security, and accessibility.

In this article, we will cover the seven best crypto copy trading exchanges, what is copy trading in crypto? What are the best copy trading platforms to use? And what are the types of crypto copy trading platforms?

Furthermore, we will show you how to choose a crypto copy trading platform, how to start crypto copy trading, how to choose the best crypto traders to follow, and answer the question: Is crypto copy trading profitable? But before we proceed, here is a comparison of the best crypto copy trading platforms in 2025, using their fees, supported markets, and key features.

| Copy Trading Fees | Commission | Supported Cryptocurrencies | |

| Binance | 0.10% maker/taker | 10% | 400+ |

| MEXC | 0.00% maker and 0.05% taker | 10% | 2,700+ |

| Bybit | 0.10% maker/taker | 10 – 15% | 650+ |

| PrimeXBT |

0.05% per trade.

1% monthly management fee |

20% | 40+ |

| OKX | 0.08% maker fee and 0.1% taker fee. | 8-10% | 350 |

| Coinbase | Starting at $0.99 | – | 240 |

1. Binance

Binance is a centralized crypto exchange offering traders an extensive selection of products and services for new and experienced traders, including copy trading tools. Binance Copy Trading is a feature that allows users to automatically replicate the trades of experienced traders, making it easier for newcomers to participate in the cryptocurrency market.

Binance Copy Trading pros are:

- Supports 100+ Spot Trading Pairs and 100+ USD-M Futures Contracts: Binance supports over 100 tradable pairs, allowing copy traders to select the pairs they want to trade.

- High Liquidity: Binance has high liquidity, allowing faster execution of trades at more stable prices. Traders can enter or exit positions quickly with minimal slippage.

- Multiple Trading Options for Copy Traders: Binance offers various trading options, including futures and spot trading. Traders can decide whether to copy simply buy and sell orders on the spot market or trade with leverage.

Binance Copy Trading cons are:

- Limited Availability: While Binance offers its products and services to traders in over 100 countries, some copy trading products may be limited in some locations.

- Small Volume Trades May Be Expensive: Binance does not charge additional fees for copy trades; however, for small volume traders, the standard cost of 0.1% and 10% profit share offered to professional traders might cut into profits.

Copy Trading Fees on Binance:

Binance does not charge copy traders additional fees. However, lead traders earn a 10% profit share and a 10% commission on fees from their followers. You can invest a minimum of 10 USDT in copy trading, but it can go as high as 10,000 USDT.

Key Features of Binance Copy Trading:

- Spot and Futures Copy Trading: The exchange allows users to automatically replicate the trades of experienced traders in spot and futures markets. Traders can amplify their position with leverage in the futures market or opt for spot trading, which is more straightforward.

- Choose Your Leverage: Binance traders can choose their desired leverage when copying trades. You can mirror the master trader’s leverage or settle for a fixed leverage ranging from 1x to 10x.

2. MEXC

MEXC is a high-performance trading engine that groups master traders into various categories to help copy traders choose who to copy from based on their trading goals. You can select from the top-performing traders based on overall ranking, highest ROI (return on investment), highest PNL (profit and loss), most followers, and new lead traders.

MEXC Copy Trading pros are:

- Wide Selection of Traders: MEXC has many successful traders that users can follow. The exchange also makes it easy for new traders to decide who to follow through their detailed grouping of professional traders.

- Customizable Preferences: When following an experienced trader to open a position, you can set parameters for your trades based on your risk tolerance level, such as the copy trade mode, margin, and order placement method.

- Pre-vetted Lead Traders: MEXC carefully reviews and approves all lead traders to ensure they are experienced and have impressive trading portfolios.

MEXC Copy Trading cons are:

- Lack of Social Trading Community: MEXC exchange does not have a social community where investors can ask questions, join discussions, and share insights, ideas, or trading strategies.

- Not Available for US Traders: MEXC does not offer copy trading services to traders in the United States.

Copy Trading Fees on MEXC

MEXC charges copy traders regular trading fees. It is one of the top zero-fee crypto exchanges, with maker fees starting at 0.00% for makers and 0.05% for takers.

Key Features of MEXC Copy Trading:

- Copy Trade Users Can Participate in Futures M-Day: The trading volume of Copy Trade users is counted for Futures M-Day, and users can get the corresponding number of tickets based on this volume. The more volume you generate through copy trading, the more tickets you earn, increasing your chances of winning rewards in the Futures M-Day event.

- Auto Margin Mode: Followers can now turn on auto margin addition when editing their Copy Trade orders. This feature helps reduce liquidation risk by automatically adding margin when needed. Before enabling it, make sure you fully understand how automated trading with this feature works.

3. ByBit

Bybit is the first crypto exchange to offer copy trading for gold and FX pairs. The Copy Trading Gold & FX feature allows users to replicate professional traders’ strategies directly within their MetaTrader 5 (MT5) accounts, using USDT as collateral.

Bybit Copy Trading pros are:

- New User Bonus: Bybit offers new copy trade users a copy trading voucher to recover up to 100 USDT on their first copy trade loss.

- User-Friendly Interface: Bybit’s MT5 platform for Gold and FX pairs offers an easy-to-use interface with features and tools to help traders of all levels profit from copy trading.

- Traders Can Choose Their Copy Mode: Traders can customize their copy mode and set up their settings by mirroring the master trader’s investment strategies, changing the investment amount, selecting items to copy, or setting other settings.

Bybit Copy Trading cons are:

- Profit Sharing is Unpredictable: While the profit for Copy Trading Classic for master traders is between 10% and 15%, the profit for Gold and FX pairs can be unpredictable since they are calculated differently.

- Not Available for US Traders: Bybit does not offer its products and copy trading services to traders in the United States.

Copy Trading Fees on Bybit

The trading and funding fees are the same as those applied when trading on Bybit’s Derivatives platform. No extra fees will be charged.

On the other hand, the fees for Copy Trade Gold & FX accounts are charged per lot and vary depending on the type of asset you are trading: FX and Gold – $6 per lot, Market Indices – $3 per lot.

Key Features of Bybit Copy Trading

- Bybit Copy Trading Classic: Before Bybit launched copy trading for Gold, FX, and indices pairs, it offered and still offers derivatives trading through the Copy Trading Classic interface. Traders can use either of these settings when copying trades on Classic: SyncMaster, parameters setting, and other settings. When SyncMaster is on, traders mirror the strategies of the master trader without modifying any settings. For parameter settings, you can change the investment amount and the account funds from which it will be taken. You can select what to copy, such as USDT perpetual trades or Trading Bot.

- Gold & FX Copy Trading: Bybit introduced a new product, Copy Trade Gold & FX, for users to trade Gold, FX pairs, and market indices. This product allows copy traders to profit from established and liquid gold and FX markets in addition to all the usual benefits of copy trading. To join, you must set up an MT5 Copy Trade Gold & FX Account on Bybit. This account simplifies the entire copy trading process by offering advanced options for thorough market analysis, including automated trading and 90+ technical indicators.

4. PrimeXBT

PrimeXBT is a multi-asset cryptocurrency trading platform offering copy trading, futures trading, and contract for-difference (CFD) trading for stocks indices, forex, commodities, and more. The PrimeXBT copy trading product also features membership plans, which provide subscribers with additional benefits, including increased profit share, reduced trading fees, and much more.

PrimeXBT Copy Trading pros are:

- Demo Account: PrimeXBT offers demo accounts with simulated trading environments for traders to practice various trading strategies and improve their trading abilities before investing money.

- High Liquidity: The exchange has high liquidity, which enables copy traders to open and close positions with minimal slippage and take advantage of volatile markets and other market conditions.

- Diverse Markets: Unlike other crypto exchanges that focus on crypto futures contracts only, PrimeXBT offers copy trading across various markets, including forex, cryptocurrencies, stock indices, and commodities.

PrimeXBT Copy Trading cons are:

- Limited Trading Options: PrimeXBT does not support spot, margin trading, options, or social trading. So, consider alternatives if you are looking for spot copy trading platforms.

- Might Not Be Suitable for Beginners: While the goal is for new users to copy successful traders’ trades, the exchange might not be the best option for traders new to trading CFDs, including stocks, indices, FX, and commodities.

Copy Trading Fees on PrimeXBT

PrimeXBT charges a profit-sharing fee of up to 20%, which is higher than other exchanges. Additionally, standard cryptocurrency trading fees of 0.05% per trade are charged. However, the high profit-sharing fee may deter some users.

Key Features of PrimeXBT Copy Trading

- Predictable Fees: PrimeXBT charges a flat 1% monthly management fee based on the total copied capital, regardless of profit or loss. So, if you allocate $5,000 to copied trades, you will pay $50 per month, irrespective of profit or loss.

- Narrow Spreads: PrimeXBT maintains low spreads, reducing costs for frequent traders.

- Partnership With Covesting: Though the exchange provides derivatives trading and margin copy trading, it also partners with Covesting, a social and copy trading platform that allows users to copy trade directly on the exchange.

5. eToro

eToro is one of the best trading platforms that offers a wide range of financial instruments for copy trading, including stocks, ETFs, cryptocurrencies, commodities, and forex. It is also a social trading platform where users can share insights, exchange ideas, ask questions, join discussions, and more.

eToro Copy Trading pros are:

- User friendly Interface: eToro has a user friendly interface, making it suitable for new and experienced traders. In addition, when you copy a trader, your portfolio is structured similarly to theirs, including the proportion of assets and any ongoing trades.

- Reputable Broker with Pre-vetted Traders: Every master trader on eToro has a profile with a real photo. When you click on a trader’s profile, you can see their name and view posts. Traders have a blog section where they share market news, and you interact with their posts, just like on traditional social networks.

- Diverse Assets: eToro supports various asset classes, including stocks, forex, indices, and cryptocurrencies.

eToro Copy Trading cons are:

- Inactivity Fee: eToro charges a $10 monthly inactivity fee after one year.

- High Fees: The broker has higher fees compared to some other platforms.

- Limited Customization: You can copy up to 100 traders simultaneously, but eToro offers limited customization options.

Copy Trading Fees on eToro

eToro charges no additional fees for copy trading. Lead traders positions replicated via eToro’s proprietary CopyTrader incur the same swap fees and spreads as regular trades. However, traders must deposit at least $200 to get started, with a minimum amount of $1 per single copied position.

Key Features of eToro Copy Trading

- Demo Account: For traders who want to try eToro’s CopyTrader feature before investing their money, the exchange provides a demo account loaded with $100,000 in virtual money. Traders can use this simulated trading environment to practice, test their strategies, and sharpen their trading skills to avoid losing money rapidly.

- Educational Resources: eToro offers tons of articles, video tutorials, and other resources for traders to learn more about copy trading and choosing a trader that matches their trading goals.

- Social Trading Community: The broker also has a large community of traders and investors (20+ million) that new traders can connect with, share ideas, and learn from other experienced investors.

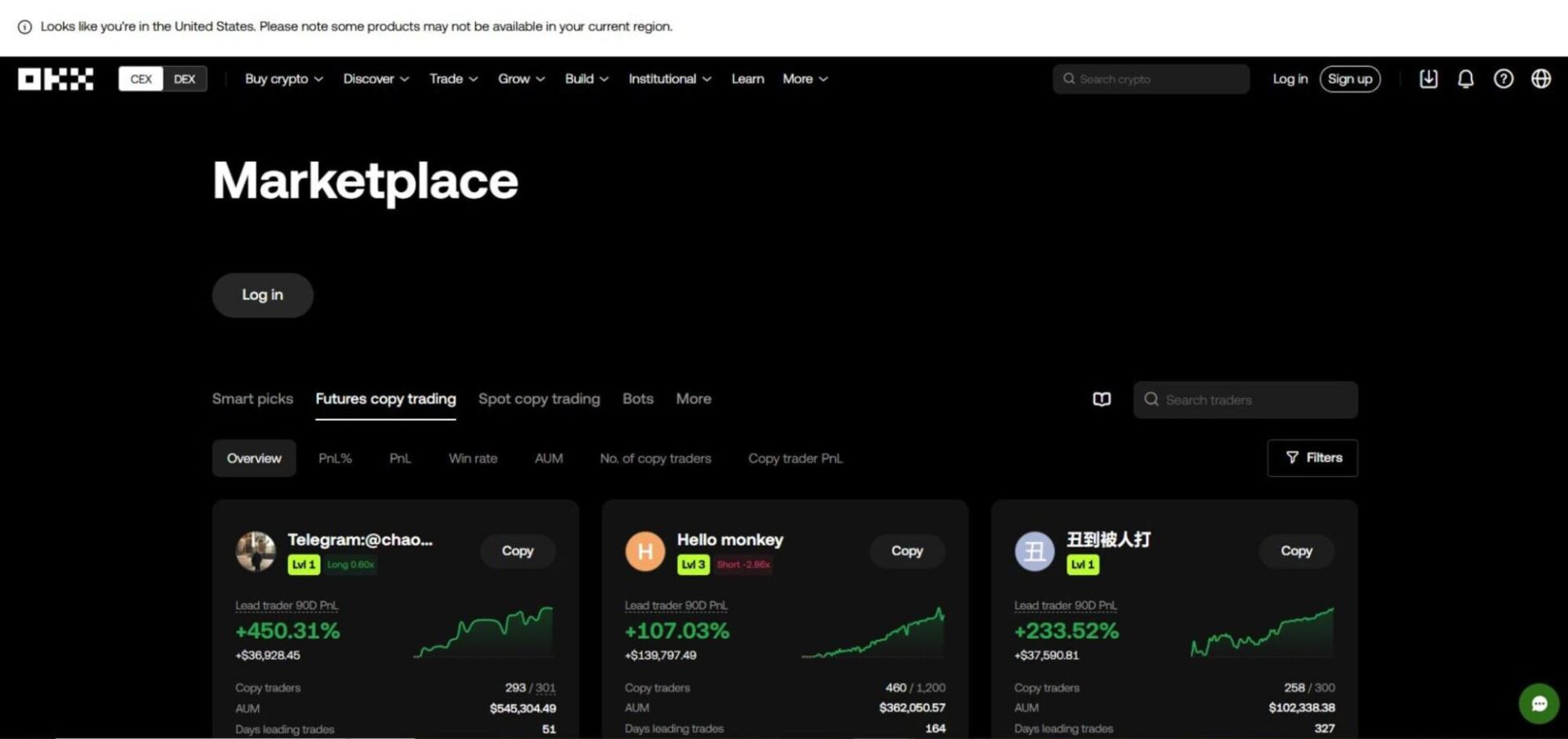

6. OKX

OKX is a cryptocurrency exchange that provides a user-friendly copy trading platform where users can select and replicate the trades of experienced investors. With OKX copy trading, you can analyze the past performance of traders, assess their risk levels, and learn and copy trade across multiple trading pairs.

OKX Copy Trading pros are:

- Comprehensive Statistics of Lead Traders: OKX provides detailed insights into the performance of top traders, allowing users to analyze their success rates, historical profits, risk levels, and crypto trading strategies.

- OKX offers 114 pairs for copy traders to explore.

- 24/7 Customer Support: OKX offers 24/7 support, and they have an open-door policy of listening to their traders’ suggestions and feedback.

OKX Copy Trading cons are:

- Not available to traders in the US, Bulgaria, Singapore, Bolivia, Malaysia, Malta, Canada, and Hong Kong

- Copiers can only replicate up to 10 trades in Open/Close Position mode.

Copy Trading Fees on OKX:

Copy trading fees on OKX are the same as the regular fees for your trading tier. No other transaction fees are charged, but you will pay an 8-10% profit share.

Key Features of OKX Copy Trading:

- Smart Sync: The Smart Sync automatically copies the lead traders positions, leverage, and margin to your available funds.

- Spot and Futures Copy Trading: OKX allows you to automatically replicate the trades of experienced traders in spot and futures markets. You can amplify your position with leverage in the futures market or simply buy and sell on the spot market.

- Custom Copy: If you don’t want to use Smart Sync, you can customize your trade parameters across leverage and position size per trade.

7. Coinbase

Coinbase is a cryptocurrency platform that offers users one of the best and most user-friendly copy trading crypto services. The exchange allows traders to replicate the strategies of more experienced traders and earn profits without needing extensive market knowledge through Copycat Finance.

Coinbase Copy Trading pros are:

- Easy to Use: The clean and user-friendly interface allows beginners and experienced traders to buy and sell crypto assets and copy the trades of experienced traders.

- Resources: Access a wide range of educational resources, helping users learn about cryptocurrencies and rewarding them with crypto.

Coinbase Copy Trading cons are:

- Low Leverage: It offers low leverage compared to other crypto futures exchanges on this list.

- High Fees: Coinbase’s fees are generally higher compared to some competitors, especially for small transactions

- Coinbase does not offer copy trading directly.

Copy Trading Fees on Coinbase:

Vary based on transaction size and payment method. For example, transactions under $10 incur a $0.99 fee, while those between $10 and $25 cost $1.49. These fees could go higher as your transaction size increases.

Key Features of Coinbase Copy Trading:

- Coinbase Earn: Coinbase offers learning tools that help users understand the fundamentals of the crypto. The exchange rewards traders with cryptocurrencies for completing educational modules. This feature makes Coinbase a good crypto trading platform and a great resource for personal growth in the crypto space.

- Robust Security Features: The exchange implements robust security features, including two-factor authentication and cold storage for 98% of user funds. In addition, Coinbase is highly compliant, making its services available to traders in various countries, including the United States.

What is Copy Trading in Crypto?

Copy trading in crypto is a strategy that allows a trader to automatically or manually replicate another trader’s positions. This tool is perfect for beginners, traders who do not have time to initiate their trades from the ground up, and experienced traders seeking to explore other products like indices, commodities, FX, gold, and crypto.

Copy trading platforms allow you to choose between thousands of experienced traders and follow them, and their trades will be synced to yours, and it will begin to run on autopilot. Depending on your platform, you could mirror the multiple traders’ exact moves or make custom changes to how much money you want to invest, leverage for futures trading, and position size.

What Are the Best Crypto Copy Trading Platforms to Use?

The best crypto copy trading platforms are Binance, MEXC, Bybit, PrimeXBT, eToro, OKX, and Coinbase. Once you follow a trader and copy them, every trade they execute will be mirrored in your account in real time. When the lead trader closes a trade, it also closes for the follower.

Since a lead trader’s strategies have much impact on whether you gain profit or lose your capital, it is essential to do your own research because each platform has its unique features, benefits, copy trade products, and modes it supports.

What Are the Types of Crypto Copy Trading Platforms?

The types of crypto copy trading platforms are broker-integrated copy trading platforms, third-party copy trading platforms, and social trading platforms. Here is a detailed overview of how each of these copy trading platform types works.

1. Broker-Integrated Copy Trading Platforms

A broker-integrated copy trading platform allows traders, especially beginners or those with limited time, to automatically replicate the trades of more experienced traders within a broker’s environment. For example, let’s say you sign up with a broker that offers integrated copy trading, such as eToro.

Instead of manually analyzing the markets, placing trades, and managing risk, you can browse a list of experienced traders on eToro and select and copy the trades of one or more traders that align with your goals.

2. Third-Party Copy Trading Platforms

Third-party copy trading platforms also allow traders to copy the trades of experienced investors, but instead of being directly integrated into an exchange infrastructure, it operates as an independent service that connects multiple brokers and crypto exchanges. An example of a third-party copy trading platform is Copycat Finance, a DeFi-based platform that copies the trading portfolios of experienced traders.

3. Social Trading Platforms

Social trading platforms take copy trading a step further by using features that allow users to interact, share insights, and discuss strategies with other traders. So, instead of passively copying trades, users can engage with expert traders, ask questions, and exchange market ideas.

One good example of a broker that doubles as a social trading platform is eToro. eToro offers social trading features where users can follow multiple traders, read their market analyses, and even discuss ongoing trades with other community members. The idea is to create an interactive space where traders can learn from each other rather than simply copy trades.

How to Choose a Crypto Copy Trading Platform?

To choose a crypto copy trading platform, consider the platform’s copy trading fees, user interface & trade execution speed, security, and accessibility.

- Copy Trading Fees

Knowing how much an exchange charges for transaction fees and how much you are willing to pay is necessary. Compare the costs of different crypto copy trading platforms to ensure you can trade with low fees. Some platforms charge competitive trading fees and offer experienced traders 10% – 15% of their profits, while others take up to 25%.

So, ensure you fully understand the platform’s fee structure, profit sharing, spread fee, and monthly charges, if there are any. It is advisable to also compare the costs of multiple exchanges, and a good place to start would be this comprehensive list of the best zero fee crypto exchanges.

- User Interface and Trade Execution Speed

You will be managing multiple trades at once, and though the trades you copy are automated, you will need to manage your portfolio and explore other products on the platform you choose. So, look for platforms with simple interfaces designed to cater to beginners and experienced traders alike.

A smooth user interface is one of the first signs of how fast you can execute trades. But besides the interface, choose a platform that offers high-speed execution, ensuring you make informed trading decisions and never miss out on trading opportunities due to sluggish performance.

- Security

When copying trades, you want your funds and data to be safe and secure. Look for crypto exchanges that implement robust security measures like cold wallet storage, two factor authentication, strong encryption, insurance funds, and other security measures. If you are concerned about sharing your information, you can opt for no-KYC exchanges like MEXC. Read this MEXC review to find out how to trade without KYC.

- Accessibility

Crypto copy trading platforms face regulatory issues in many countries. However, they are also able to provide services in a lot of countries. So, look for platforms that offer copy trading services to traders in your location, as well as web interfaces and mobile apps for trading to ensure you have a hassle free trading experience.

How to Start Crypto Copy Trading?

Here is a step-by-step guide on how to start crypto copy trading:

- Choose Copy Trading Crypto Platform: Select a crypto copy trading software that matches your trading goals. Look out for the abovementioned factors and ensure the exchange has everything you need.

- Set Up Your Account: Visit the platform’s website or download their mobile app and register by providing the necessary details, including a referral code. If you don’t have one, check out this crypto sign-up bonus article to get promo codes for various copy trading platforms and secure up to $30,000 in sign-up bonuses, depending on the exchange.

Some crypto exchanges offer users access to various trading features without requiring identity verification, while others enforce strict KYC policies. If you prefer to maintain privacy while trading, check out this compilation of the best no KYC crypto exchanges. However, if you are comfortable with KYC, you can choose any exchange that aligns with your needs.

- Deposit Funds: Fund your account using the platform’s accepted payment methods, such as direct crypto deposits, bank transfers, or debit/credit cards, considering the convenience and transaction fees of each option.

- Select a Trader to Copy: The majority of copy trading platforms rate lead traders based on their experience, profit and loss within a specific period, and other factors. So, analyze various traders’ performance, risk levels, and trading strategies, and choose someone who aligns with your goals.

- Set Your Copy Trading Parameters: Indicate how much capital to allocate to copying the trader and set stop-loss orders, leverage limits, and take-profit levels to manage risk. You can mirror the trader’s strategies if you don’t have extensive market knowledge.

Once you execute the trade, review the performance of your investments and adjust your settings or chosen trader as needed based on market changes.

How to Choose the Best Crypto Traders to Follow?

To choose the best crypto traders to follow, consider their consistency, trading strategies, profitability, risk score, win rates, and even how they communicate with their followers.

- Trading Style: Check whether they prefer day trading, swing trading, or long-term trading and ensure their trading styles align with what you need in a master trader. In addition, look at the products they trade (cryptocurrencies, stocks, indices, gold, FX, or commodities) and choose the trader that matches your goals.

- Consistency: Even though past success does not determine how well they trade you copy will go, a consistent trading history over an extended period will help you predict the out of your investment.

- Profitability (ROI): Check their historical return on investment. You want to profit from your investment, so it is only right to pick a trader to help you achieve that.

- Risk Score: Determine your risk tolerance level and pick a trader who matches that. As a rule of thumb, a lower risk rating indicates more stable trading.

- Communication: Good traders often share their thought processes, strategies, and market analyses. This transparency can help you understand their trading decisions.

These metrics are not an assurance that your trade will be profitable, considering how unpredictable the crypto market can be. However, they are a good way to determine traders who can make your trades profitable.

Is crypto copy trading profitable?

Yes, crypto copy trading is profitable. However, it depends on the trader you copy and whether that trader has predicted market movements correctly. Aside from that, the crypto market is highly volatile, and even traders with consistent profitability can sometimes lose. There are other ways to make free money on crypto exchanges, especially for new traders.

You can use promo codes during registration and earn sign up bonuses, mystery boxes, and other monetary rewards. For instance, if you are using MEXC or Binance for copy trading, you can use this MEXC referral code and get up 8,000 USDT or Binance referral code and earn up to $100 in sign up bonus.

The post Best Crypto Copy Trading Platforms to Use in 2025 appeared first on CryptoNinjas.

#Exchange, #Binance, #Bybit, #Coinbase, #EToro, #MEXC, #OKX, #PrimeXBT