Ethereum has once again taken center stage in the crypto market after surging to a new all-time high above the $4,900 level on Sunday. The rally, which pushed ETH into uncharted territory, highlighted the strength of bulls after weeks of steady institutional accumulation and market momentum. However, the price did not hold these highs for long. Ethereum has since retraced, dropping back to the $4,600 region, where bulls are now attempting to establish support before the next move higher.

This pullback has sparked debate among analysts. Some view the retracement as a sign of a potential local top, cautioning that ETH may require a period of consolidation before another breakout attempt. Others, however, remain firmly bullish, pointing to strong fundamentals and growing institutional interest as signals that Ethereum’s rally is far from over.

Adding weight to the bullish case, key on-chain data reveals that Binance whales continue to position themselves heavily in Ethereum. Large spot and futures orders attributed to these players have been flowing consistently, particularly after ETH confirmed its positive trend. This steady accumulation suggests confidence in Ethereum’s long-term trajectory, even as short-term volatility continues to shape the market’s direction.

Binance Whales Accumulate Ethereum

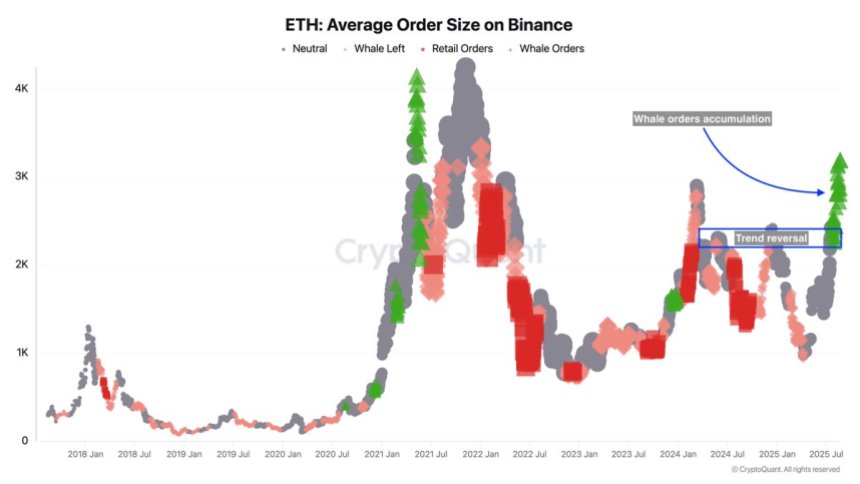

According to top analyst Darkfost, Ethereum’s Average Order Size on Binance chart provides clear insight into the behavior of different cohorts, distinguishing between retail investors and whales. Since July, a significant shift has taken place: whale activity on Binance has surged. This reflects a growing trend of large-scale accumulation, with whale-sized spot and futures orders continuing to flow into the market as ETH edges closer to the $5,000 mark.

What makes this trend particularly noteworthy is the timing of whale participation. Unlike retail investors, who often try to buy early and ride potential upside, whales tend to prefer entering once a bullish trend has been confirmed.

Darkfost highlights that this pattern is evident now, as whale orders began accelerating only after Ethereum reversed its earlier downtrend and regained strong bullish momentum. This validates the idea that large players seek reduced risk and clearer confirmation before allocating capital at scale.

With both retail and institutional participants aligning, the coming weeks could be decisive in determining whether ETH firmly breaks into new price discovery. If whales continue to buy at this pace, Ethereum’s rally could extend far beyond its 2021 highs.

Testing Critical Support LevelEthereum (ETH) is currently trading around $4,598 after a sharp retracement from its new all-time high near $4,900. On the 4-hour chart, the structure shows that ETH is still maintaining a bullish trend, although momentum has cooled after last week’s explosive rally.

The 50 SMA ($4,455) and 100 SMA ($4,435) are now converging just below current price levels, acting as immediate dynamic support. This cluster strengthens the bullish outlook as long as ETH can remain above it. A deeper drop toward the 200 SMA ($4,068) would signal a broader correction phase and potentially extend the consolidation before another push higher.

The recent pullback shows that sellers are active near the $4,900–$5,000 region, which now forms a critical resistance. A breakout above this level would open the path to uncharted territory and likely accelerate momentum, with targets potentially stretching toward $5,200 and beyond.

On the downside, failure to hold the $4,450–$4,400 support area could shift sentiment bearish in the short term, with traders eyeing $4,200 as the next key demand zone.

Featured image from Dall-E, chart from TradingView

#Ethereum, #ETH, #Ethereum, #EthereumAnalysis, #EthereumDemand, #EthereumNews, #EthereumPrice, #EthereumWhaleActivity, #EthereumWhaleDemand, #ETHUSDT