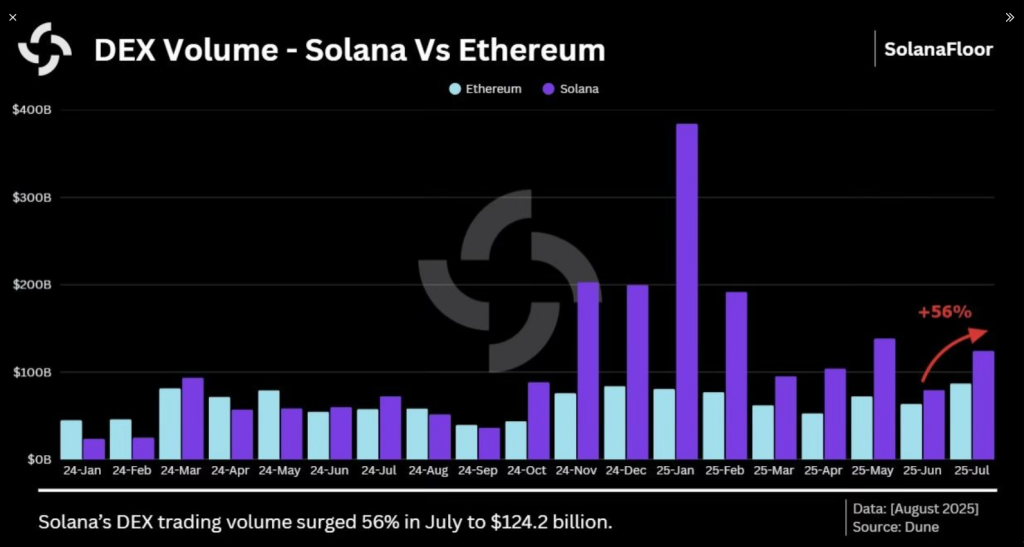

Solana is holding its dominance in decentralized finance with a striking performance in July. Reports indicate that DEX activity on its network hit $124 billion during the month, extending a winning streak against Ethereum to 10 straight months. Analysts say this gives Solana a 40% edge over its rival in this segment, signaling a clear shift in user behavior.

Shift To Solana Picks Up Speed

Reports have disclosed a sharp rise in new projects choosing Solana. Alliance DAO data show that more than 40% of founders in the first half of 2025 picked Solana, up from 25% a year earlier.

That change is being linked to Solana’s ability to run large numbers of transactions quickly and at low cost, which makes it attractive to teams building performance-focused DeFi apps.

This week in data by @SolanaFloor:

Solana outpaced Ethereum in DEX trading volume for the 10th consecutive month, reaching $124B in July, 42% higher than Ethereum. pic.twitter.com/TT0nb8wrtm

— Solana (@solana) August 23, 2025

Developers say they want speed and predictable fees. Solana offers both. The move by creators is not trivial; it reshapes where new liquidity and smart-contract work gets built.

Solana’s DEX volumes have not just grown; they have been sustained. For 10 straight months Solana has outpaced Ethereum on that metric.

That streak is unusual. It shows trading activity and automated market makers on Solana are busy. Onlookers point out that higher DEX throughput can draw more users, and more users can bring more developers. A feedback loop can form.

Technical Signals

Based on reports, SOL is trading above the $205 zone after a recent breakout. The 20-day SMA sits near $191 and is being watched as short-term support.

Market indicators are cited as positive. The MACD is showing green movement bars, which some traders interpret as upward momentum.

$SOL is on a one-way ticket to the moon.

After a brutal drop, Solana has found its footing and is riding a perfect uptrend channel. The path to $300 is wide open pic.twitter.com/vR4HdL272O

— 𝐊𝐚𝐦𝐫𝐚𝐧 𝐀𝐬𝐠𝐡𝐚𝐫 (@Karman_1s) August 24, 2025

Analysts have set nearby resistance points at $215, $228, and $240. Kamran Asghar is among those forecasting a longer-term target of $300 if current trends persist.

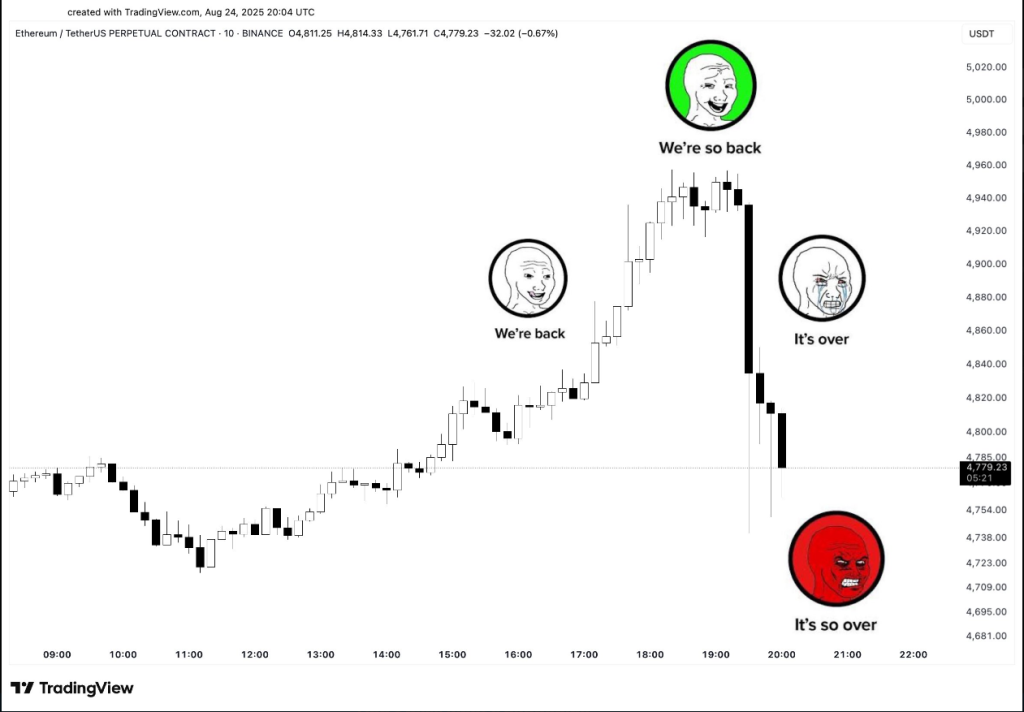

At the same time, Ethereum has been volatile: it fell below $4,800 and briefly swung from about $4,940 down to under $4,720 within hours, a move that underscored how choppy markets remain. This was echoed by crypto analyst Ali on X, suggesting his bearish opinion as the market changed in sentiment.

IT’S SO OVER! $ETH pic.twitter.com/atcQbHhMJi

— Ali (@ali_charts) August 24, 2025

Solana’s gains are happening while Ethereum handles continued institutional demand and holds leadership in other measures.

That contrast suggests the market is fragmenting in where different types of activity concentrate — DEX volume on one chain, institutional flows on another.

The shift of new projects toward Solana is being framed as a practical response to throughput limits rather than as a wholesale rejection of Ethereum.

Featured image from Equiti, chart from TradingView

#Altcoin, #Altcoins, #Bitcoin, #Crypto, #DEX, #ETH, #Ether, #Ethereum, #Ethusd, #Sol, #Solana, #SOLDUSD