The Dogecoin weekly chart has slipped back into the same lull that characterised the first half of 2024, yet two independent technicians argue the lull is nothing more than a reset before a decisive push higher.

Dogecoin to $1 By Summer’s End?

On the one‑week time‑frame, analyst Chris (@StonkChris) plots an expanding rising channel that has been guiding price action since the October‑2023 low at $0.056. That structure has produced a sequence of higher highs—~$0.229 in March 2024 and ~$0.484 in December 2024—and higher lows around $0.077 (February 2024) and $0.08 (early August 2024).

The latest pull‑back has just retested the channel’s lower rail at $0.13, where Chris notes that the weekly Stochastic‑RSI has begun to curl up from single‑digit territory and the Ichimoku cloud is turning supportive above $0.22.

From that confluence he sketches a steep, almost parabolic trajectory that slashes through the cloud resistance in May, re‑tests the mid‑cloud span near $0.30 and accelerates toward the upper boundary of the channel—an area that will sit close to $1.00–$1.10 by late‑summer 2025. “DOGE to $1 by the end of the summer 2025 anyone?” he asked followers on X, leaving little doubt about his conviction that the secular up‑trend remains intact.

A Higher High Is Needed

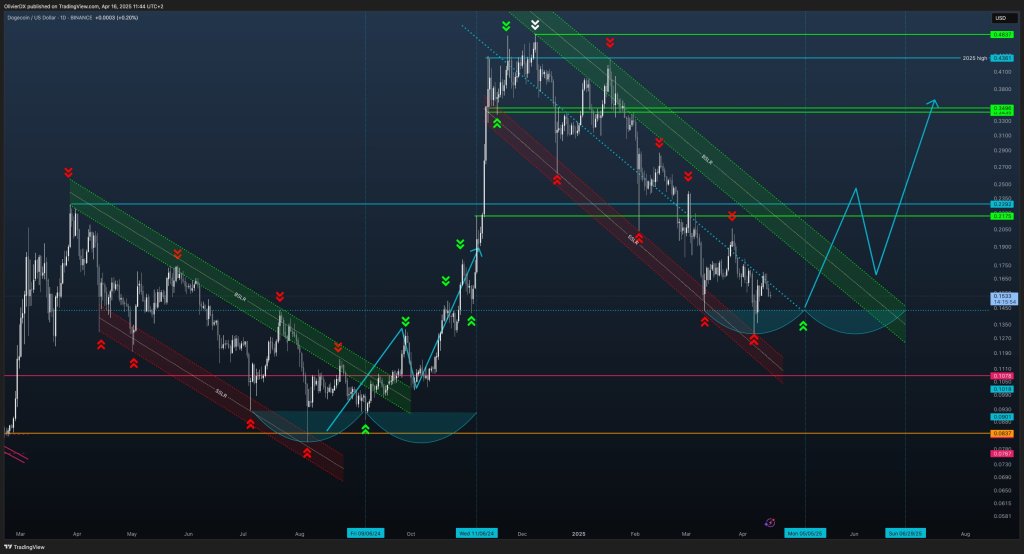

The short‑term picture is less binary in the eyes of Olivier (@Dark64), who analyses Dogecoin on the daily chart. His canvas is dominated by two features: a descending regression channel (labelled “BLSR”) that has trapped price since the November peak at $0.484, and a large rounded accumulation base projected to end between 5 May 2025 and 29 June 2025.

Key horizontal levels flank the pattern. Immediate support sits at $0.1533, the level price is presently hugging. Should that shelf give way, Dogecoin could revisit the lower line of the channel below $0.13. To the upside, Olivier marked $0.2175 the most crucial resistance where DOGE could break out of the descending channel and mark the first higher high in months.

Meanwhile, the area around $0.229 could be a last line of defense for bears as this is the local high from March 2024. A break above this level would expose $0.3496—a key support in December last year until January this year. Ultimately, the December high at $0.4361, with the year‑to‑date high at $0.484 completing the measured‑move objective.

Olivier’s trading logic is brutally simple. “The up‑trend won’t resume until it prints a new higher low,” he wrote, adding in reply to a sceptic who wondered whether DOGE might first undercut $0.12: “If it breaks the last low, it will go lower. If it prints a new higher low and a new higher high, then I’ll be confident a new up‑trend is on.” His road‑map therefore allows for one more flush—potentially into the $0.13–$0.11 pocket.

At press time, DOGE traded at $0.154.

#Dogecoin, #Doge, #DOGENews, #DogePrice, #DogecoinNews, #DogecoinPrice