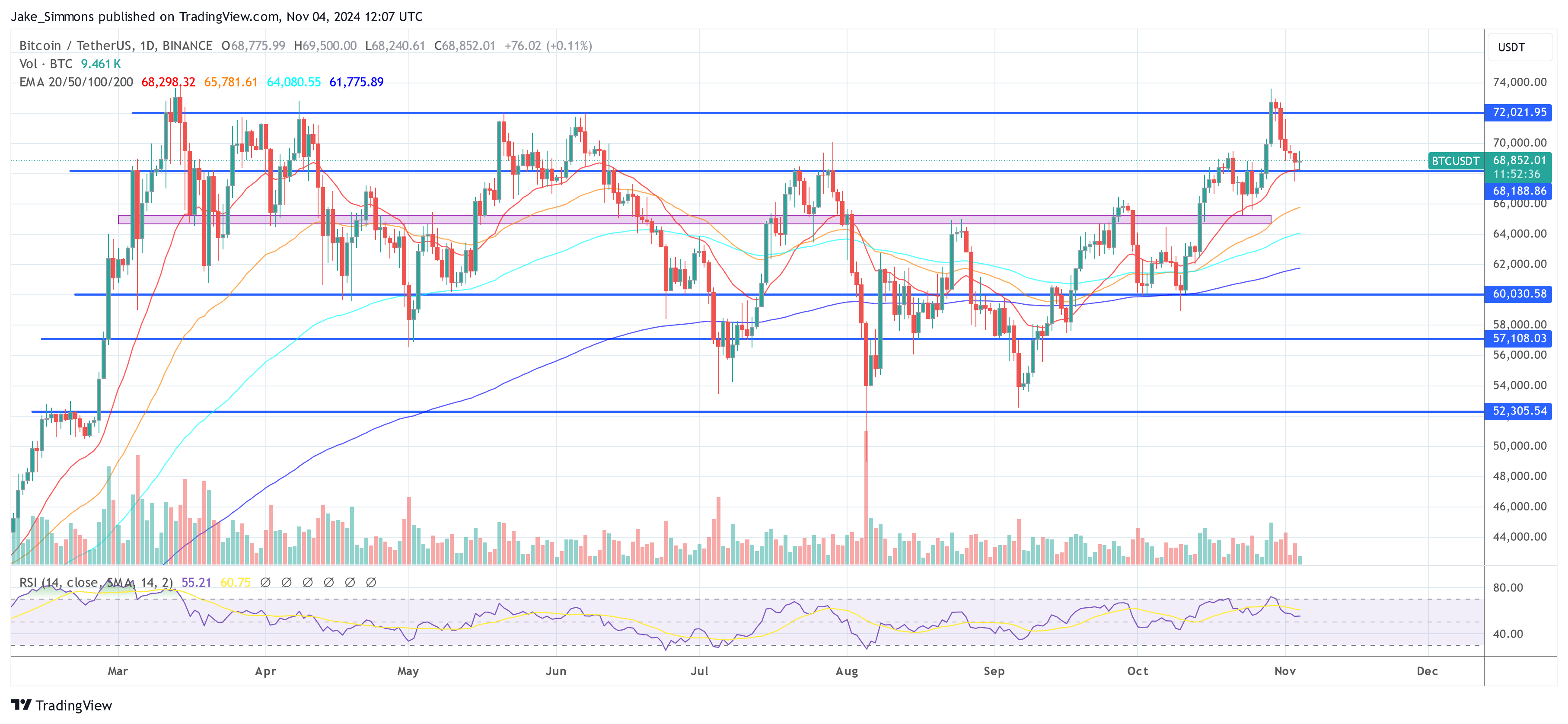

The Bitcoin price has posted five consecutive red daily candles since it stopped just short of its all-time high at $73,620 last Tuesday. As a result, the BTC price has fallen by around 7%. This decline is evident on the weekly chart, which shows a major bearish weekly candle – a gravestone doji.

Chartered Market Technician (CMT) Aksel Kibar noted via X, “BTCUSD weekly candle can look similar to GOLD,” and explained that it indicates a reversal is on the horizon. However, he added, “It is not dependable as an individual candle. Best to combine it with a following weak candle as a confirmation of trend reversal. […] The market narrative is that the bulls attempt to push to new highs over the session but the bears push the price action to near the open by the session close.

Bitcoin To Hit $75,000 By End Of November?

Despite this, Singapore-based crypto trading firm QCP Capital remains bullish in its latest investor note, highlighting significant shifts in both political prediction markets and the BTC derivatives market.

According to QCP Capital, the odds on the decentralized prediction market Polymarket have “moved closer to actual poll estimates,” with Vice President Kamala Harris and former President Donald Trump “locked in a tight race.” While Polymarket still favors Trump at 55%, this marks a decrease from 66% a week ago, indicating a narrowing margin that aligns more closely with mainstream polling data.

The firm also noted a cautious sentiment prevailing in the cryptocurrency market. The “sideways price action over the weekend” and a decrease in leveraged perpetual futures positioning—from $30 billion to $26 billion across exchanges—suggest that traders are adopting a wait-and-see approach. This pullback may be due to uncertainties surrounding macroeconomic factors or the upcoming election.

Despite the current market hesitancy, QCP Capital sees potential for significant upward movement in Bitcoin’s price. The firm questioned whether this is “the calm before a break from the multi-month range and push toward all-time highs.” Supporting this outlook, QCP observed an increase in topside positioning with substantial buying of end-November $75,000 call options since last Friday. This surge in call options at that strike price suggests that traders are positioning for a substantial rally by the end of November.

Additionally, the firm highlighted increased activity in options tied to the election date. “Election-date options positions are also rising,” QCP noted, with Friday implied volatility exceeding 87%, even as realized volatility remains at 40%. The elevated implied volatility indicates that options traders are anticipating significant price swings around the election period.

Looking ahead, QCP Capital expects Bitcoin’s spot price to remain range-bound until the US election results provide more clarity. The firm stated that they “expect spot to chop around this range until we get more clarity on the election results this week,” adding that “a Trump win is likely to cause a knee-jerk reaction higher, and vice versa if Kamala wins.”

At press time, BTC traded at $68,852.

#Bitcoin, #Bitcoin, #BitcoinNews, #BitcoinPrice, #BitcoinUSElection, #Btc, #BtcPrice, #DonaldTrump, #KamalaHarris