The Bitcoin price has already been up by 10% in the past seven days, breaking above the $67,000 mark again in the last few hours. The Coinmarketcap Fear And Greed Index has now switched to greed in light of recent buying momentum and is showing no signs of slowing down.

The buying pressure on Bitcoin has been so great in the past few days, leading to a huge decline in the number of BTC available on crypto exchanges. According to on-chain data, this has caused the Bitcoin exchange reserve to drop to its lowest point in five years.

BTC Exchange Reserve Drop to 5-Year Low

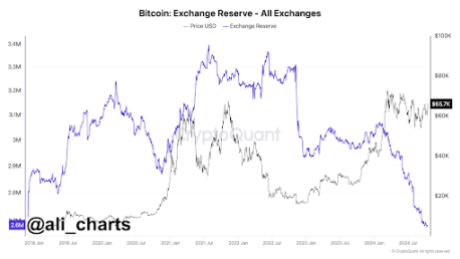

Over the past few days, the demand for Bitcoin has outweighed its supply, leading to a sharp decline in the exchange reserves. According to CryptoQuant data reposted on social media platform X by crypto analyst Ali Martinez, the number of BTC held on exchanges is now at a five-year low of 2.6 million BTC.

Martinez’s chart reveals an intriguing trend in Bitcoin’s exchange reserves that has unfolded throughout the year. At the beginning of 2024, the reserves stood at approximately 3.05 million BTC. However, this number has declined massively since that time.

The dwindling supply of Bitcoin on exchanges can be attributed to several key factors. First, there’s the surging interest from institutional players, especially following the approval and growing momentum of Spot Bitcoin ETFs. These ETFs have triggered significant buying activity, with US-based Spot Bitcoin ETFs eventually becoming the second-largest holders of BTC behind Satoshi Nakamoto.

Many long-term holders also contributed to the buying pressure, as many continued buying in droves. Even periods of price corrections and selloffs from short-term holders were highlighted by the movement of more BTC into stable long-term hands who are less likely to sell.

As a result, the total amount of Bitcoin held on crypto exchanges has dropped by about 450,000 BTC since January, bringing the current reserve to just 2.6 million BTC. This is the lowest level seen since January 2019, and such a sharp decline typically signals a bullish outlook for Bitcoin. “We all know what this means,” Martinez said.

What Does This Mean For Bitcoin Price?

The current state of Bitcoin’s exchange reserves suggests that market participants are increasingly holding onto their BTC in anticipation of future gains, as many people continue to speculate about where the Bitcoin price could be heading in the coming months.

When fewer coins are available on exchanges, it often indicates reduced selling pressure, which drives the price higher as demand continues to rise.

Uptober is now fully in play, and Bitcoin is already up by 6.3% in the month. At the time of writing, Bitcoin is trading at $67,200. This notable price point puts Bitcoin on the path to breaking above its all-time high of $73,737 before the end of October.

#Bitcoin, #Analyst, #Bitcoin, #BitcoinNews, #BitcoinPrice, #Btc, #BTCNews, #BtcPrice, #Btcusd, #BTCUSDT, #Crypto, #CryptoAnalyst, #CryptoNews