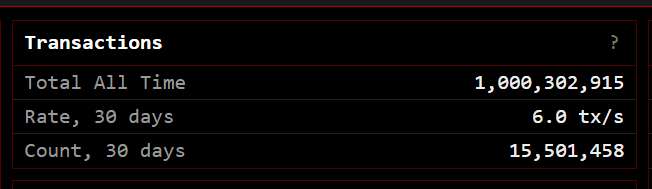

Bitcoin, the trailblazer of cryptocurrencies, reached a symbolic milestone this weekend, processing its 1-billionth transaction. This achievement has ignited a celebratory mood among proponents, who hail it as a testament to the digital currency’s growing legitimacy and potential. However, beneath the champagne toasts, whispers of caution linger as analysts grapple with the true significance of this benchmark.

Bitcoin’s Blockchain Bonanza: Security And Speed Take Center Stage

At the heart of the celebration lies the accomplishment itself. Bitcoin’s decentralized network, often touted for its security, has demonstrably facilitated 1 billion transactions – a testament to its ability to function flawlessly at scale.

This feat, based on data by Clark Moody, is particularly noteworthy when compared to established payment giants like Visa, which took roughly 25 years to reach the same milestone. Proponents like Tarik Sammour emphasize this achievement, highlighting that “Bitcoin has done so flawlessly, securely, and without any centralized intermediary,” a stark contrast to the traditional financial system.

What’s amazing is not that the #Bitcoin network has now processed 1B transactions, but that it has done so flawlessly, securely, and without any centralised intermediary. https://t.co/XC09H5bO6u

— Tarik Sammour (@tarik_sammour) May 6, 2024

Bitcoin Vs. The Goliaths: Can Crypto Really Compete?

The celebratory mood extends to Bitcoin’s potential as a viable payments platform. Analysts point to the rapid growth of Bitcoin compared to established players like Visa and Mastercard. Founder of the Orange Pill App, Matteo Pallegrini, emphasizes this point, underscoring Bitcoin’s resilience despite facing giants with “billions of dollars in marketing spend and thousands of employees.”

This comparison fuels the narrative that Bitcoin is disrupting the payments landscape, offering a faster and more transparent alternative.

While the celebratory chorus is loud, a closer look reveals some lingering concerns. Bitcoin grapples with scalability issues, struggling to handle the high transaction volume necessary to truly compete with traditional payment processors.

This often translates to high transaction fees, potentially hindering broader adoption. Furthermore, the environmental impact of Bitcoin mining, which relies on vast amounts of energy, remains a significant point of contention.

The 1 billion transaction milestone undoubtedly marks a significant moment for Bitcoin. It underscores the growing popularity and potential of this digital currency. However, a balanced perspective recognizes the challenges Bitcoin faces – scalability, transaction fees, and environmental concerns.

Related Reading: XRP Holders Stack Coins Despite Price Dip: Bullish Signal Or HODL Of Desperation?

While institutional investment and comparisons to internet adoption are encouraging signs, widespread individual adoption remains a question mark. The future of Bitcoin hinges on its ability to address these issues and evolve into a truly viable alternative in the global financial landscape.

Featured image from Pexels, chart from TradingView