Originally published on Unchained.com.

Unchained is the official US Collaborative Custody partner of Bitcoin Magazine and an integral sponsor of related content published through Bitcoin Magazine. For more information on services offered, custody products, and the relationship between Unchained and Bitcoin Magazine, please visit our website.

There are many different ways to custody bitcoin, and there isn’t one perfect method that suits everyone in all situations. The amount of bitcoin, the frequency it needs to be accessed, and other factors can determine which approach makes the most sense.

The resources and security requirements of individual bitcoin holders will differ from those of institutions. In this article, we’ll take a look at how the custody strategies for these two groups compare, and then uncover an important truth about the application of multisig.

Custody for individuals

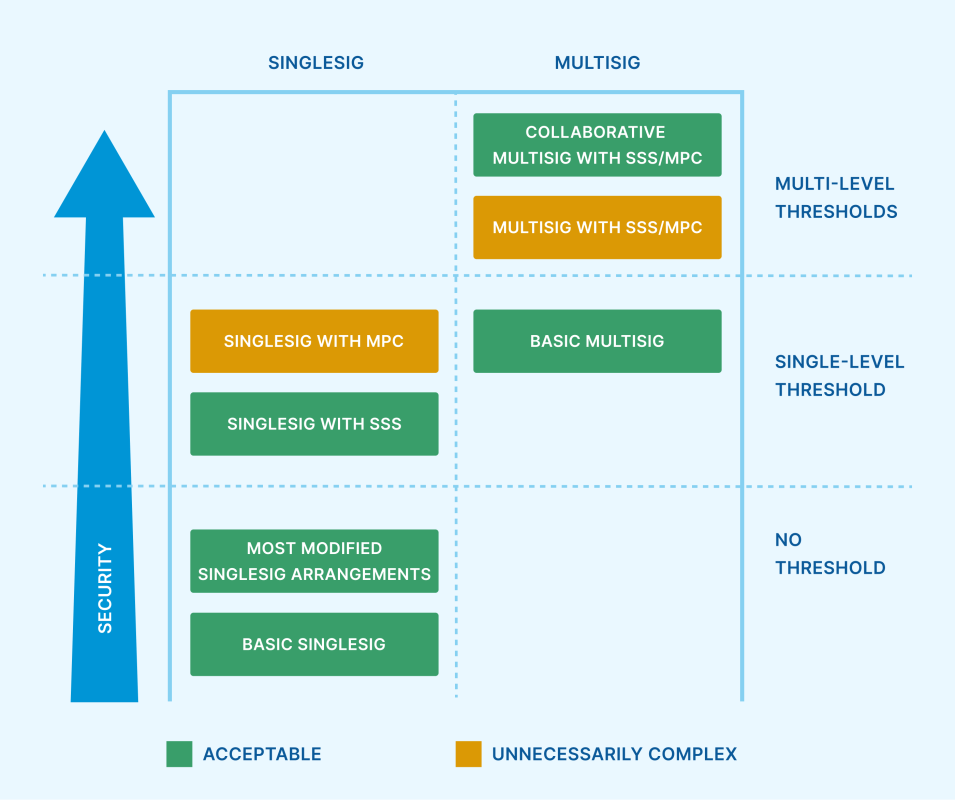

For typical individuals looking to hold bitcoin in self-custody, there are a number of tools to choose from. Depending on the situation, a simple singlesig wallet could be sufficient, with the option to add modifications such as seed phrase copying or BIP 39 passphrases. We created an article going into detail on various configurations, comparing their strengths and weaknesses.

Individuals less concerned with making frequent withdrawals, and looking to secure larger amounts for long-term savings, should consider a multisig wallet. Multisig offers threshold security, which can protect users from single points of failure, ensuring that no funds are lost if any one component of the setup is destroyed, misplaced, or stolen. Achieving threshold security is crucial for anyone who wishes to protect a substantial amount of funds.

There are a couple of other methods of threshold security besides multisig, but they are less appropriate for the average person. Shamir’s secret share (SSS) is one method that still leads to temporary single points of failure during the initial setup, and during a withdrawal procedure. Multiparty computation (MPC) is another method which is extremely complicated to safely use. You can learn more about these in our article about threshold security models.

Multisig can be combined with SSS or MPC to create multi-level thresholds. Multi-level thresholds refers to a threshold on the blockchain level (multisig) as well as a threshold on the key level (SSS or MPC). By combining these concepts, a fundamental threshold of keys serves as the primary security for bitcoin holdings, and each key can have protection from becoming compromised by using a threshold of its own. Despite a more complicated structure, two levels of thresholds offers clear advantages for keeping bitcoin maximally secure.

For a sole individual trying to protect their bitcoin, this approach is widely considered unnecessarily complex. However, if the individual enters a collaborative custody partnership with one or more institutional key agents capable of deploying SSS or MPC, this increased layer of security becomes more easily accessible.

Custody for institutions

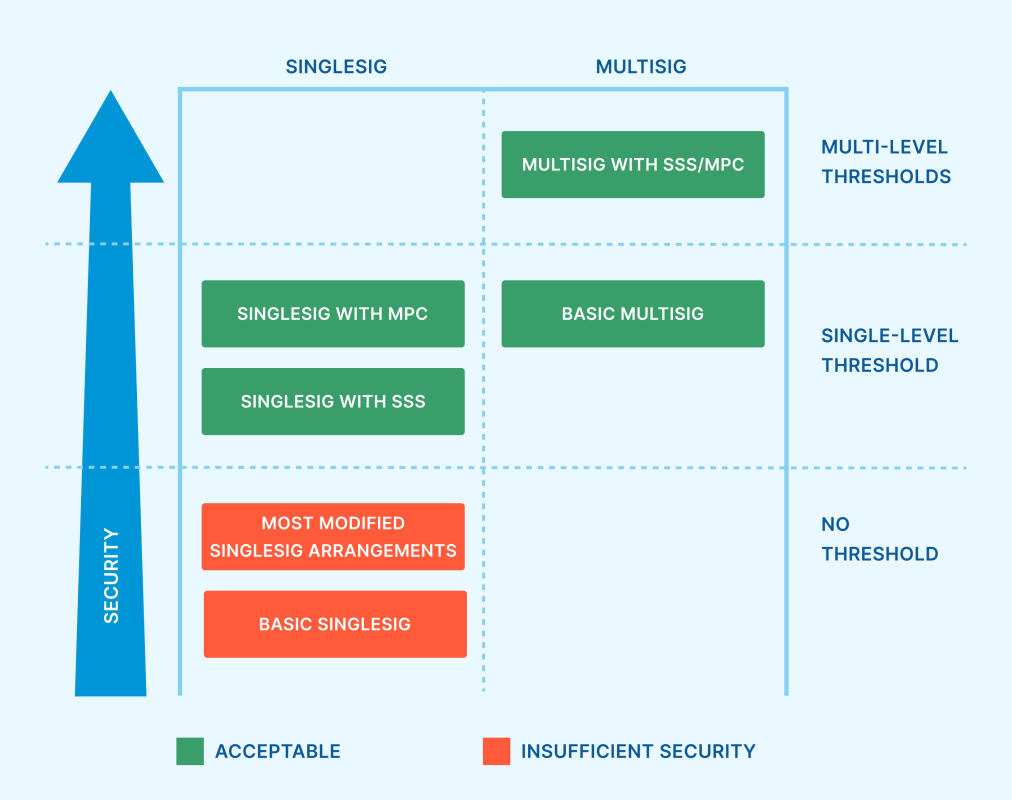

For companies, governments and other institutions who want to secure a bitcoin treasury, it wouldn’t be appropriate to employ some of the custody strategies used by typical individuals. If multiple people are responsible for large sums of money, more rigorous controls are necessary. Institutional-grade bitcoin custody requires threshold security as a bare minimum.

Multisig, SSS, and MPC are the available choices to meet that requirement. While MPC is by far the most complicated to safely use, and wouldn’t be recommended for individuals, an institution with a team of experts might consider it. However, the extra effort to set up MPC doesn’t mean that it’s a superior option to basic multisig. All three models have trade offs, as discussed in our earlier article comparing them.

If an institution wants the highest level of security possible, they should consider using multi-level thresholds. In this arrangement, the foundation is multisig, which allows for a threshold of multiple separate private keys in order to access funds. Several different enterprise key agents can be responsible for each key, minimizing counterparty risk from any single custodian. Additionally, each key agent can apply their own threshold security for the key they are responsible for, by using SSS or MPC. This protects the key from any single officer within the key agent firm.

Multisig has a higher security ceiling

As you may have noticed from the charts above, there is a distinct difference between the upper security limits of singlesig and multisig. With singlesig, there is only a single key which can have a threshold applied to it, creating a single-level threshold. Multisig can act as a single-level threshold as well, but also travel a step further: it can be the foundation of multi-level thresholds.

Therefore, sizable bitcoin holdings that utilize a singlesig foundation rather than a multisig foundation—which can often be observed by examining the address type—have an opportunity for a security upgrade. Multi-level thresholds can unlock a robust multi-institution custody structure that distributes risk across key agents. Unchained private wealth and enterprise clients have several high-end key agents to choose from in order to set up this structure. Learn more and book a consultation!

Originally published on Unchained.com.

Unchained is the official US Collaborative Custody partner of Bitcoin Magazine and an integral sponsor of related content published through Bitcoin Magazine. For more information on services offered, custody products, and the relationship between Unchained and Bitcoin Magazine, please visit our website.

Source: Bitcoin Magazine - Bitcoin News, Articles and Expert Insights