In a significant milestone for the cryptocurrency market, Bitcoin (BTC), the largest digital asset, shattered its previous records, surging past the $69,000 mark to establish a new all-time high (ATH) of $69,300 on Tuesday.

The achievement marked a historic moment for BTC, which hadn’t reached such levels in over two years. However, the crypto’s upward trajectory shows no signs of slowing down, with experts predicting further price gains.

Bitcoin Price And ETFs In Perfect Harmony

According to data from Deribit, an options and futures crypto exchange and analytics firm GenesisVol, BTC is anticipated to experience a potential increase of up to 20.8% within the next 30 days.

These projections suggest that, under ideal circumstances, Bitcoin’s price could break through the $80,000 barrier. Even conservative traders are optimistic, expecting BTC to easily surpass $70,000 and reach around $75,000.

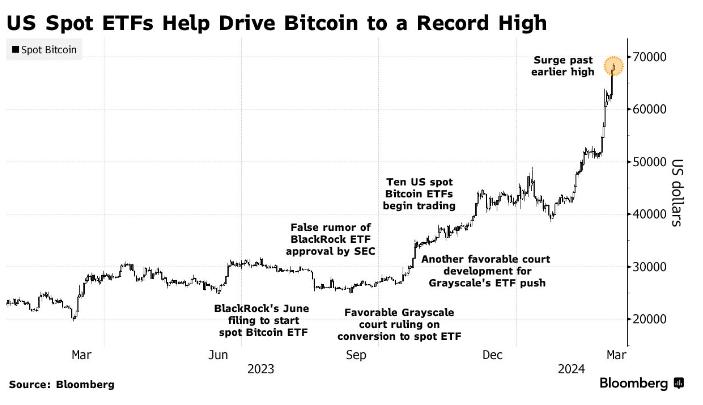

In addition, the recent approval of spot Bitcoin exchange-traded funds (ETFs) has played a pivotal role in Bitcoin’s success, suggesting that the upward trend in BTC prices, coupled with bullish sentiment among options traders and institutional and retail investors, is far from over.

Bloomberg ETF expert Eric Balchunas emphasized the significance of this development, stating that it represents a crucial moment for both Bitcoin and ETFs. Balchunas believes the surge from $25,000 to $69,000 was largely driven by hopes of ETF approval and subsequent flows.

The expert claimed that the synergy between ETFs and Bitcoin has proven mutually beneficial, as ETFs have enhanced liquidity, affordability, convenience, and standardization for investors.

Notably, the ten-spot Bitcoin ETFs have amassed over $50 billion in assets, with a staggering $8 billion generated from flows and the rest attributed to the rising value of Bitcoin.

However, as Bitcoin reached its new peak, increased market volatility led to a liquidation surge. Journalist Colin Wu reported a sharp 5% drop in Bitcoin’s price within an hour, with Binance recording below $65,000. During this hour, liquidations amounted to a staggering $142 million.

BTC Sell Signal

Although bullish investors are currently on cloud nine, renowned crypto analyst Ali Martinez has sounded the alarm as the TD Sequential indicator recently flashed a sell signal on the daily chart of Bitcoin.

The TD Sequential indicator, developed by market expert Tom DeMark, utilizes price patterns and sequences to identify potential trend reversals in various financial markets, including cryptocurrencies.

Martinez emphasized the indicator’s notable track record in predicting Bitcoin’s price movements since the beginning of the year. The TD Sequential indicator issued a buy signal in early January, just before Bitcoin’s price surged 34%.

Conversely, a sell signal was given in mid-February, followed by a 4.44% drop in the value of BTC. So, considering the previous sell signals, a potential drop towards the $62,000 price level could be in the making for the largest cryptocurrency on the market, still holding the $60,000 support, which will be key for BTC’s prospects.

Featured image from Shutterstock, chart from TradingView.com

#BitcoinNews, #Bitcoin, #BitcoinAlltimeHigh, #BitcoinChart, #BitcoinNews, #BitcoinPrice, #BitcoinSignals, #BitcoinTechnicalAnalysis, #BitcoinTrading, #Btc, #Btcusd, #BtcusdPrice, #BTCUSDT, #Crypto, #Cryptocurrency