Data from defillama.com reveals that over the past 93 days, the total value locked (TVL) in decentralized finance (defi) protocols escalated from $37.46 billion on Oct. 20, 2023, to the present $57.74 billion. Notably, 57.3% of the total value in defi is anchored in the Ethereum blockchain, while Lido’s liquid staking protocol accounts for 40.21% of this aggregate.

TVL in Defi Jumps 54%

The value locked in decentralized finance (defi) protocols has significantly increased in 2024 compared to the previous year. Since Oct. 20, 2023, there has been a 54.13% surge, bringing the total value locked (TVL) to an impressive $57.74 billion. Lido stands out as the largest protocol in terms of TVL, which has climbed by 10.66% since last month, now standing at $23.22 billion.

Following Lido, Maker, the second-largest defi protocol, has experienced a slight dip of about 1.52% over 30 days, with its TVL at approximately $8.41 billion at the time of reporting. The top five defi protocols by TVL size also include Aave ($7.22B), Justlend ($6.09B), and Uniswap ($4.34B). Aave has seen a 10.34% increase in TVL over the past 30 days, while Justlend has seen a decrease of 9.43%.

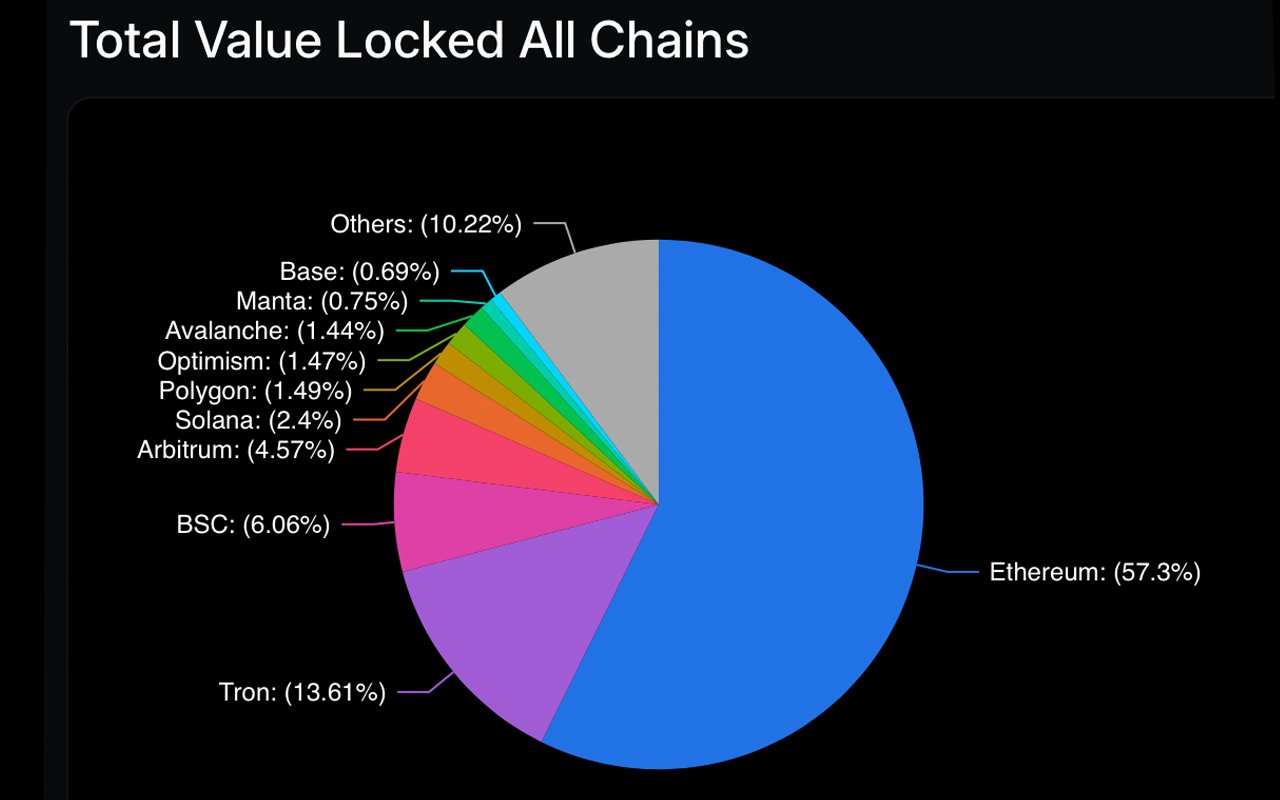

Uniswap, however, has reported the most significant growth among the top five, with its TVL rising by 78.56% since last month. Among these defi applications, four are built on the Ethereum blockchain, with Justlend being the exception as a Tron-based protocol. Ethereum continues to lead in the defi space, commanding 57.3% of the aggregate TVL, which amounts to $33.10 billion. Tron’s $7.86 billion in value makes it the second largest chain by TVL size.

Ethereum and Tron are followed by Binance Smart Chain (BSC) with $3.50 billion, Arbitrum with $2.64 billion, and Solana with $1.38 billion. Solana saw the biggest monthly increase over the 30-day mark with a 38.52% rise. Ethereum followed with a 10.57% increase since last month. Tron was the only blockchain that saw a 30-day reduction after 5.44% was erased over the past month. Notable chains that saw significant TVL growth besides the top five were SUI, MANTA, and APT.

As the defi landscape evolves, uncertainty still looms over its future trajectory. Despite a strong growth pattern in TVL, evident since October 2023, there’s been a noticeable deceleration since Jan. 10, 2024. Slowdowns like these can cast doubt on the sustainability of the current growth trend in defi. Whether this burgeoning sector can maintain its momentum remains an open question, but so far the growth has added $20.28 billion in value over the last 93 days.

What do you think about the state of defi in 2024? Share your thoughts and opinions about this subject in the comments section below.

#Defi, #BSC, #Crypto, #CryptoEconomy, #Cryptocurrency, #DecentralizedFinance, #DeFi, #DefiToken, #Ethereum, #Solana, #Tron