Bitcoin’s value experienced a turbulent Tuesday, largely due to a rogue post from the U.S. Securities and Exchange Commission’s hijacked X account, mistakenly proclaiming the green light for all spot bitcoin exchange-traded funds (ETFs).

False Spot ETF Approval Post Causes Chaos in Bitcoin Markets

This erroneous message from the official Twitter of the U.S. Securities and Exchange Commission (SEC) sparked a rapid increase in bitcoin’s price, soaring close to $48,000 per unit. Yet, this surge was short-lived as the price promptly dropped to around $45,000 once the market recognized the false nature of the announcement. This event stirred unease among investors and crypto enthusiasts, with some drawing parallels to a pump-and-dump strategy. Tennessee Senator Bill Hagerty demanded clarity from the SEC, pointing to possible market manipulation.

Hagerty stated:

Just like the SEC would demand accountability from a public company if they made such a colossal market-moving mistake, Congress needs answers on what just happened. This is unacceptable.

Before this downturn, there was a noticeable upward movement, signifying strong buying interest during this timeframe. The price encountered a ceiling near $47,897, peaked, and then plunged dramatically. Currently, bitcoin’s value is striving to stabilize above the $46,000 zone as of 6:45 p.m. Eastern Time. The anticipation surrounding the endorsement of a spot bitcoin ETF has injected considerable volatility, as traders respond to each update pertaining to its potential sanction. A similar situation unfolded when Cointelegraph inaccurately reported the approval of Blackrock’s spot bitcoin ETF.

The fluctuation in bitcoin’s price on Jan. 9, 2024, mirrors the intricate dynamics of market responses to regulatory developments (both accurate and spurious), expectations of key happenings like the spot BTC ETF sanction, trends in institutional investment, and the overall market mood. Despite these ups and downs, optimism persists around bitcoin, with its market capitalization eclipsing major entities such as Berkshire Hathaway in late 2023. Some believe that the sanction of a spot bitcoin ETF could significantly sway the market, likely boosting institutional involvement and enhancing liquidity.

Ahead of this approval, bitcoin had already seen notable price growth, surging over 160% within a year. The sector has been preparing for this event, and its occurrence might trigger diverse reactions, particularly following two previous misleading announcements.

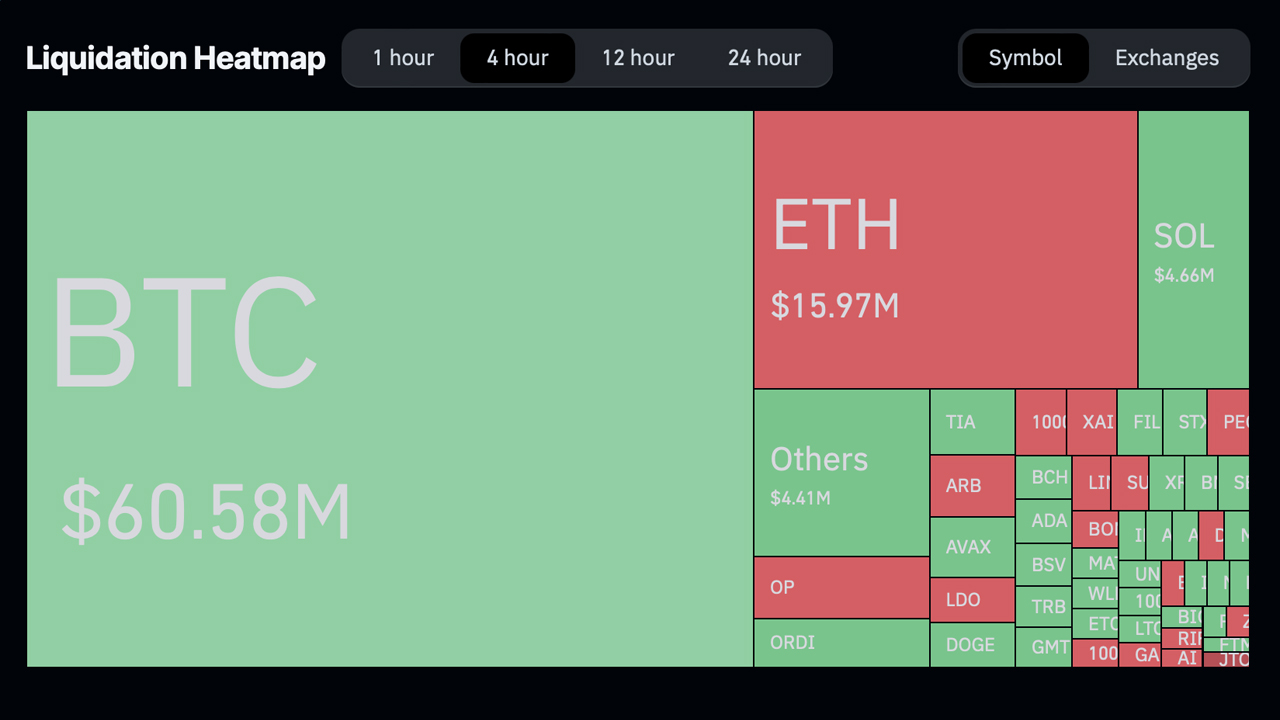

Amid the SEC’s recent fake announcement, $60.58 million in BTC long positions were liquidated within the past four hours according to coinglass.com stats. Moreover, the SEC is trending on the social media platform X with more than 172,000 posts about the subject trending at 7 p.m. Eastern Time.

What do you think about the rogue tweet from the SEC on Tuesday and how it impacted bitcoin’s market? Share your thoughts and opinions about this subject in the comments section below.

#MarketUpdates, #Bitcoin, #BitcoinEtf, #BitcoinSEC, #Crypto, #Cryptocurrency, #SECPost