Ever since, the relationship between Ripple’s XRP buybacks and its impact on price has been a subject of intense discussion. Crypto Mark, an active community member on X, raised a pertinent question regarding Ripple’s strategy of purchasing more of the cryptocurrency. “Shouldn’t Ripple be trying to distribute XRP and not buying more though? Would like to see them own less XRP, not more,” Crypto Mark posted.

The Influence Of XRP Buybacks By Ripple On The Price

This inquiry was addressed by Mr. Huber, a renowned member of the community, who provided a detailed explanation of the dynamics at play. Huber emphasized the strategic rationale behind Ripple’s buybacks.

“That’s just a question of your knowledge. Ripple makes it transparent. That’s why we know. And you want Ripple to buy back XRP. You don’t want them to just sell it. Believe me. If XRP actually has a use for Ripple then you want them to buy on open markets for liquidity reasons,” he explained. This statement highlights the necessity and benefits of Ripple’s buyback strategy, suggesting that it is beneficial for maintaining market liquidity.

In his analysis of the market, Mr. Huber pointed out key patterns: “Facts; 1. XRP has sudden inexplicable very fast price spikes between 30 and 100% which are then lost over several months. 2. These price spikes almost invariably coincide with buybacks of Ripple on open markets. They take place approximately once a quarter. 80% reliability. 3. If you look at these buybacks, you realize that when Ripple buys 100 million dollars of net purchases within 1-2 days, they trigger a price spike of around 50%.”

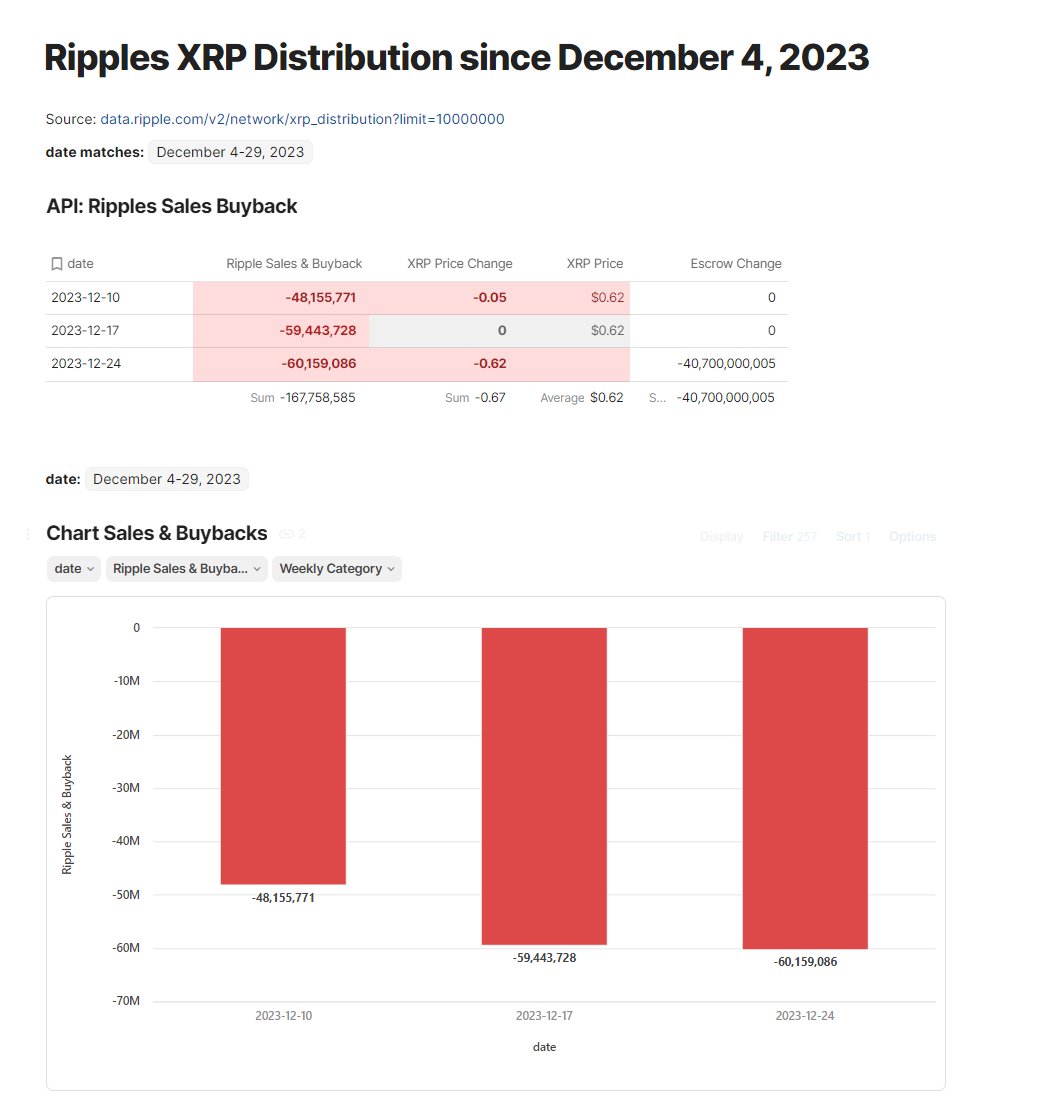

Recent data from Ripple’s API revealed a notable decrease in the company’s buyback activity. The researcher noted that the API was updated just days ago with the newest data. Ripple’s sales now account for 167,758,585 XRP, for an average of $0.62, which results in a total of $104,010,323 from December 4 to 29.

“This is twice the usual sales volume of the last 6 months. I suspect that Ripple wants to push this cut down again with the next buyback,” reported Mr. Huber.

Addressing a user’s question about the scale of investment needed for a substantial increase in the cryptocurrency’s price, Mr. Huber stated, “$100 million dollars trigger a price swing of around 30-50%. So for 2,000% you would have to expect at least 4-6 billion dollars in net purchases.” This response provides a clear indication of the financial magnitude required for substantial market movements.

Impact Of Ripple’s Sale And Distributions

Furthermore, Mr. Huber compared Ripple’s sales and distribution strategy with other cryptocurrencies. He wrote, “Ripples Sales and Distribution of XRP of the past 10 years. 6.48% Inflation for 2023. In comparison with SOL and ETH, it becomes clear that the price action is due much more to a lack of demand than to Ripple sales.”

He added, “ETH – Reducing supply and proof of stake, but hardly any price action since the Merge. […] The (XRP/XRPUSD)/(BTC/BTCUSD) chart shows that over the last 9 years, the supply of XRP has only increased by 22.73% more than the supply of Bitcoin.”

At press time, XRP traded at $0.63135.

#XRPNews, #Ripple, #RippleBuybacks, #RippleXRPBuybacks, #Xrp, #XRPPrice, #XRPUSD