A new research study has partly attributed the growth in the use of bitcoin “as a transactional layer” to the increased number of crypto platforms that have joined the Lightning Network ecosystem. The study however found that just over 6% of centralized crypto exchanges have integrated the layer 2 protocol with their respective platforms.

Record Increase in Bitcoin’s Quarterly Transactions

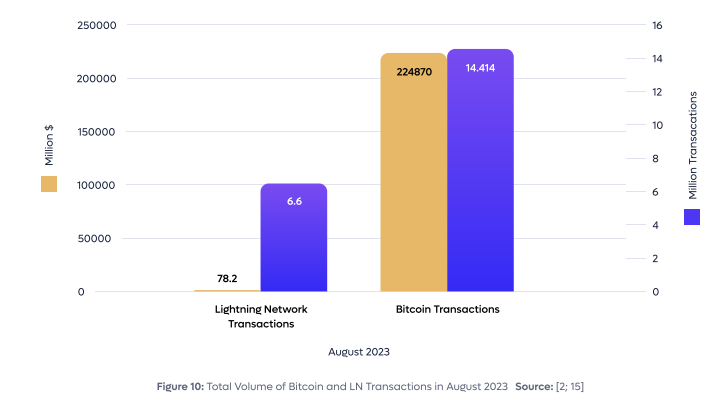

According to the findings of new market research conducted by Kaminari, the use of bitcoin “as a transactional layer” has grown steadily in the past few years. The research points to the 40 million transactions settled in Q3 of 2023 as evidence.

Kaminari’s findings report that the introduction and growing adoption of the Lightning Network (LN) by crypto exchanges and other platforms is one of the reasons behind the crypto asset’s record increase in quarterly transactions. The market research data indicates that the number of companies in the LN ecosystem has grown from 94 in October 2021 to 179 companies spread across 28 categories.

Centralized cryptocurrency exchanges have been the main driving force behind the increased use of the LN — the so-called layer 2 payment protocol built on the Bitcoin blockchain. Top crypto exchange platforms, such as Binance, Okx, and Bitstamp, are some of the more prominent entities that recently joined the Lightning Network ecosystem.

However, while they are touted as a potential catalyst in the further adoption of the Lightning Network, just over 6% of centralized crypto exchanges have integrated the layer 2 protocol with their respective platforms.

“There are currently 224 active centralized crypto exchanges, 14 of which are connected to the Lightning Network – in other words, only 6% of crypto exchanges currently use the Lightning Network to conduct transactions with Bitcoin,” the Kaminari market research report said.

Stablecoins on the Lightning Network

Market research has also found that crypto wallets, both custodial and non-custodial, are another key growth vector for the Lightning Network (LN). However, just like centralized crypto exchanges, the majority of crypto wallets are yet to integrate the LN. So far, only two of the top 10 most popular wallets by user count, Exodus and Bitpay, have embraced Layer 2, the report revealed.

Meanwhile, the research report predicts the forthcoming RGB — a client-side validated state and smart contracts system operating on Layers 2 and 3 of the Bitcoin ecosystem — and Taproot Assets protocols as undertakings which “will enable the creation of stablecoins compatible with the Lightning Network.” The report added:

“This presents an opportunity for a significant migration of USDT transactions from Tron and Ethereum to the Lightning Network, potentially involving billions of dollars daily.”

What are your thoughts on this story? Let us know what you think in the comments section below.

#Blockchain, #Binance, #BitcoinTransactions, #CryptoExchanges, #LightningNetwork, #Stablecoins, #USDT