The price of Bitcoin was rejected as it approached critical resistance north of $27,000, and selling pressure continues over today’s trading session. If buyers can’t defend current levels, BTC’s price will likely re-test critical support, but this action could trigger a bounce for the cryptocurrency, according to fresh data.

As of this writing, Bitcoin trades at $26,650, with a 2% loss in the last 24 hours. Over the previous seven days, the cryptocurrency has recorded sideways price action and underperformed XRP and Toncoin’s TON, which recorded a 5% and 25% profit, respectively, across a similar period.

The Bitcoin Level To Watch If Bears Take Over

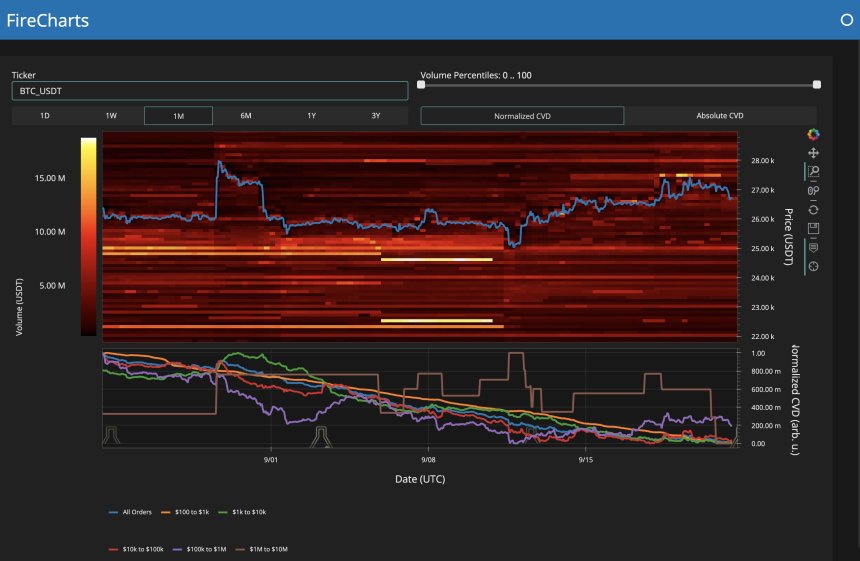

An analyst crypto research firm Material Indicators shared a fire chart showing the most significant liquidity levels for the BTCUSDT trading pair on Binance. On a monthly basis, traders on this venue have been selling the cryptocurrency and moving liquidity below current levels.

The chart below shows that the Binance orderbook for this trading pair looks ‚Äúthin.‚ÄĚ The analyst claims a ‚Äúsmall buy wall‚ÄĚ at around $24,700, which stands as a ‚Äúline in the sand‚ÄĚ that needs to be defended to prevent further downside price action.

Liquidity around this critical level is low, but bulls can inject capital to defend the level in case of further downside. If bulls succeed, Bitcoin will likely rally and reclaim previously lost territory.

Otherwise, bears will have the opportunity to press further on the price, returning it to critical support around $23,000 and $22,000. These levels display even less liquidity than $25,000, which could hint at a deeper correction of ‚ÄúBearadise,‚ÄĚ as the analyst called it.

Additional data provided by trading desk QCP Capital indicates that macroeconomic forces have played a critical role in influencing the price of Bitcoin. Yesterday, the US Federal Reserve (Fed) sent a ‚Äúhawkish‚ÄĚ surprise across financial markets, limiting any BTC upside momentum.

This event had a bearish impact on legacy markets, with the Nasdaq 100 and rates markets breaking ‚Äúsome very key levels,‚ÄĚ QCP Capital stated. The trading desk added:

(…) reflexivity can take over with the bearish thesis from here. If we are right, then this macro move could seep into crypto markets and take BTC lower with it (Chart 3), albeit with a lower beta as compared to other very stretched macro markets like the NASDAQ.

Cover image from Unsplash, chart from Tradingview