After a short-lived rally above $28,000 this week following Grayscale’s landmark court case victory against the US Securities and Exchange Commission (SEC) over the conversion of GBTC into a spot ETF, the price of BTC has once again settled around the $26,000 mark. This comes after yesterdays’ SEC’s decision to postpone all Bitcoin spot ETF decisions for 45 days.

Renowned crypto analyst, Rekt Capital, has weighed in on the situation with a series of tweets that provide insight into Bitcoin’s potential trajectory for the upcoming month. As the analyst remarks, Bitcoin has registered a bearish monthly candle close for the month of August due to yesterdays’ price plunge.

Bitcoin Price Prediction For September 2023

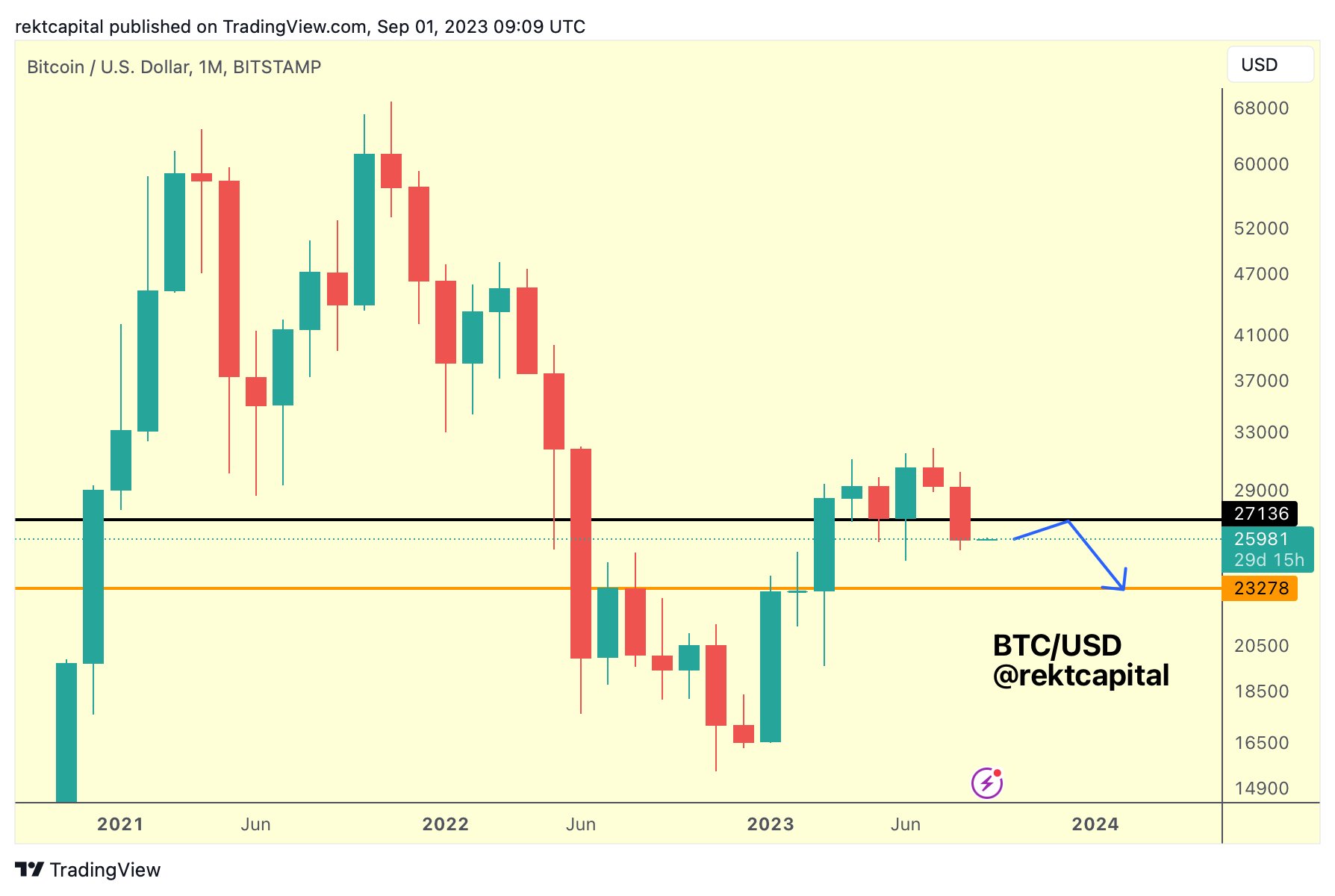

In a series of tweets, Rekt Capital explained, “BTC closed below ~$27,150, confirming it as lost support. It’s possible BTC could rebound into ~$27,150, maybe even upside wick beyond it this September. But that would likely be a relief rally to confirm ~$27,150 as new resistance before dropping into the $23,000 region.

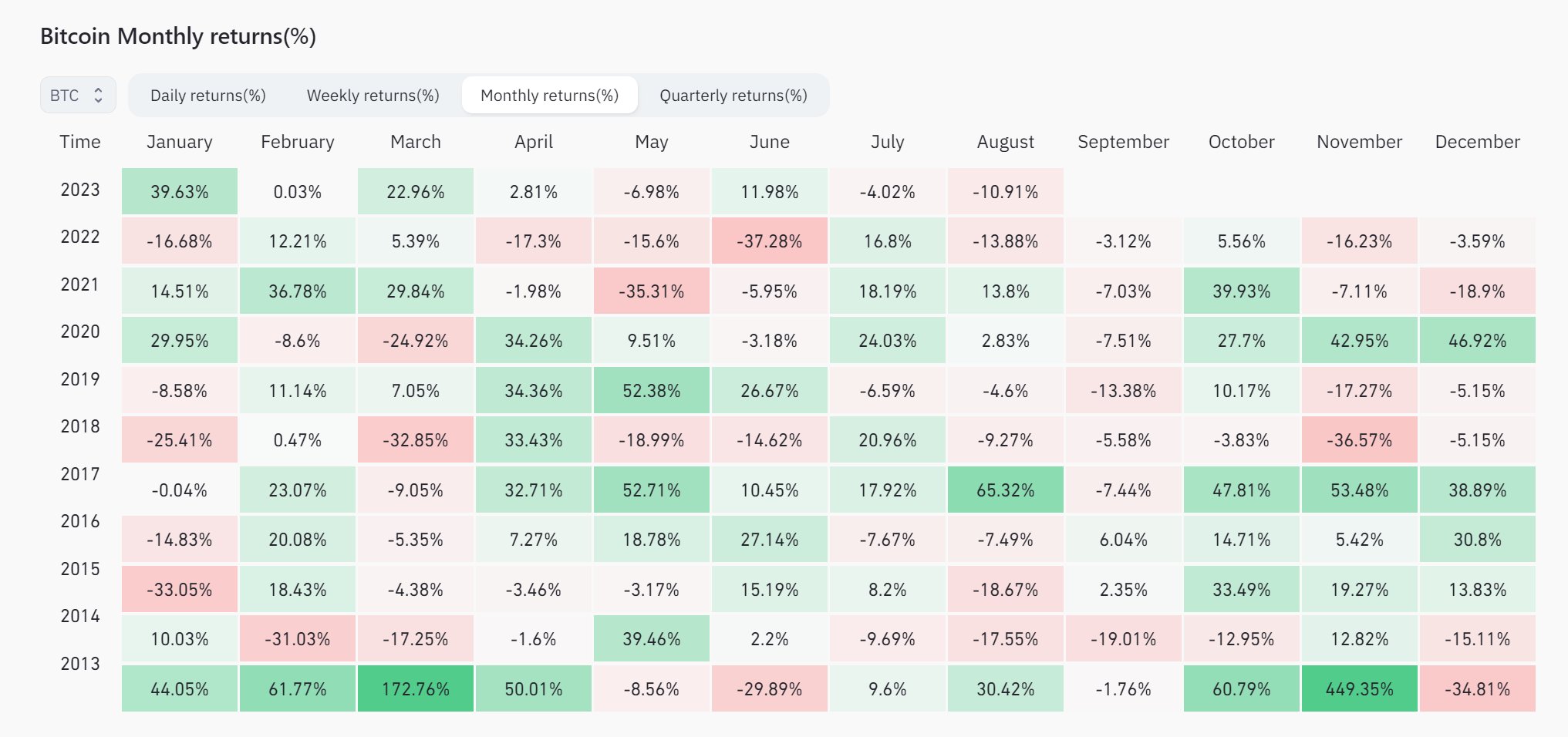

Historically, September has not been particularly kind to Bitcoin, with the month recording the least number of positive-returning months at just two, and currently being on a 6-year negative-returning streak.

Rekt Capital delves deeper into this trend, stating, “A frequently recurring downside amount for BTC in the month September is -7%. If BTC were to drop -7% from current price levels this month, price would retrace to ~$24,000.”

However, according to the analysis by the analyst, the next major monthly level is sitting at ~$23,400. This suggests that price maybe does not stop at -7% if BTC can’t gain new momentum. Instead, BTC could potentially downside wick -10% in total to reach that next major monthly level.

The analyst further elaborated on the historical performance of Bitcoin in September, noting, “September – positive or negative month? Typically, we tend to see a negative month for BTC in September. However, for the most part BTC sees single-digit drawdown in Septembers. 8 out of 10 of the past Septembers have experienced downside. Only 2 months saw small, single-digit gains in the month of September (+2% in 2015 and +6% in 2016).”

Worst Case Scenario

Drawing parallels with previous years, Rekt Capital highlighted that the most recurring drawdown in September has been a -7% dip, as observed in 2017, 2020, and 2021. However, he also pointed out that Bitcoin only saw double-digit retracement in 2019 (-13%) and in 2014 (-19%). The latter, being a bear market year, might not be the best comparison for 2023, which is shaping up to be a bottoming out year, akin to 2019 or 2015.

Addressing the looming question of another potential crash in September, the analyst opined, “In 2019 BTC saw a -13% retrace but we also need to keep in mind that BTC just saw one of its worst-ever August drawdowns at -16%. It’s unlikely that Bitcoin would experience severe back-to-back drawdown both in August and now in September as well.”

Concluding his analysis, Rekt Capital shared his personal forecast, “I think a drawdown of around -7% to -10% September could reasonably occur from current levels. This would see price drop to ~$24,000 – $23,000.”

Remarkably, there is unlikely to be a Bitcoin spot ETF decision in September, which may be the biggest catalyst for the market at the moment. The next deadlines for filings by Bitwise, BlackRock, Fidelity and the others is October 16 and 17. Only an action by the SEC after the lost lawsuit against Grayscale could provide a surprise event. However, there are currently no deadlines or statements from the SEC if and when they will carry out the ruling.

At press time, BTC traded at $26,104.

#Bitcoin, #Bitcoin, #BitcoinPricePrediction, #BitcoinSpotETF, #BlackRock, #Btc, #Btcusd