An Analysis Into GoMining’s New NFT, and their Tokenomics

Bitcoin mining company, GoMining, has changed the way we think about bitcoin mining with their GoMining NFTs, giving holders a share of ownership in their mining operations. With over 2,000 BTC paid out over the last two years, GoMining is proving their thesis that bitcoin mining can be easy and accessible for everyone.

With brand ambassadors like Khabib Nurmagomedov and the project’s avid participation in the Bitcoin Mining Council, GoMining understands the importance of the cryptocurrency industry and the role of their bitcoin mining operations within it.

GoMining recently launched a major update to their tokenomics for the GoMining token. The new system has several implications for token and GoMining NFT holders. So let’s dive into what exactly GoMining offers crypto users and their tokenomics system, breaking down the token’s life cycle and distribution.

What is GoMining?

In its truest essence, GoMining is a bitcoin mining company that provides investment vehicles and settlement layers for crypto investors to invest in bitcoin mining and earn returns in BTC without the hassle of operating their own mining equipment. This fundamental revenue stream is the foundation for GoMining’s ecosystem.

The project is able to offer “virtual” bitcoin mining through their GoMining NFT, which is a digital asset that represents a share of hashrate, otherwise understood as computing power. The more computing power you own of GoMining’s servers, the higher the share of mined BTC you get.

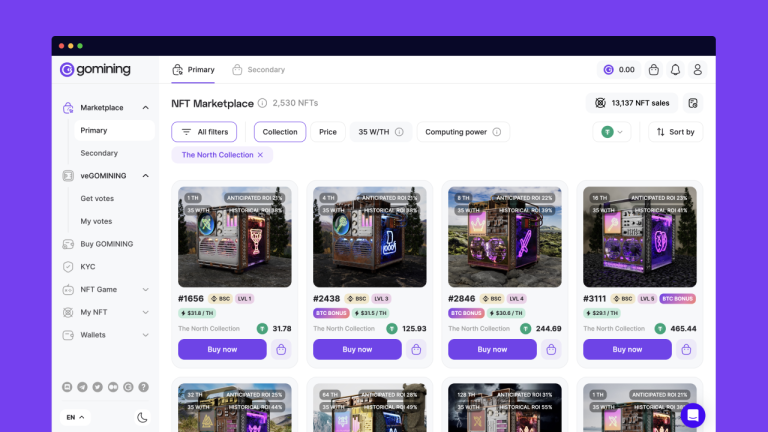

A sample of GoMining NFTs at their NFT Marketplace.

A sample of GoMining NFTs at their NFT Marketplace.

GoMining considers the GoMining NFT a new class of digital asset: Liquid Bitcoin Hashrate.

Liquid Bitcoin Hashrate Explained

Liquid Bitcoin Hashrate (LBH) is a new token concept pioneered by GoMining, that is designed to be a way that mining companies can tokenize bitcoin mining computing power.

LBH tokens are similar to staked Ethereum (stETH) in that they can be traded, used as collateral, and used in DeFi protocols. However, there is one key difference. Whereas stETH is a representation of staked Ethereum in a larger pool, LBH tokens represent a real-world asset, namely hashrate, and represent a tangible value of computing power.

The introduction of LBH tokens could have a number of benefits for the DeFi ecosystem. First, it has the potential to create access to bitcoin mining for a wider range of users. Second, like stETH did for ETH, LBH could help to increase the liquidity of Bitcoin, as LBH tokens can be traded on decentralized exchanges. Third, it could help to reduce the energy consumption of bitcoin mining, as users can choose to mine with more efficient mining companies.

Overall, Liquid Bitcoin Hashrate is a new and innovative concept that has the potential to make bitcoin mining more accessible, liquid, and efficient. It’s because of the GoMining NFT that we have a true proof-of-concept for LBH.

The GoMining NFT

GoMining NFTs are digital assets that represent ownership of a part of GoMining’s operation. Specifically, each NFT represents ownership of real-life hashrate, otherwise understood as the computing power for bitcoin mining.

Each NFT has two fundamental traits: their hash power and their electrical efficiency. The more hash power, the more Bitcoin earned. The more electrical efficiency, the cheaper the mining fees are.

Hash power is measured in terahashes per second (TH/s), and electrical efficiency is measured in watts per terahash.

GoMining NFTs earn BTC every day depending on the total Bitcoin mined by GoMining, the hashrate of the NFT, and the mining fees incurred.

Breaking Down the GoMining Token Life Cycle

GoMining’s token update introduces new fundamentals that work to simultaneously increase the token demand, and decrease the token supply over time.

It’s a lot to understand at once, so let’s break it down part by part.

It’s a lot to understand at once, so let’s break it down part by part.

Bitcoin: Where It All Begins

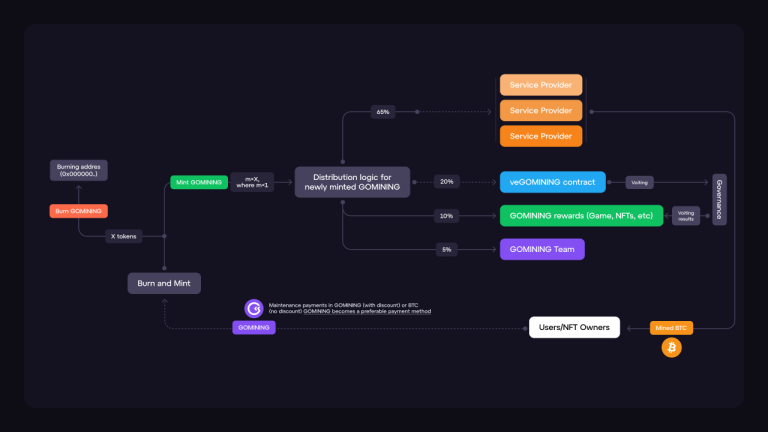

Let’s start with the most fundamental part of the project’s business model — the bitcoin mining process. Basically, the Service Providers send mined BTC to GoMining NFT holders.

Service Providers are simply the miners, the people that go to work at GoMining’s data centers, where they monitor and maintain the bitcoin mining operation.

When GoMining NFT owners receive their distributed BTC, they incur electricity and maintenance fees, just like any mining equipment might. However there are a few differences between GoMining NFT holders and someone with their own mining equipment:

- GoMining NFT holders don’t actually maintain any mining equipment;

- The project’s economies of scale make for cheaper electricity rates;

- The company lets users pay for fees with their earned BTC;

- GoMining lets users get a 10% discount on fees if they pay with GoMining token.

Breaking Down GoMining’s Service Provider Fees

GoMining has been able to lower the cost of electricity across their operations, allowing the servers to obtain more hash power for less. As it currently stands, GoMining has been able to lower their costs to $0.03 per kWh, which is cheaper than electricity rates in the United States, currently averaging at $0.13/kWh.

What GoMining does to maintain sustainable growth is that they then sell the electrical costs at a premium to GoMining NFT owners at $0.05 per kWh. This way, Service Providers can earn on the usage of their electricity.

Enter the GoMining Token

GoMining gives their NFT holders the opportunity to discount 10% of their fees by paying with the GoMining token, effectively creating an electricity rate of $0.045 per kWh.

By utilizing GoMining token as a form of payment for fees, GoMining effectively designed a new demand flow for GoMining token purchases within their ecosystem. This is what is considered a form of demand-side tokenomics, which focuses on generating buying pressure through capturing value. GoMining token is capturing the cost of electricity for the GoMining operation.

Enter the Burn & Mint Cycle

Here’s where things get interesting. All tokens that are used to pay fees go through a “Burn and Mint” process. The key formula to determine how much GoMining token to burn is m*X, where m. X represents the total amount of tokens paid for fees, and m represents the “mint coefficient,” which determines the portion of X that is reintroduced into circulation.

Simply put, GoMining’s Burn & Mint is a key mechanism to tighten GoMining token supply over time. By burning more tokens than what is reintroduced back into GoMining’s circulation, the company designed a mechanism that will inevitably decrease token circulating supply.

Combine that with the GoMining token’s demand-side discount fee model, and we can start to envision the spinning flywheel that is GoMining’s tokenomics.

Using the m*X function, we can explore what a decreased GOMINING supply might look like over a series of epochs, each epoch per every 10 million GOMINING burned. The exact value of m is determined through governance, but currently, it stands at m = 0.8.

Where Does the New GOMINING Go?

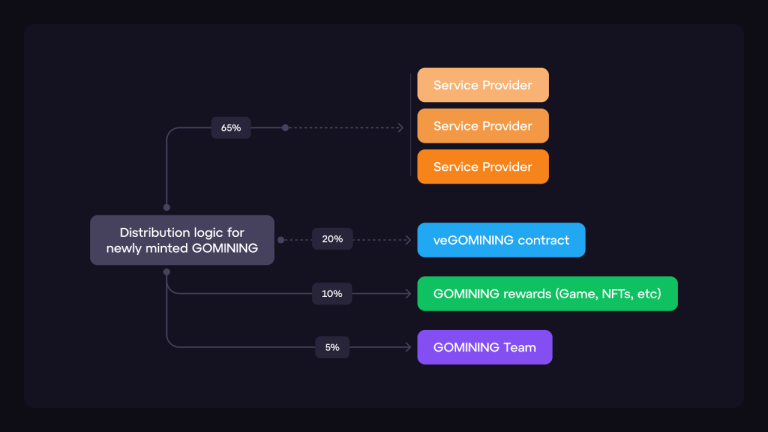

The newly minted GoMining tokens are dispersed across the Service Providers, the veGOMINING contract, GoMining’s NFT Marketing, and the GoMining team.

The GoMining token distribution is broken down as such:

The GoMining token distribution is broken down as such:

- Service Providers — 65%: Payment for electricity fees and maintenance costs to run the mining servers;

- veGOMINING Contract — 20%: Weekly rewards for veGOMINING vote holders;

- NFT Marketing — 10%: Coverage for maintenance discounts, bonuses, referral program, and round multipliers. If any GoMining token remains, voters can distribute extra token to NFT holders;

- GoMining Team — 5%: Royalties to the GoMining team for development.

GoMining Service Provider Fee Breakdown

Service Providers continue to afford the electrical costs because of two reasons. The first reason is that, according to GoMining’s contract data on NFT holders’ payments, around 30% of fees are paid directly in BTC. The other 70% are NFT holders that get the 10% discount on fees by paying with GoMining token. Remember, Service Providers are making between $0.015–$0.02 per kWh they spend thanks to the premium GoMining charges, allowing them to stay afloat, even if the circulation of the token is decreasing each epoch.

veGOMINING Contract Breakdown

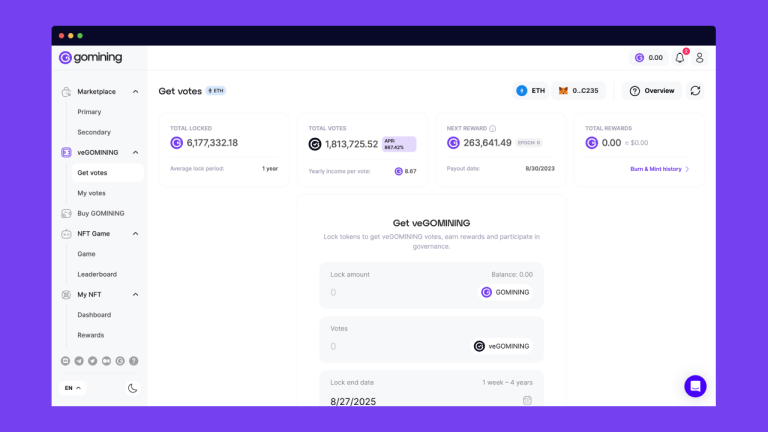

GoMining will distribute 20% of newly minted tokens to its stakers. Like other ve token models, the staking and locking mechanism will tighten the supply of tokens available by encouraging token holders to lock their tokens for more tokens promised later.

NFT Marketing Breakdown

Some 10% of GoMining tokens is used for NFT promotions, specifically to cover for maintenance discounts, bonuses, earnings from referral programs, and round multipliers. Any extra tokens that remain are then offered to GoMining NFT holders.

veGOMINING token holders determine the distribution of these GoMining rewards through their governance process.

GoMining’s Governance Process

Users that lock their GoMining tokens in the vote-escrow contract will receive voting power to engage in governance processes regarding GoMining rewards distribution, and staking yield in the form of GoMining emissions. It is only through locking tokens that users can access voting power or staking emissions.

GoMining token stakers have a choice between locking their tokens from 7 days to 4 years, with voting power and staking yield increasing linearly as the lock time increases.

GoMining token stakers have a choice between locking their tokens from 7 days to 4 years, with voting power and staking yield increasing linearly as the lock time increases.

Lock a token for four years, and the ratio for veGOMINING/GoMining is 1/1. Lock a token for one year, and the ratio for veGOMINING/GoMining is 1/4.

- 1 GoMining for four years = 1 veGOMINING

- 1 GoMining for one year = 0.25 veGOMINING

Conclusion

Overall, GoMining is a leading player in the bitcoin mining industry. Their innovative approach to bitcoin mining and their unique tokenomics have the potential to change the way we mine Bitcoin for the better.

GoMining’s tokenomics are designed to increase the demand for GoMining tokens and decrease the supply over time. Through demand-side discount fees, to the Burn and Mint cycle, to veGOMINING governance, GoMining is building the best ecosystem for easy and accessible bitcoin mining for everyone.

Check the project’s website.

This is a sponsored post. Learn how to reach our audience here. Read disclaimer below.