Spot and futures trading volumes on centralized crypto exchanges (CEXs) have increased in June, a new report shows. At the same time, website traffic to major trading platforms for digital assets continued to decline, according to the study which also tracks its geographical distribution.

Spot Volume on Leading Exchanges Jumped by Over 10% in a Month

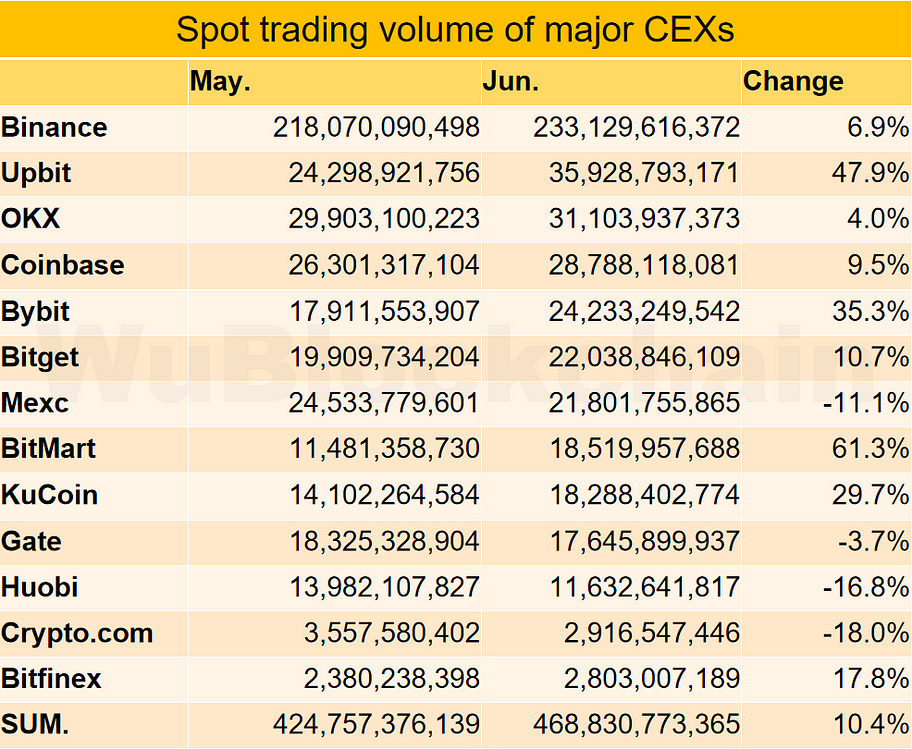

Spot trading volume on major centralized platforms for cryptocurrency exchange rose 10.4% in June over the previous month, according to data from Coingecko compiled by Chinese crypto journalist Colin Wu, also known by his Twitter handle ‘Wu Blockchain.’

The highest increases were registered by Bitmart (61%), Upbit (48%) and Bybit (35%). Those with the most negative rates were Crypto.com (-18%), Huobi (-17%) and Mexc (-11%), Wu detailed in a blogpost published earlier this week.

The futures trading volumes on these exchanges climbed by a similar percentage last month (9.5%). The top three change rates were Bitmart (46%), Deribit (15%) and Kucoin (14%) and the bottom three were Crypto.com (-29%), Gate (-17%), and (-5%), the report added.

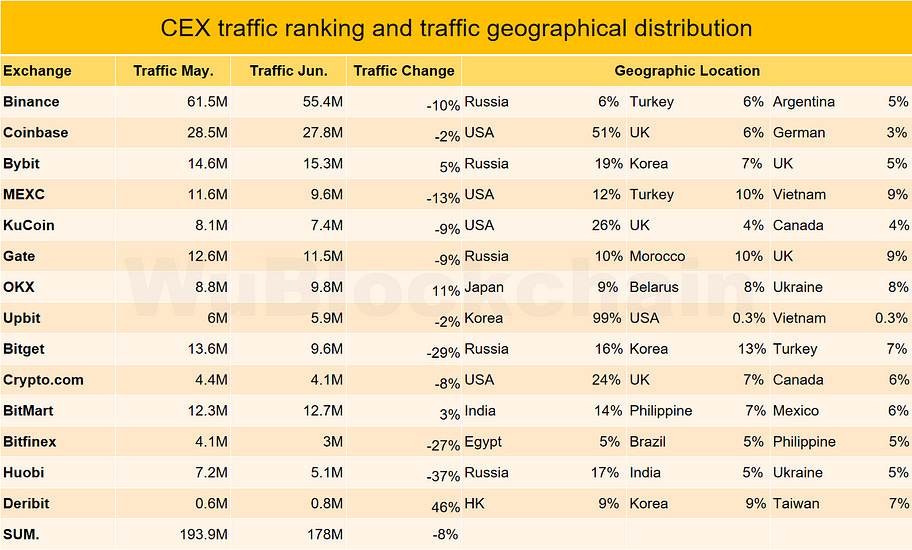

Meanwhile, website traffic to the leading trading platforms declined further, by 8% from May. The three exchanges that saw the highest increase in terms of visits were Deribit (46%), Okx (11%) and Bybit 5%. Huobi (-37%), Bitget (-29%) and Bitfinex (-27%) witnessed the steepest declines, traffic data from Similarweb indicates.

Spot trading volume on , the world’s largest cryptocurrency exchange, has expanded by 6.9%, and futures trading volume increased 6.3%. Traffic to the global trading platform, which has been dealing with pressure from regulators around the world, decreased by 10%.

What are your thoughts on the market data in Wu Blockchain’s report? Share them in the comments section below.

#Exchanges, #Binance, #CryptoExchanges, #Data, #Derivatives, #Futures, #FuturesTrading, #MarketData, #Report, #SpotTrading, #Traffic, #Volume, #Volumes, #WuBlockchain