On July 6, 2023, the World Gold Council (WGC) released its 2023 Mid-Year Outlook, revealing that a “strong first half for gold is likely to give way to a more neutral H2.” According to WGC researchers and market strategists, central banks are “nearing the end of their tightening cycles,” and the market consensus indicates “a mild contraction in the U.S. in late 2023.”

Gold Maintains Resiliency in H1

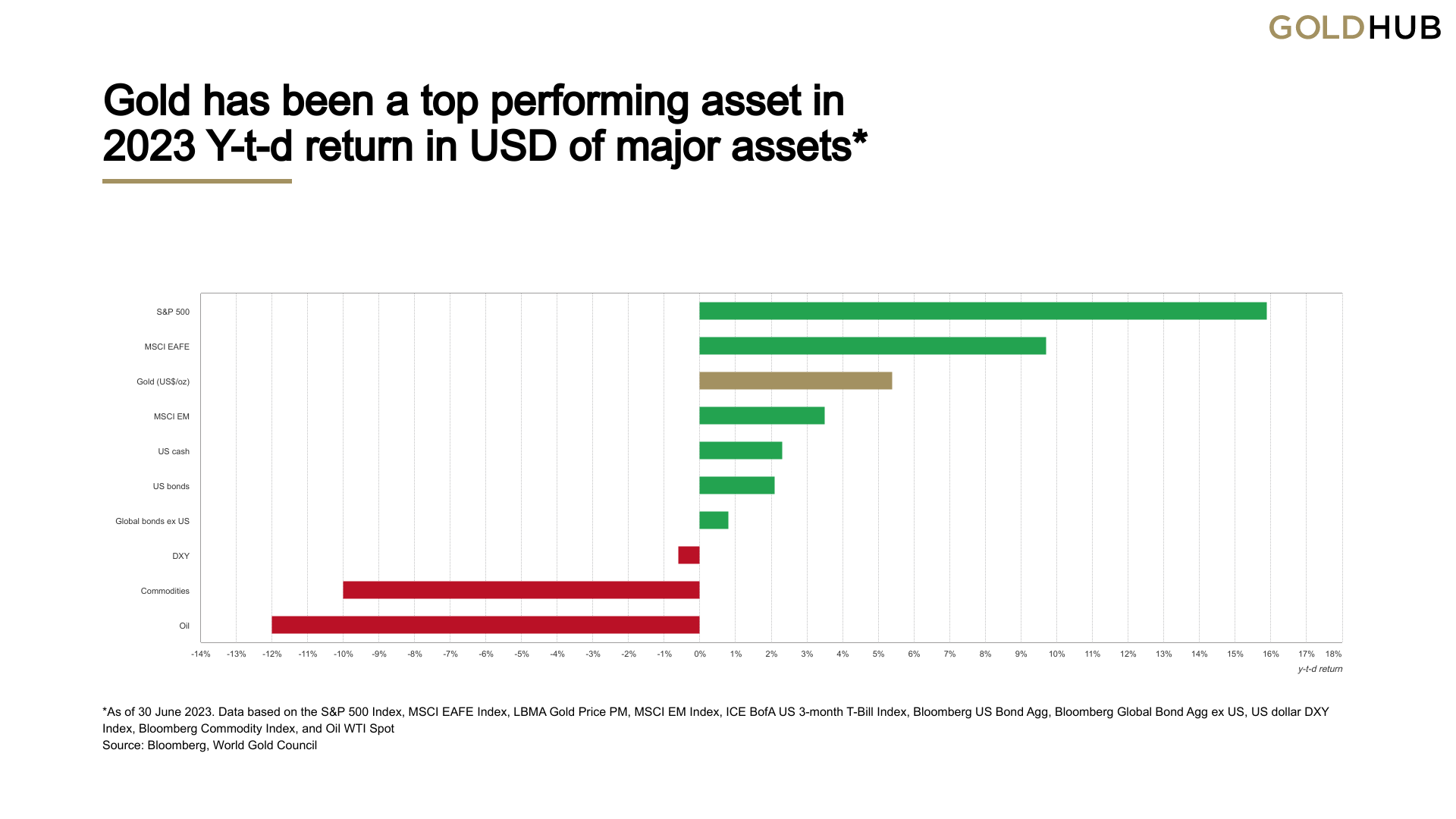

At press time, the price of an ounce of .999 fine gold hovers just above the $1,900 range, specifically at $1,924 per unit. Over the past 30 days, this precious metal has maintained a relatively stable position, while the first half (H1) statistics indicate a 5.4% increase against the U.S. dollar. Over the past five years, gold is up 53% against the greenback.

The World Gold Council (WGC) emphasizes in its latest 2023 Mid-year Outlook report that it anticipates “gold to remain supported on the back of rangebound bond yields and a weaker dollar.” The report further highlights that if economic conditions worsen, gold will experience heightened demand. “Conversely, a soft landing or much tighter monetary policy could result in disinvestment,” the report explains.

“If the recession risk increases, gold investment could see greater upside,” the WGC report details. “An economic deterioration could be driven by a significant increase in defaults following tighter credit conditions or other unintended consequences of the high-rate environment. Historically, such periods have resulted in higher volatility, significant stock market pullbacks, and an overall appetite for high quality, liquid assets such as gold.”

While bitcoin (BTC) is not mentioned among the competitive assets, the WGC mid-year report specifies that gold emerged as one of the top-performing assets in 2023 when compared to U.S. cash, U.S. bonds, and the MSCI EM Index. In contrast, BTC proved to be the strongest performer in the first half (H1), experiencing a significant increase of over 80% during the initial six months of 2023.

The World Gold Council’s analysis shows gold has a tendency to surpass equities in performance when the manufacturing purchasing managers’ index (PMI) is below 50 and declining. Additionally, historical data indicates that if the PMI drops below 45, gold’s outperformance could be even more significant.

WGC researchers and market strategists further say gold tends to be more influenced by bond yields rather than actual policy rates. This is because bond yields encompass market expectations regarding future policy decisions and the probability of an ensuing economic downturn.

“Given the inherent uncertainty in predicting the global macroeconomic outcome, we believe that gold’s positive asymmetrical performance can be a valuable component to investors’ asset allocation toolkit,” the 2023 Mid-year Outlook report concludes.

Will gold’s resilience continue to shine amidst economic uncertainties, or will investors explore alternative assets? Share your thoughts and opinions about this subject in the comments section below.

#Economics, #2023MidYearOutlook, #AssetAllocation, #Bitcoin, #BondYields, #CentralBanks, #CompetitiveAssets, #EconomicContraction, #Gold, #Investment, #ManufacturingPurchasingManagersIndex, #MarketTrends, #Performance, #PriceStability, #RecessionRisk, #TighteningCycles, #USDollar, #WorldGoldCouncil