The fate of Binance USD (BUSD), the stablecoin introduced by Binance, hangs in the balance as its market capitalization has experienced a significant decline of over 80% in 2023.

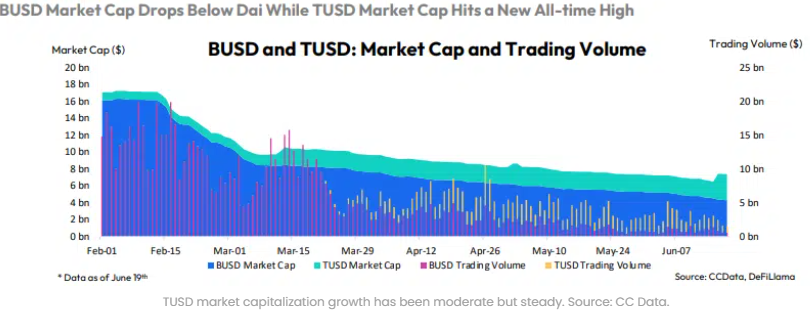

From November 2022 to June of the current year, BUSD’s market capitalization has plummeted from USD23 billion to USD4 billion. Notably, the capitalization suffered an 18% loss in May alone, as reported by CCData, an analysis company.

TrueUSD (TUSD) Gains Traction As BUSD Market Cap Declines

As the market capitalization of BUSD continues to decline and reach a critical level, representing less than 5% of the overall stablecoin market capitalization, Binance has begun actively promoting the adoption of TrueUSD (TUSD).

While TUSD’s market capitalization still falls slightly below that of BUSD, currently standing at over USD3.1 billion, it has surpassed BUSD in terms of trading volumes. According to data provided by CCData, the trading volumes of TUSD have tripled, indicating a growing interest and usage of the stablecoin.

Related Reading: Mask Foundation Moves 2.5 Million Tokens To Exchanges, Huge Dip Incoming?

TrueUSD (TUSD), introduced in 2017 by TrustToken, has emerged as the fifth-largest stablecoin in the market, trailing closely behind BUSD. Functioning as an Ethereum-based ERC-20 token, TUSD secures its value with dollar reserves deposited in multiple US-based banking entities. The company behind TUSD ensures a 1:1 convertibility with the US currency, instilling confidence in its stability and reliability among users.

As BUSD’s market capitalization experiences a significant decline, the growing popularity and trading volumes of TUSD serve as a testament to the increasing demand for an alternative stablecoin option. Also, Binance’s shift towards promoting TUSD suggests a strategic response to the changing landscape of stablecoin usage and market dynamics.

The steep decline in BUSD’s market capitalization can be attributed to its impending discontinuation. In February 2023, NewsBTC reported that Paxos would cease issuing the BUSD stablecoin due to an ongoing lawsuit filed by the United States Securities and Exchange Commission (SEC).

As per Paxos’ official statement, BUSD will be redeemable until February 24, 2024, marking the potential date for its exit from the market.

Investors Move To USDT As It Nears Its All-Time High Capitalization

As the market capitalization of Tether (USDT) continues to rise steadily, approaching its all-time high, investors are taking notice and making strategic moves. According to data from CoinMarketCap, USDT’s current market capitalization stands at $82.9 billion (USD), close to its previous peak of $83.2 billion, reached in May 2022. This upward trajectory has prompted investors to diversify their portfolios and explore alternative stablecoin options.

Related Reading: Bitcoin Just Gained Over 18% In Seven Days: What’s Happened When This Has Occurred In The Past?

Also, Investors are drawn to USDT due to its stability and pegging to the US dollar, offering a reliable store of value amidst market fluctuations. With its widespread acceptance and liquidity, USDT has become a preferred choice for traders, providing a convenient and secure means of preserving their capital during volatile market conditions.

At press time, USDT was trading at $0.9780 per coin with a 24-hour price increase of 1.38%.

Featured image from iStock, charts from Tradingview and CCData

#CryptocurrencyMarketNews, #Binance, #BUSD, #Paxos, #Stablecoin