The market share of the U.S. subsidiary of Binance has declined amid an ongoing crackdown by America’s securities regulator. According to new data, leading U.S. crypto exchange Coinbase, also sued by the Securities and Exchange Commission (SEC), is taking a hit, too.

Binance US Market Share Drops to 1.5%, According to Kaiko

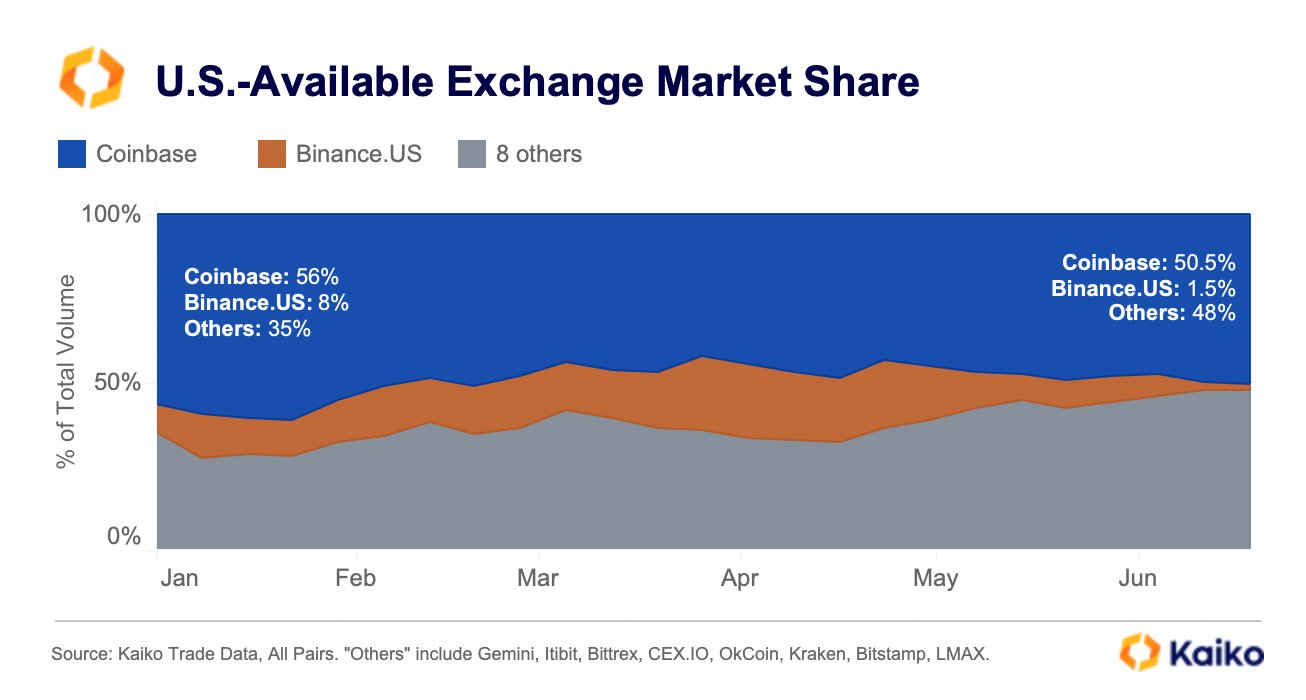

The litigation with the SEC is taking a toll on Binance US, the American unit of the world’s largest cryptocurrency exchange. The platform’s share is now only 1.5% of the weekly trading volume on exchanges in the United States, according to digital assets market data provider Kaiko.

That’s down from 8.2% at the beginning of 2023, the research indicated. The significant decline comes in a difficult moment for Binance’s subsidiary in the U.S. which is dealing with customers withdrawing funds and payment partners cutting off support, Bloomberg noted in a report.

The latest troubles began when the securities regulator sued the operators of the American exchange, BAM Trading Services and BAM Management US Holdings, and Binance founder Changpeng Zhao (CZ), accusing them of violating U.S. securities laws, misleading investors, and mishandling user assets.

Thanks to a deal with the SEC that requires Binance to repatriate all U.S. customer funds, Binance US managed to avoid an asset freeze that would have crippled its business. However, according to Clara Medalie, director of research at Kaiko, “What we are seeing here is sort of the collapse of Binance US.” She elaborated:

Can Binance US survive in a post-SEC world? I think the jury is still out on that, but looking at the data, I think it’s very unlikely.

Meanwhile, the market share of Coinbase has also shrunk, to 51% in late June from 56.5% at the start of the year. The SEC filed a lawsuit against the largest U.S. crypto exchange as well, alleging that the San Francisco-based company was also infringing upon securities laws.

Kaiko pointed out that the market shares of other crypto exchanges, such as Lmax, Bitstamp, and Kraken, are expanding in the United States. U.S.-based Kraken has grown its market share in Europe, from 41% at the beginning of this year to 53% this month. In 2023, Binance’s global platform lost more than half of its market share in euro-denominated crypto trades.

announced last week it’s leaving the Dutch market as it was unable to register as a crypto service provider in the Netherlands. Earlier, its entity in Cyprus applied to be removed from the country’s register of digital asset service providers and Binance’s unit in Britain canceled its U.K. regulatory authorization.

What future do you expect for Binance US and other major crypto exchanges in the U.S. and Europe? Share your thoughts on the latest developments in the sector in the comments section below.

#Exchanges, #Binance, #Binanceus, #Coinbase, #Crackdown, #CryptoExchange, #EU, #Europe, #Exchange, #Kaiko, #Kraken, #Lawsuit, #Market, #MarketData, #MarketShare, #SEC, #Subsidiary, #UK, #US