The token of the layer-2 solution Arbitrum, ARB, is one of the best-performing cryptocurrencies within the top 100 by market cap over the past seven days. With a gain of 8.5% despite the heavy drawdown in the broader crypto market, the Arbitrum token records the fifth highest price gain over the last week.

Arbitrum Token Shows Relative Strength

Looking at the ARB / BTC chart (2-hour) shows that the Arbitrum token is one of the few altcoins that has recently shown strength against Bitcoin. If BTC sees a rise towards $30,000, it is generally advisable to look for the altcoins that show relative strength at the moment and ARB is definitely one of them.

In the 2-hour chart, ARB/BTC is writing higher highs and higher lows since Monday, May 8. Currently, ARB/BTC needs to break above the 0.00004477 level to continue the trend. If this is successful, stronger resistance at 0.00004620 can be expected. But, a successful breach would be an extremely bullish signal.

The 4-hour chart of ARB/USD shows that the price was once again rejected at the 23.8% Fibonacci level at $1.22. This resistance is crucial for ARB at the moment. In order to maintain the uptrend, the price level must be cleared, otherwise a renewed fall towards $1.05 could be on the cards.

If a breakout succeeds, the zone between $1.30 and the 38.2% Fibonacci at $1.33 would come into focus. Strong resistance can also be expected at $1.42, where the 50% Fibonacci retracement level is located.

Renowned Crypto Traders Are Bullish On ARB

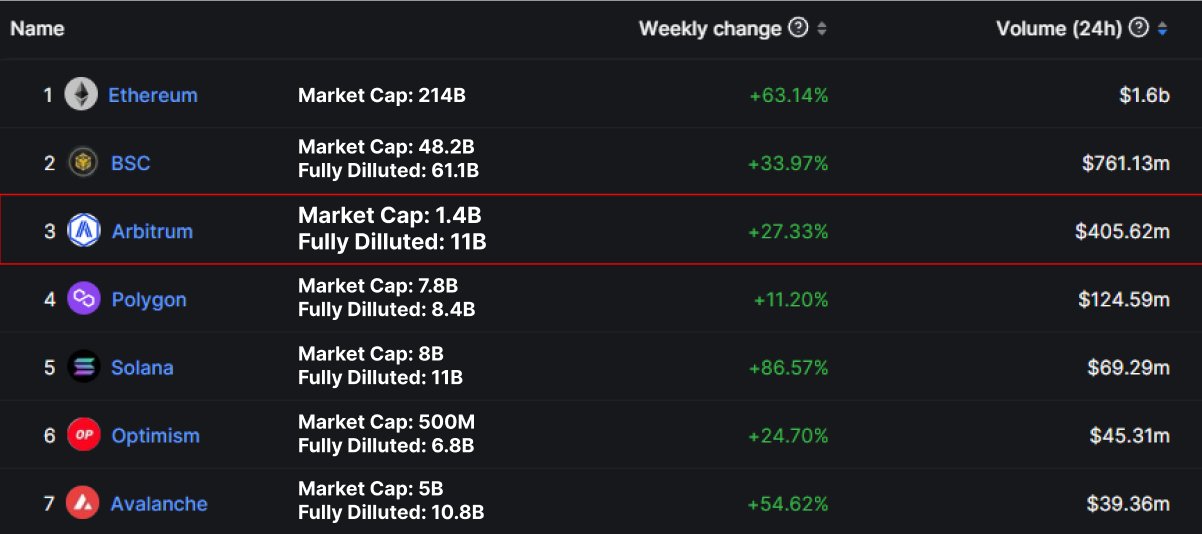

One of the analysts who is bullish on ARB is popular crypto trader @DaanCrypto. The analyst points to the high on-chain transaction volume on Arbitrum, where the layer-2 ranks only behind Ethereum and BSC.

Moreover, it is interesting to note that the fully diluted market caps of ARB, MATIC, SOL, OP and AVAX are relatively close to each other, according to the analyst, while the circulating supply is quite different. According to Daan, ARB is still undervalued or less overvalued compared to the other protocols, such as Optimism (OP).

One reason, in addition to ARB’s strong fundamentals, are the scheduled token unlocks: “This is important to note when you’re investing for the longer term. OP for example will be getting some bigger unlocks throughout the year while ARB won’t get any until March 2024”, says Daan, who concluded, “the unlocking schedule & adoption was a reason for me to open this pair trade between ARB & OP.”

$ARB / $OP Pair Trade going strong.

Well on it's way to my target of $ARB being 2x the Fully Diluted Valuation of $OP. https://t.co/uJSKilhc0u pic.twitter.com/z635BpCztr

— Daan Crypto Trades (@DaanCrypto) May 15, 2023

Andrew Kang, co-founder of Mechanism Capital, also shares this view. In mid-April, the notorious altcoin whale wrote that “Arbitrum is the fastest growing blue chip chain not yet valued at blue chip status and will rerate to be top of the alt L1/L2 stack.”

His reasoning: When it comes to dApps with real value and innovation, Arbitrum dApps are at the forefront. “While these bullish conditions sustain this year, FDV [Fully Diluted Value] is a meme. Especially considering there are no major unlocks until next year,” added Kang.