Dogecoin has declined around 3% in the past 24 hours following a pattern formation that has often signaled tops in the past.

Dogecoin Social Volume And Sentiment Shot Up Shortly Before The Decline

As per data from the on-chain analytics firm Santiment, euphoria has historically led to price tops in the cryptocurrency. A relevant indicator here is the “social volume,” which measures the total number of text documents that contain a given search term (which, in this case, is Dogecoin) at least once.

The text documents here include social media posts like tweets, telegram messages, Reddit posts, and other forum-related text pieces. A key feature of the social volume metric is that it doesn’t count these documents based on the number of times they mention the search term, but by if they do it even once.

For example, if a tweet mentions Dogecoin once, while a Reddit post mentions the meme coin five times, the indicator will still count both of them as 1 document each (meaning that the total social volume here would be 2).

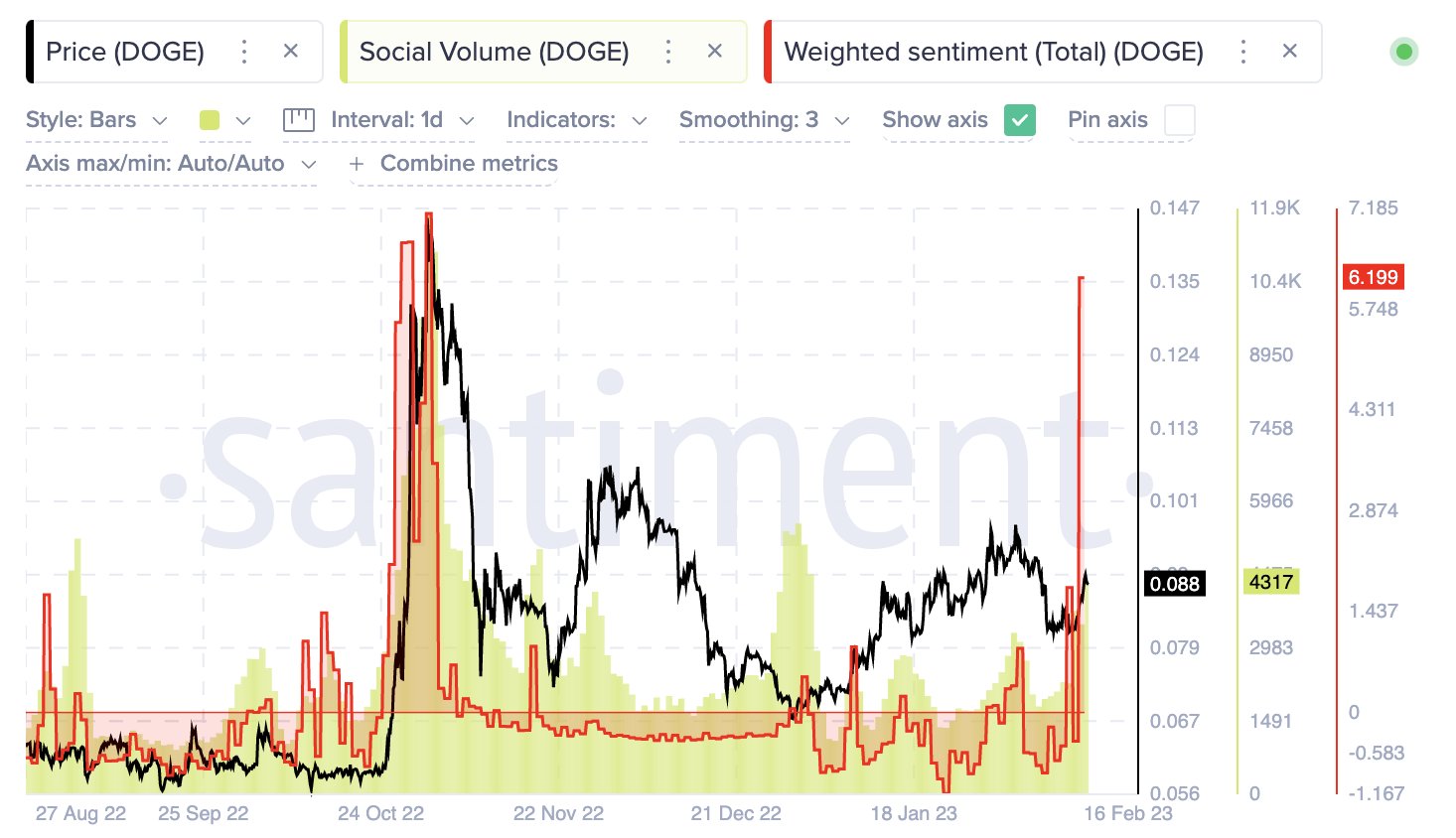

Now, here is a chart that shows the trend in the social volume for DOGE over the last few months:

As displayed in the above graph, the Dogecoin social volume (in green) has seen a sharp spike during the past couple of days, showing that discussion around the meme coin has been at pretty high levels recently.

The chart also shows data for another indicator, called the “weighted sentiment,” which first measures the general sentiment in the market around the cryptocurrency, and then weighs it against the social volume.

This metric quantifies the sentiment by going through the earlier mentioned social text documents and checking whether users are talking positively or negatively about the meme coin, using a machine learning model.

Afterward, the indicator weighs this calculated sentiment against the current social volume of the asset. In simpler terms, this means that the metric will only show high values when both the social volume is high and the overall sentiment is very positive at the same time.

From the graph, it’s visible that this indicator has also shot up to very high values recently. In fact, the current level of the indicator is the highest it has been since October of last year. This means that not only are a lot of people talking about DOGE right now, but they are also in fact mentioning it in a positive light.

Interestingly, back in October, the price of the cryptocurrency was surging, but following both the social volume and weighted sentiment spiking to extremely high values, Dogecoin topped out and soon saw a sharp correction.

While hype can naturally generate a bullish wind for the coin, it’s also true that too much of it can lead to the price hitting the top and declining instead. “Regardless of your opinion on DOGE, hype on this asset in particular historically foreshadows market corrections,” explains Santiment.

Following the latest spikes in the two metrics, Dogecoin has already suffered a 3% drawdown after hitting a local high above the $0.09 level. At present, it’s currently unclear whether it’s truly the effect of euphoria that has appeared on the market with this latest drawdown, but if it is, then DOGE may be in for a further downtrend.

DOGE Price

At the time of writing, Dogecoin is trading around $0.0864, up 5% in the last week.

#Dogecoin, #Doge, #DogecoinSentiment, #DogecoinSocialVolume, #DogecoinWeightedSentiment, #Dogeusd