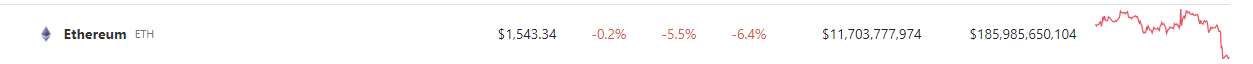

Top altcoin Ethereum has been facing some resistance lately, slowing down growth to a snail’s pace as ETH is smothered in red in the charts. At the time of writing, the altcoin is currently facing losses in the one-hour time frame, the 24-hour, as well as in the weekly.

The current situation for Ethereum is crucial for the altcoin’s continuous rise in price. Analysts, however, have been very neutral on the altcoin’s current position. But as the bulls struggle to reclaim the $1.6k mark, it’s a must for investors to carefully monitor the market to make a sound decision.

On Shanghai Upgrade & Rumors About Scrapping Staking

The Shanghai network upgrade for Ethereum is expected to bring a lot of new features for the top altcoin. It would reduce gas fees on-chain and will make withdrawing staked ETH possible. However, there are regulatory headwinds ahead that could deal a heavy blow on staking.

According to the recent tweets of CoinBase CEO Brian Armstrong, the US Securities and Exchange Commission is rumored to get rid of staking for retail investors which would remove a lot of projects and put investors in trouble.

Armstrong said in the thread:

“1/ We’re hearing rumors that the SEC would like to get rid of crypto staking in the U.S. for retail customers. I hope that’s not the case as I believe it would be a terrible path for the U.S. if that was allowed to happen.”

This would have a lot of repercussions for DeFi as a whole. On Ethereum, the total value locked is at $28 billion which, if the rumors are true, could mean most if not all retail investors would be missing out on rewards on-chain. Not to mention that staking, just like how Armstrong said it, is a vital part of DeFi which will inevitably affect Ethereum’s performance in the long term.

Can Shanghai Hype Boost Ethereum?

As of writing, the altcoin is currently changing hands at $1,543 with support at $1,450. With the recent rumors surrounding staking in crypto, the hype around the Shanghai upgrade might not be enough for the altcoin to get a boost in price.

Ethereum has a strong correlation with Bitcoin which, as of February 10th, is also experiencing strong bearishness.

Meanwhile, ETH bulls should focus on strengthening their support level as a bearish break on $1.5k would mean problems for the token as this could start a sell-off.

With this in mind, the altcoin should then close above the $1.5k support for a chance to continue its climb.

Featured image from Wallpapers.com

#CryptocurrencyNews, #Altcoin, #ETH, #Ethereum, #PriceAnalysis, #Regulation